Corporations which can be shopping for ether (ETH) for his or her treasury technique are a greater purchase for traders than ETH spot exchange-traded funds (ETFs), mentioned Normal Chartered analyst Geoff Kendrick.

The analyst famous that these companies are attracting consideration not only for their holdings but in addition for his or her monetary construction, which is beginning to change into engaging for traders.

“The NAV multiples (market cap divided by worth of ETH held) have now additionally began to normalise for the ETH treasury firms,” mentioned Kendrick, including that this dynamic is making the “treasury firms now very investable for traders looking for entry to ETH worth appreciation.”

Shopping for ETH for the stability sheet, following Michael Saylor’s bitcoin

shopping for technique, has taken off not too long ago. Many publicly traded companies have jumped on board and seen their share costs surge initially, boosting their market cap and NAV multiples. Now, their NAV multiples are coming down from their preliminary peak.

A few of the prime firms having fun with this market euphoria embrace BitMine Immersion Applied sciences (BMNR) and SharpLink Gaming (SBET).

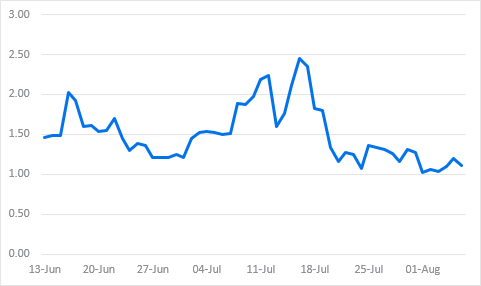

Amongst these firms, Kendrick highlighted SharpLink Gaming’s (SBET) NAV a number of, which at its peak was round 2.50 and is now coming right down to a extra normalized stage of close to 1.0. This implies its market cap is just barely larger than the worth of its ETH holdings.

To make certain, the analyst mentioned that he does not see any motive for the NAV to go under 1.0, as these treasury companies present traders with “regulatory arbitrage alternatives.”

Kendrick additionally highlighted that these treasury firms have purchased simply as a lot ETH as U.S.-listed spot exchange-traded funds (ETFs) since June.

Each teams now maintain round 1.6% of the full circulating ETH provide — slightly below 2,000 ETH — over that point interval, including to his name that each the treasury shares and ETF holders now present comparable publicity to ETH, all else being equal.

The mixture of those two elements is now including to his thesis that ETH treasury performs are a greater shopping for alternatives than ETFs. “Given NAV multiples are at the moment simply above 1 I see the ETH treasury firms as a greater asset to purchase than the US spot ETH ETFs,” he mentioned.

Normal Chartered is sustaining its year-end worth goal of $4,000 for ether. ETH is at the moment buying and selling at $3,652, up 2% over the previous 24 hours.

Learn extra: Ether Treasury Corporations to Finally Personal 10% of Provide: Normal Chartered