Main altcoin Ethereum has famous a 9% uptick previously week because the broader cryptocurrency market makes an attempt a restoration from latest lows.

Whereas the rally is partly fueled by the gradual resurgence within the normal market’s bullet sentiment, two key on-chain metrics recommend that ETH’s momentum may strengthen additional.

ETH’s Provide Hits Yearly Low Whereas Merchants Guess Huge

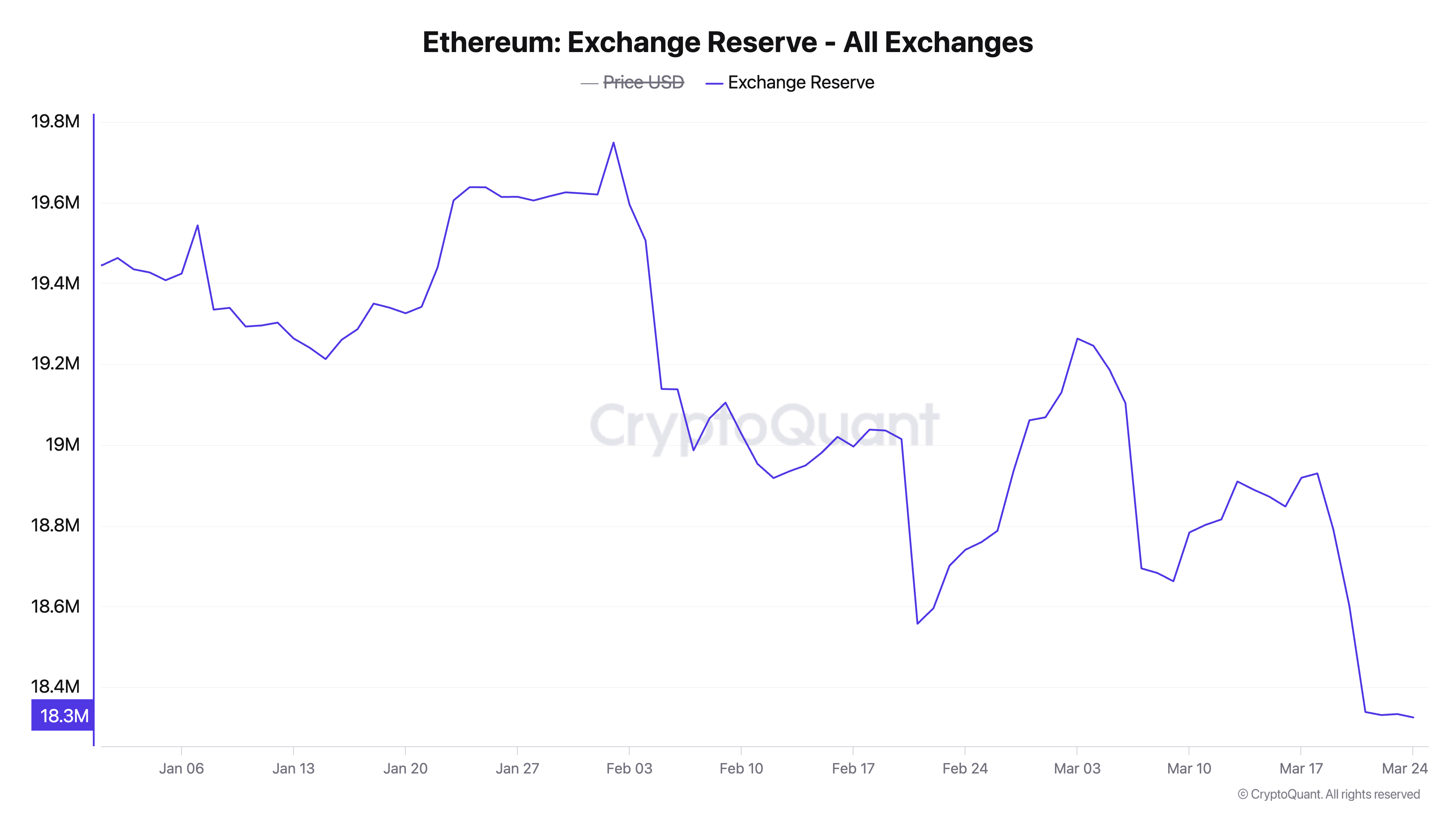

On-chain information reveals that ETH’s alternate reserve has dropped to its lowest degree this 12 months. As of this writing, the metric stands at 18.32 million ETH, plummetting 7% from its year-to-date peak of 19.74 million cash reached on February 2.

ETH Alternate Reserve. Supply: CryptoQuant

An asset’s alternate reserve measures the entire quantity of its cash or tokens held in alternate wallets, representing the provision obtainable for fast buying and selling. When it declines, merchants transfer their holdings off exchanges for long-term storage, staking, or spot ETH ETFs, thereby decreasing the asset’s obtainable provide.

Which means that ETH’s provide decline can create upward worth strain, as decrease promoting liquidity and regular demand are likely to drive its worth greater.

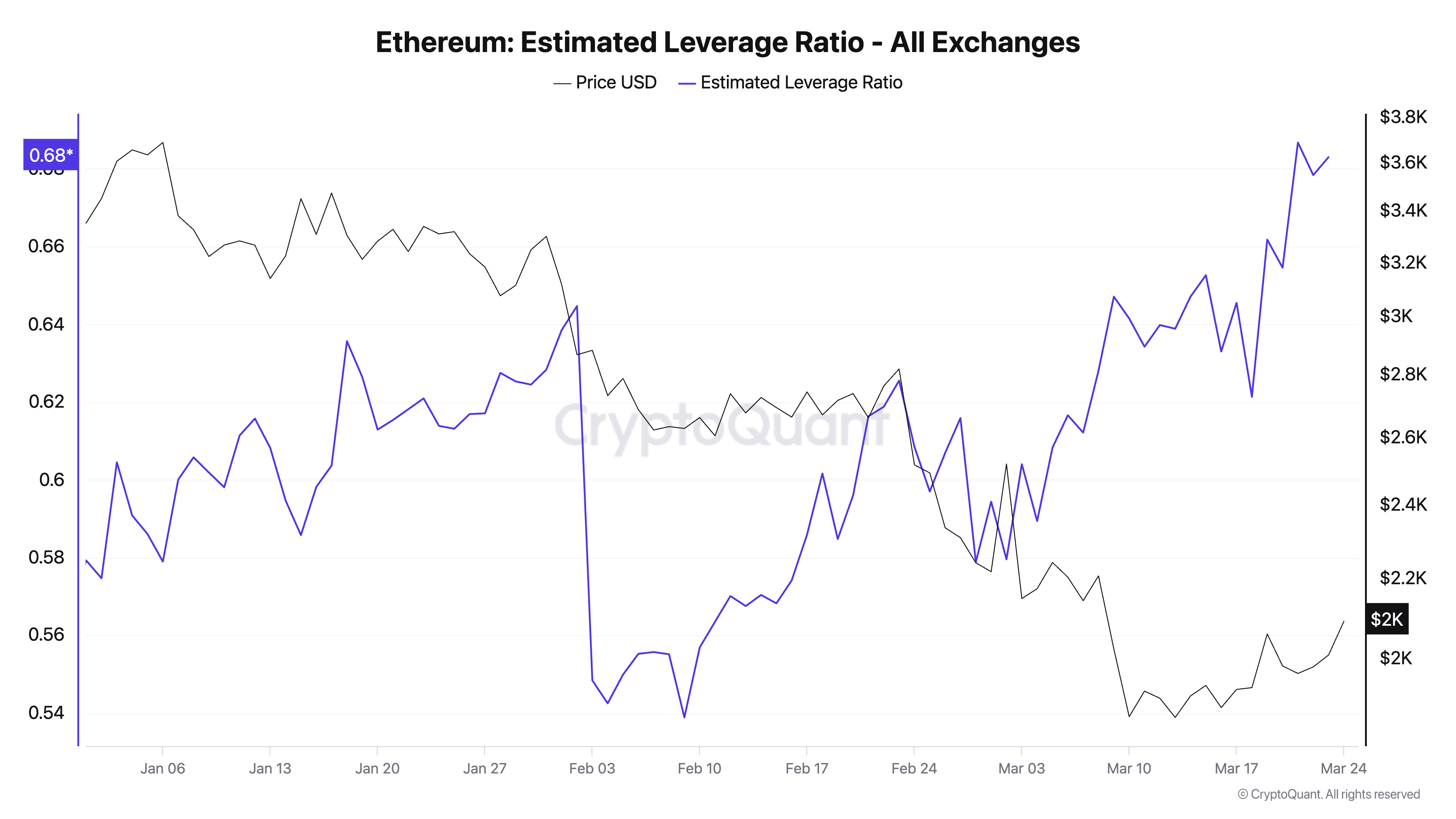

Additional, ETH’s Estimated Leverage Ratio (ELR) has climbed, suggesting that merchants are more and more utilizing leverage to amplify their bets on the coin’s future worth good points.

For context, ELR reached a year-to-date excessive of 0.686 on March 21 earlier than witnessing a minor pullback. As of this writing, ETH’s ELR is at 0.683.

ETH’s Estimated Leverage Ratio. Supply: CryptoQuant

The ELR measures the common quantity of leverage merchants use to execute trades on a cryptocurrency alternate. It’s calculated by dividing the asset’s open curiosity by the alternate’s reserve for that forex.

ETH’s surging ELR indicators an elevated danger urge for food amongst merchants regardless of its worth troubles for the reason that starting of the 12 months. This development signifies that many coin holders stay optimistic a couple of near-term rally and are prepared to leverage their positions to amplify potential good points.

ETH at a Turning Level: Will Bulls Drive It to $2,224 or Bears Pull It to $1,924?

ETH presently trades at $2,089, registering 4% good points over the previous day. The inexperienced histogram bar posted by its Elder-Ray Index displays the rising bullish bias towards the altcoin. It’s at 52.80 at press time, its highest previously 30 days.

The indicator measures shopping for and promoting strain available in the market. When its worth is constructive, it signifies that consumers are dominant, suggesting stronger bullish momentum and a possible worth uptrend.

If ETH bulls strengthen their management, they may push the coin’s worth to $2,148.

ETH Worth Evaluation. Supply: TradingView

Nonetheless, if the bears regain dominance, the altcoin’s worth may fall to $1,759.