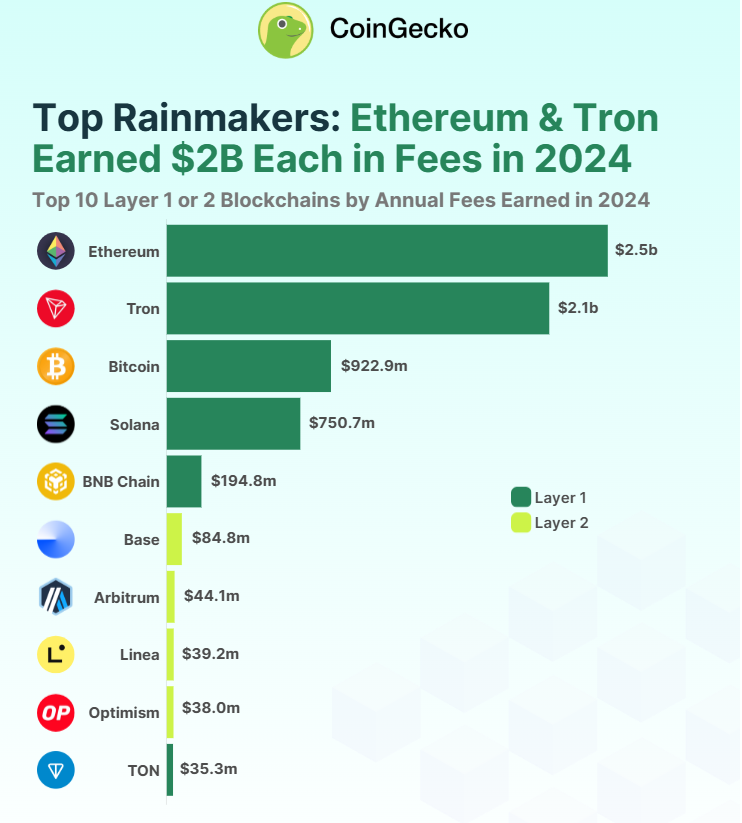

The yr 2024 was pivotal for digital property, with quite a few historic milestones achieved. The newest knowledge exhibits that blockchains collectively generated $6.9 billion in charges in 2024.

Ethereum led the cost, adopted by Tron and Bitcoin, which secured their locations within the high three. Moreover, Solana skilled a big surge in charges.

Ethereum Dominates Blockchain Charge Income in 2024

Based on CoinGecko’s report, Ethereum generated $2.48 billion from fuel charges, marking a 3.0% yearly improve.

“This means that Ethereum has continued to guide in price earnings regardless of the Dencun improve in March 2024 that lowered L2 transaction prices, and the continued consumer migration from the L1 chain to its L2 scaling options,” the report famous.

High blockchains by earnings. Supply: CoinGecko

Ethereum’s price earnings contrasted with its underwhelming value efficiency, which fell wanting expectations in 2024.

Whereas many cryptocurrencies reached all-time highs this yr, ETH was unable to observe go well with. Moreover, Ethereum ETFs underperformed in comparison with Bitcoin, with inflows solely selecting up in November.

In the meantime, Tron skilled a outstanding development spurt, securing $2.15 billion in charges, a 116.7% improve from $922 million in 2023.

The blockchain benefitted from the rising use of stablecoins, with month-to-month price earnings climbing from $38 million in January 2023 to a peak of $342 million in December 2024. Tron’s efficiency surpassed Ethereum’s within the final six months of the yr, though it stays to be seen whether or not it might probably preserve this lead in 2025.

Bitcoin, in distinction, earned $922 million in charges, reflecting a gentle rise in exercise, together with Ordinal NFTs, BRC-20 tokens, and rising curiosity in Bitcoin-based functions.

Solana’s Meteoric Rise

Notably, Solana, recognized for its high-speed transactions, posted a unprecedented 2,838.0% improve in price earnings, reaching $750.65 million in 2024.

“Solana was by far the most well-liked blockchain ecosystem final yr, with transaction quantity surging to the purpose of community congestion in April 2024,” the report learn.

Its dominance in decentralized change (DEX) buying and selling additionally surged in This fall, with its market share climbing above 30%.

The community additionally hit a document peak in charges and income on January 20. A good portion of this development got here from the rise of the TRUMP and MELANIA cash. This new milestone adopted SOL’s all-time excessive on January 19, 2025.

Whereas layer 1 blockchains dominated the vast majority of the charges, contributing $6.6 billion, layer 2’s weren’t left behind, including $294.92 million. 4 of the highest 10 highest-earning blockchains have been layer 2 options—Base, Arbitrum, Linea, and Optimism—surpassing layer 1s like TON in charges.

Base topped the L2s with $84.78 million in fuel charges in 2024, benefiting from sturdy adoption and its Coinbase integration.