- The Ethereum worth is anticipated to retest the $3,100 area as potential assist after a significant breakout.

- Latest on-chain knowledge exhibits that $3,150 and $2,800 stand as fast assist.

- U.S. jobless claims surged to 236,000, triggering a risk-off transfer throughout crypto.

On Thursday, December eleventh, the Ethereum worth plunged over 3.5% to succeed in $3,215 buying and selling worth. These losses align with broader market pullback amid disappointing U.S. unemployment knowledge and the latest Fed fee minimize choice, appearing as a sell-the-news set off. Whereas the macroeconomic jitters are including strain to digital belongings, on-chain knowledge highlights aggressive consumers in ETH, making ready to take over.

Rising U.S. Jobless Claims Set off Crypto Pullback

The crypto market witnessed a bearish pullback on Thursday as U.S. weekly jobless claims rose to 236,000, a 44,000 enhance from the earlier knowledge. The determine was greater than consensus forecasts, though labor market situations are nonetheless pretty tight.

In consequence, the Ethereum worth dived 3.5% to at present commerce at $3,227 and its market cap wavers at $390.2. Regardless of the macroeconomic uncertainty, the most recent on-chain knowledge exhibits robust conviction from consumers to drive a better rally.

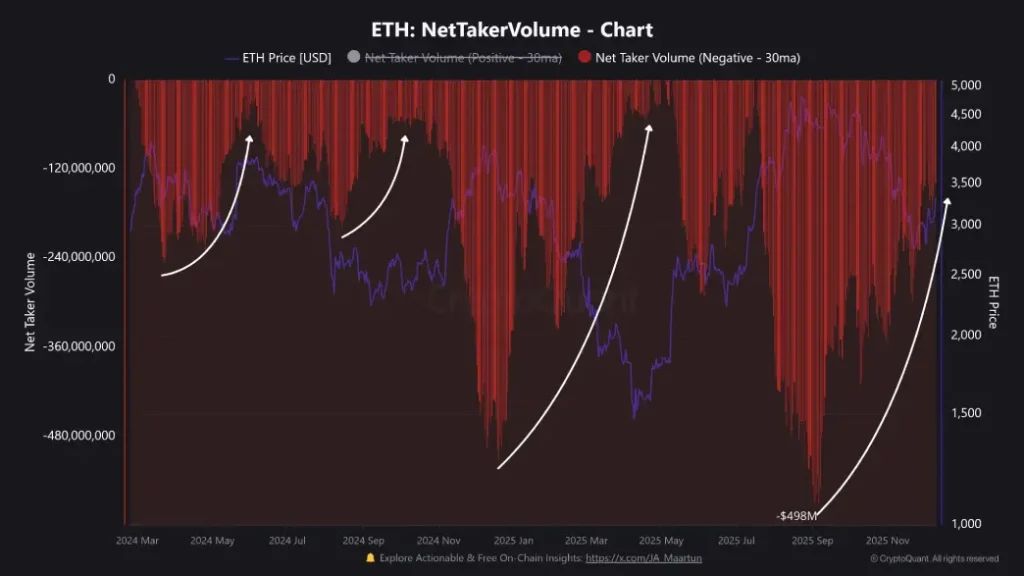

Perpetual futures knowledge revealed internet taker quantity registered $138 million over the past 24 hours, a big rebound from the $500 million peak damaging studying of late-October liquidation strain, coinciding with a pointy drop in Ethereum’s worth.

The online taker quantity is the distinction between aggressively executed purchase and promote orders in perpetual contracts. Optimistic readings suggest that consumers are paying premium costs to fill now, and sustained damaging values mirror dominant promoting strain from market orders.

The gradual lower in damaging taker circulate signifies that aggressive shopping for curiosity is returning regardless of spot costs on the verge of lows. Market contributors take the shift to be an early sign that downward momentum could also be working out of steam.

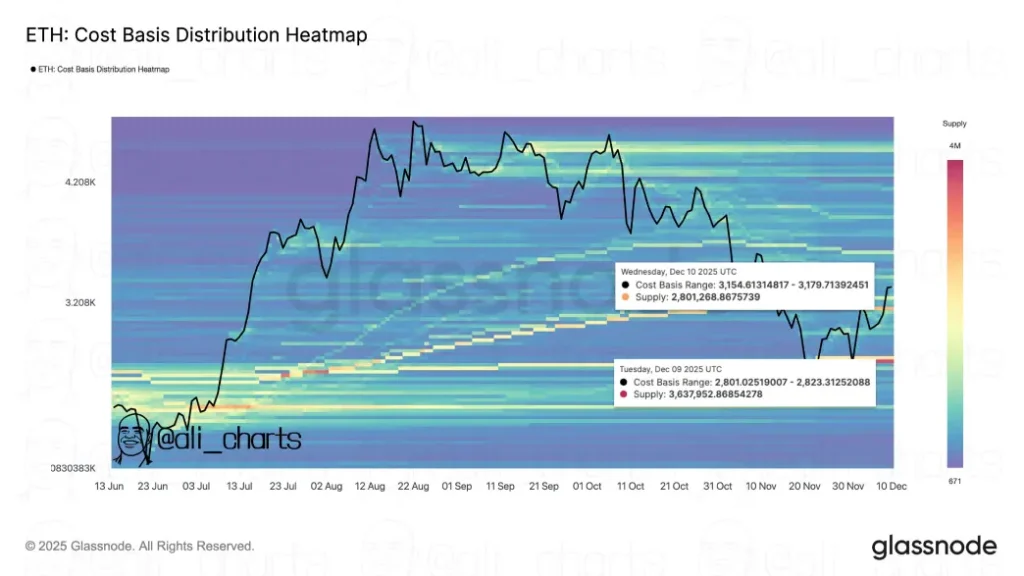

Separate on-chain evaluation discovered two massive accumulation zones for Ethereum. Round 2.8 million ETH tokens are owned by addresses that bought them at or across the $3,150 degree and represent a attainable demand cluster. A deeper cluster lies close to $2,800, the place some 3.6 million ETH modified fingers in what represents a better quantity assist zone, ought to promoting actually choose up.

Merchants are watching to see if the enhancing taker aggression can push costs over close by resistance or if the upper variety of jobless claims results in one other bout of risk-off positioning throughout digital belongings.

Ethereum Worth Awaits Key Help Retest $3,100

On December ninth, the Ethereum worth skilled a powerful surge in intraday achieve, giving a decisive breakout from the resistant trendline of a falling channel sample. Since early October, the chart setup has been carrying a gentle correction pattern, resonating inside two downsloping trendlines.

Thus, the latest breakout alerts a change in market dynamics and bolsters consumers with appropriate assist for additional restoration. With right now’s market downtick, the ETH worth retested the breached trendline as a possible assist.

The coin worth additionally takes assist from the 20-day exponential transferring common, accentuating an earlier bullish sentiment. If the concrete exhibits sustainability above $3,300 mark, the post-breakout may drive a 12.75% surge to hit $3,666 resistance, adopted by a leap in the direction of $4,245.

ETH/USDT -1 Chart

Then again, if the retest section is pushed throughout the channel construction, the bullish thesis will get invalidated.