With Ethereum again above $1,800, upcoming community upgrades and elevated whale exercise trace at a bullish reversal towards $2,000.

As Bitcoin struggles close to the $94,000 mark, Ethereum continues to pattern sideways above the $1,750 stage. Nonetheless, short-term pullbacks within the broader market have triggered fast corrections towards the decrease boundary.

Presently, Ethereum is buying and selling at $1,819, reflecting a decline of round 1.5% over the previous 24 hours. As ETH holds its floor amid market volatility, might a bounce again to the $2,000 mark be on the horizon?

Ethereum Worth Evaluation

On the 4-hour chart, Ethereum’s worth motion exhibits a bullish breakout above a short-term descending resistance trendline. This breakout allowed ETH to surpass the 61.80% Fibonacci stage at $1,834.

Nonetheless, Ethereum has retested the damaged resistance line as a result of broader market pullback over the weekend. Following a bounce, ETH has gained 1.5% over the previous 4 hours, forming a bullish engulfing candle and reclaiming the 50 EMA.

Moreover, the cheaper price rejection indicators robust bullish help close to the 200 EMA. Because the uptrend continues, the 100 and 200 EMA strains are on the verge of forming a bullish crossover.

Regardless of this, the current pullback has resulted in a bearish crossover between the MACD and sign strains. The shifting averages are approaching unfavourable territory on account of weakened bullish momentum.

Nonetheless, a bullish crossover within the MACD is probably going because the post-reversal rally strengthens. In keeping with Fibonacci ranges, the breakout above 61.80% suggests a possible transfer to the 78.60% stage at $1,948.

Optimistically, this may increase the possibilities of Ethereum reaching the $2,000 psychological stage, which aligns with the 100% Fibonacci retracement. On the draw back, essential help lies on the 50% Fibonacci stage close to $1,755.

This demand zone has supplied a number of bouncebacks for Ethereum all through late April. Within the occasion of a breakdown, ETH might retest the important thing help stage at $1,577.

Analysts Sign a Good Time to Accumulate ETH Amid Low Valuations

Forward of Ethereum’s Pectra improve scheduled for Could 7, on-chain information factors to a possible bullish reversal. In keeping with a current tweet by Michael van de Poppe, Ethereum’s valuation is nearing a traditionally low level.

The valuation of $ETH is on its lowest level since:

– August ’22

– COVID Backside March ’20

– January ’19All marked the underside.

Ahead-looking 12 months after these dates costs have been considerably larger.

Completely satisfied to build up $ETH. pic.twitter.com/yzlP9EzSI2

— Michaël van de Poppe (@CryptoMichNL) Could 4, 2025

Citing the MVRV Z-score, the analyst highlights previous low-valuation durations for Ethereum, together with the August 2022 backside, the March 2020 COVID crash, and the January 2019 correction.

Every of those historic corrections was adopted by important recoveries inside a 12-month timeframe. With ETH at present at low valuations, analysts recommend this can be a robust alternative for accumulation.

Ethereum Whales Return

As Ethereum continues to commerce at comparatively low valuations, whales have begun accumulating once more. In keeping with Arkham Intelligence, a beforehand inactive pockets has re-entered the market to buy ETH.

After a four-year dormancy, whale pockets 0xBE11 withdrew roughly 2,600 ETH, valued at $4.72 million, from Binance.

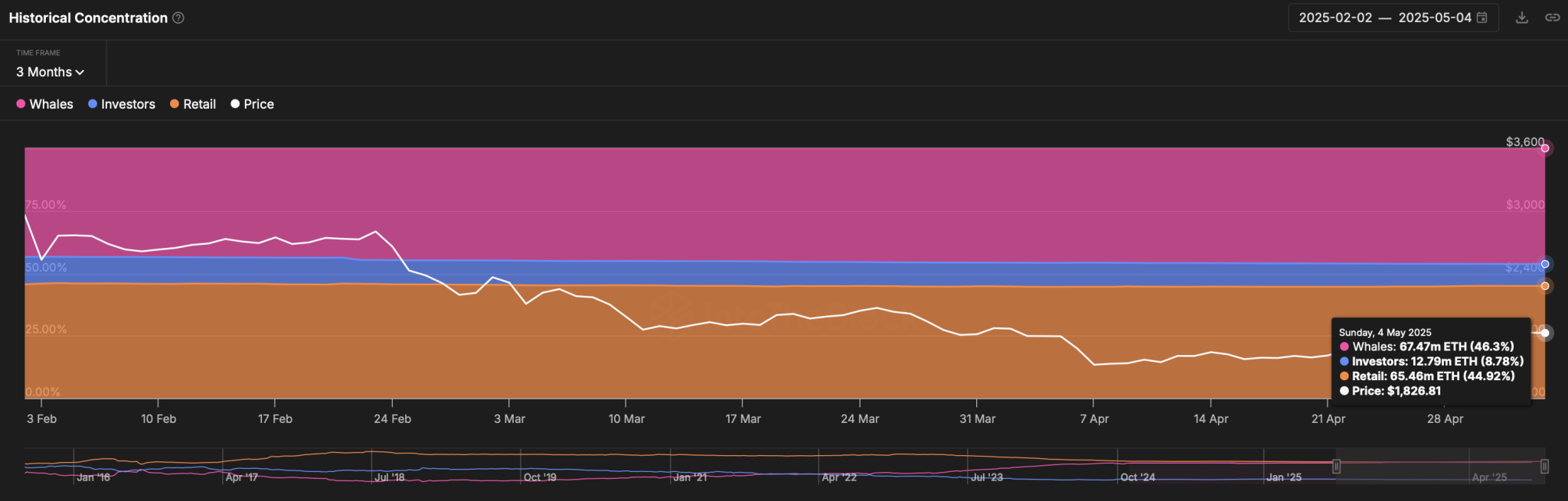

Additional information from IntoTheBlock reveals that whale focus has grown considerably over the previous three months. The overall held by whales elevated from 61.69 million ETH to 67.47 million ETH, now representing 46.3% of the whole circulating provide.

In the meantime, each investor and retail focus have decreased. Investor holdings have declined from 10.92% to eight.78%, and retail possession has dropped from 45.57% to 44.92%.

Historic Ethereum Focus