Ethereum is approaching a key breakout from a triangle sample, with bulls eyeing the $2,000 mark.

At $1,623, Ethereum has registered an intraday restoration of 1.60% on the time of writing. This bullish comeback is on the verge of erasing Sunday’s 2.8% drop from the $1,650 mark. Ethereum’s restoration has introduced it to the apex of a triangle sample.

Amid bettering broader market sentiment, Ethereum’s probabilities of a breakout are steadily rising. Will this push ETH towards the psychological $2,000 degree?

Ethereum’s Restoration Rally Nears Key Breakout, Bulls Goal $2,000

Within the 4-hour worth chart, the current bullish turnaround from the $1,418 degree marks a big restoration for Ethereum. The upper excessive formation in Ethereum led to an area help trendline.

The overhead resistance close to $1,675, coinciding with the 38.2% Fibonacci degree, highlights the highest of an ascending triangle sample. A longstanding resistance trendline additionally creates a symmetrical triangle sample on the 4-hour chart.

Additionally, technical indicators are exhibiting a bullish development. The Supertrend indicator suggests an uptrend is in movement, and the 4-hour RSI, remaining above the midway mark, displays robust bullish momentum. These indicators preserve an optimistic outlook for Ethereum.

As Ethereum approaches the apex of the triangle, worth motion merchants expect a high-momentum transfer in both course. In keeping with Fibonacci ranges, a bullish breakout may goal the 78.6% Fibonacci degree at $1,948.

This may improve the probabilities of Ethereum reaching the $2,000 psychological degree. Nonetheless, a possible breakdown may retest the $1,418 help degree.

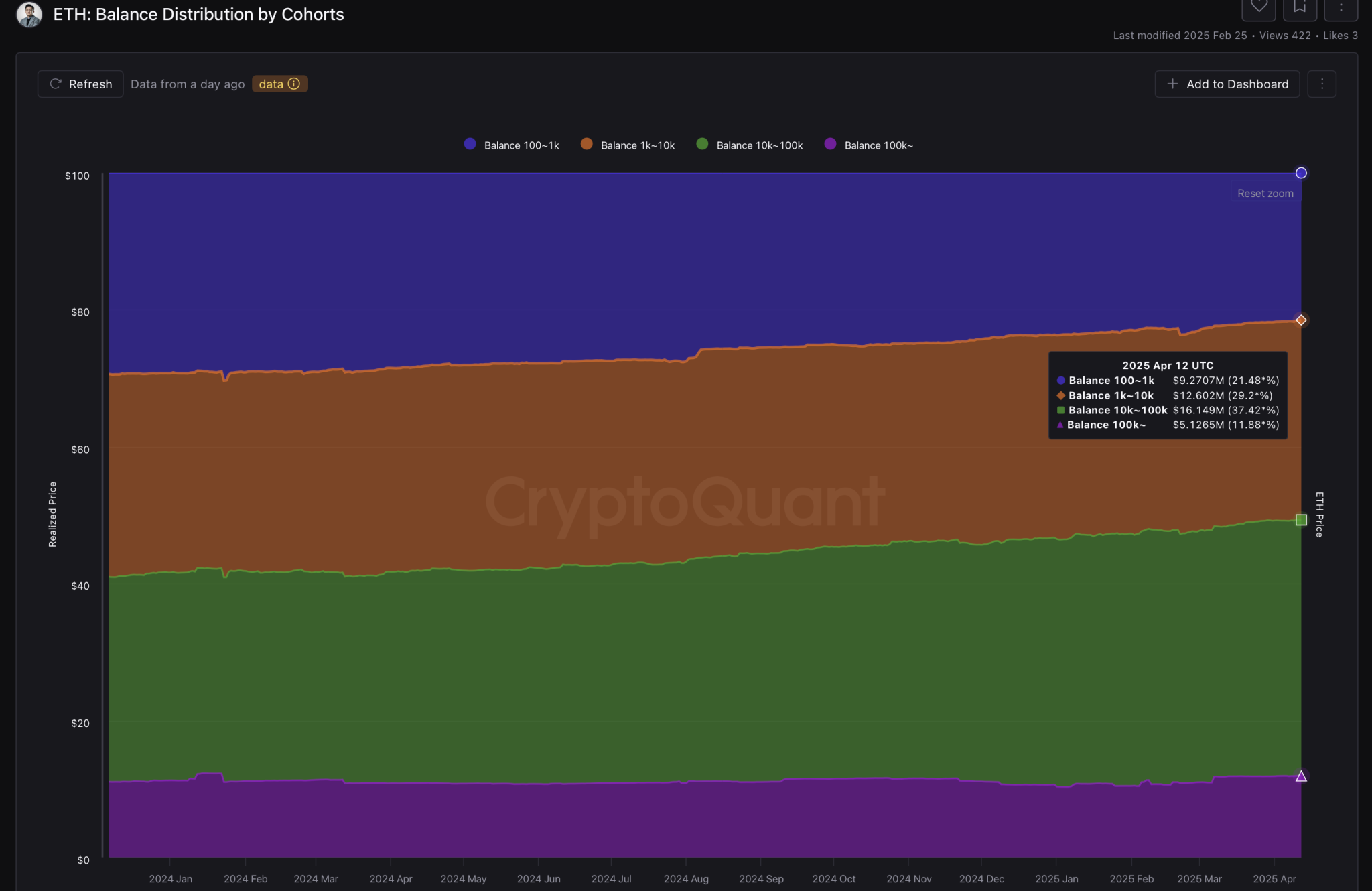

Steadiness of Cohorts Holding 10k to 100k ETH Hits New Excessive

As Ethereum trades at comparatively low ranges, giant traders are ramping up accumulation. In keeping with CryptoQuant, the stability distribution of Ethereum by cohort reveals vital progress in giant holdings.

Previously yr, the stability of holdings between 10,000 and 100,000 ETH has elevated from 29.64% to 37.42%. The stability of wallets holding greater than 100,000 ETH has risen to 11.88%, up from 11% a yr in the past.

In the meantime, the retail phase has been lowering its holdings, with the stability of wallets holding 100 to 1,000 ETH falling from 29.47% to 21.48%.

Regardless of this, the robust help from giant traders suggests an prolonged rally could possibly be on the horizon.

ETH Steadiness Distribution by Cohorts

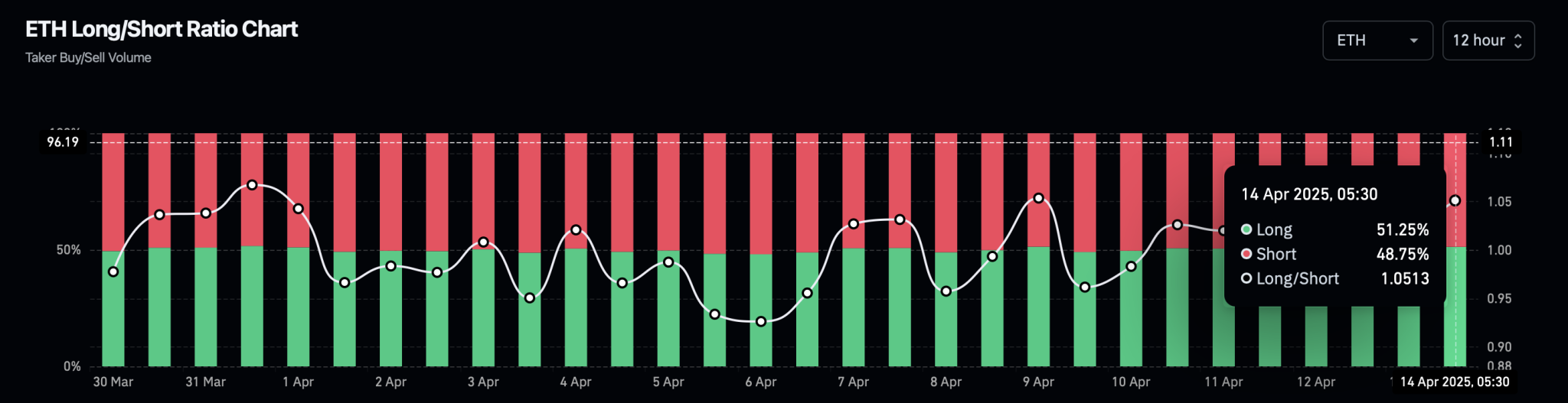

Crypto Merchants Go Lengthy on Ethereum

As Ethereum nears a possible breakout rally, bullish sentiment within the derivatives market has considerably elevated. Lengthy positions in Ethereum have surged to 51.25%, boosting the long-to-short ratio to 1.0513.

The Ethereum open curiosity stays regular close to $17.94 billion, whereas the funding fee has jumped to 0.0060%. The constructive funding fee and the rising variety of lengthy positions sign rising optimism for Ethereum.

Ethereum LongShort Ratio Chart