Ethereum’s Whole Worth Locked (TVL) has surged by a powerful $7.79 billion over the previous week, marking it because the blockchain with the best progress in TVL throughout this era. This important growth coincides with the momentary rise of the ETH worth to $4,000, indicating renewed investor confidence within the cryptocurrency.

The blockchain will not be the one one which has had notable progress. Nevertheless, in accordance with current knowledge, no different venture has skilled Ethereum’s degree of progress.

Confidence in Ethereum Reaches New Heights

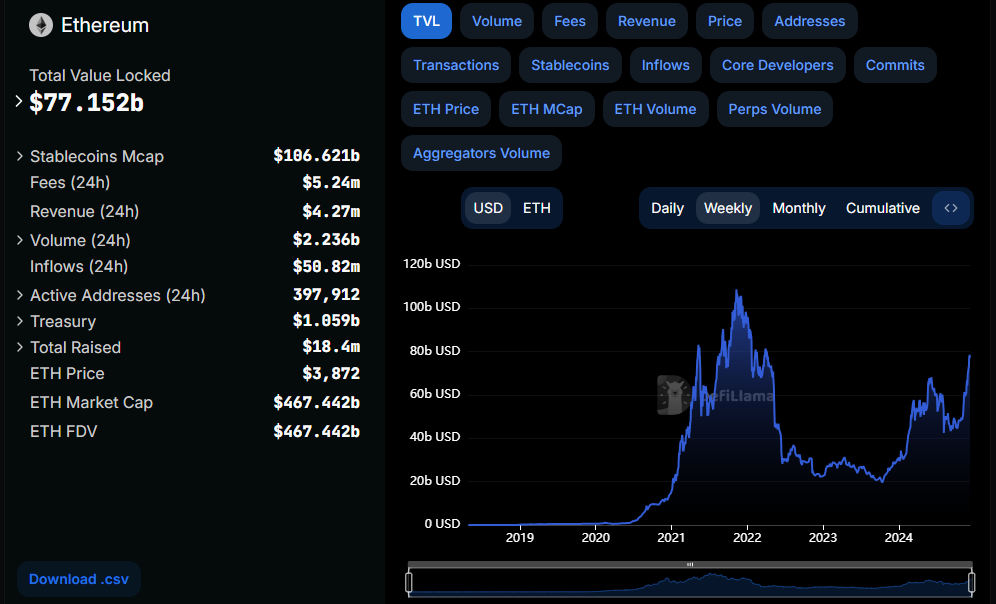

On December 2, the Ethereum TVL was rather less than $70 billion. However right this moment, the metric has grown to $77.15 billion. TVL is an important metric throughout the cryptocurrency and decentralized finance (DeFi) ecosystem.

It represents the entire worth of belongings locked or staked in decentralized functions (dApps), good contracts, or blockchain-based protocols. This metric serves as an indicator of the expansion, adoption, and consumer confidence in DeFi platforms.

A better TVL means that extra customers are partaking with these techniques, signifying belief of their performance and safety. Then again, a lower within the metric signifies dwindling liquidity, suggesting falling deposits on the blockchain

Due to this fact, the rise in Ethereum’s TVL signifies the cryptocurrency’s rising adoption and recognition amongst buyers. This surge suggests heightened belief in Ethereum-based decentralized functions and protocols.

Ethereum Whole Worth Locked. Supply: DeFiLlama

If this pattern persists, it might doubtlessly drive additional appreciation for ETH worth, as rising TVL typically correlates with elevated community exercise and demand for the asset. It is usually necessary to notice that Tron’s and Solana’s TVL additionally elevated by $900.23 million and $618.40 million.

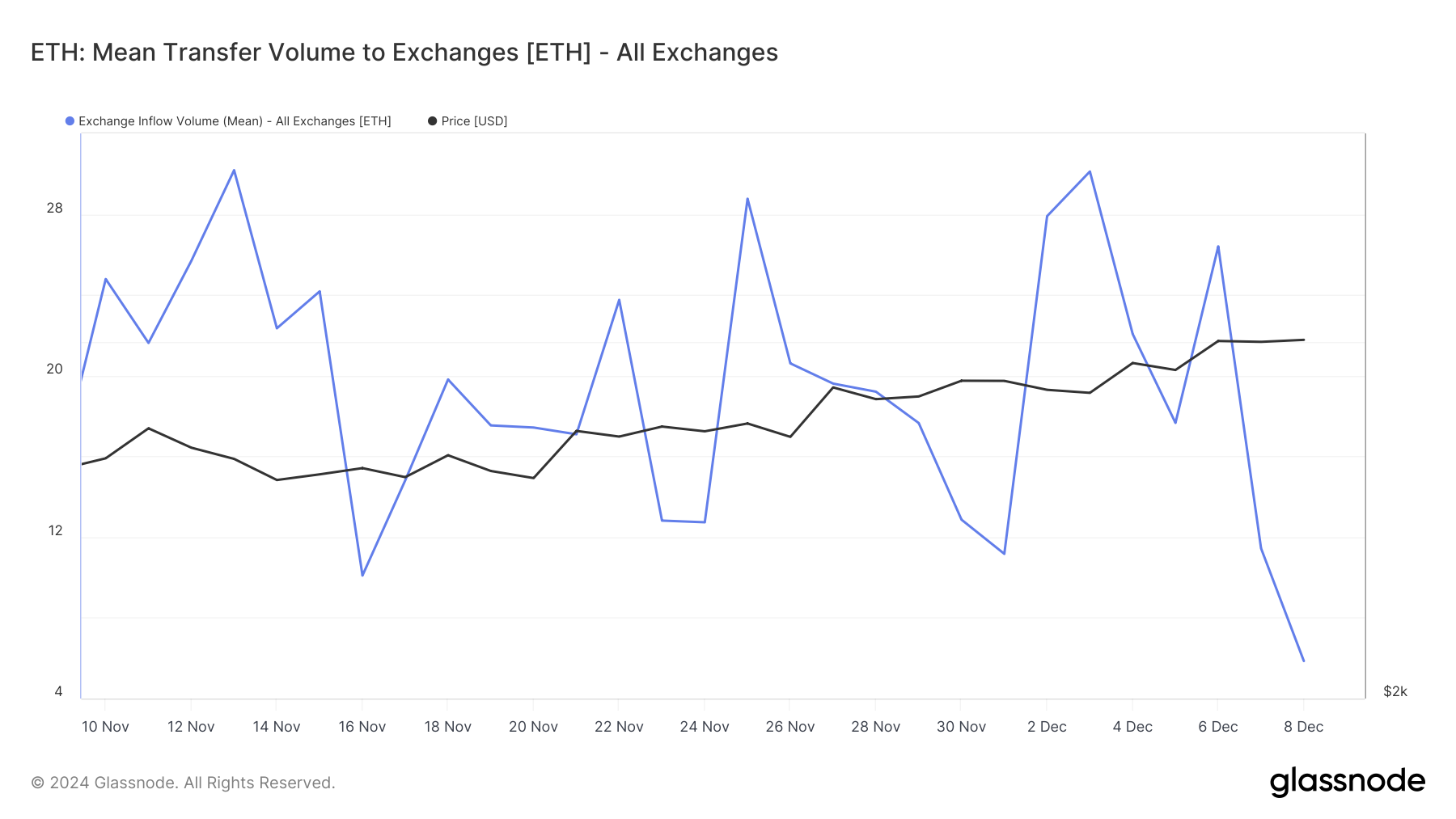

Past that, Glassnode knowledge confirmed that Ethereum trade influx quantity has dropped to the bottom degree in over a month. When trade influx rises, it means holders are keen to promote.

Nevertheless, because it decreased, it signifies that many ETH holders have determined to not liquidate their belongings, which is bullish for the value.

Ethereum Change Influx. Supply: Glassnode

ETH Worth Prediction: $4,200 Goal Looms

The ETH/USD 3-day chart reveals that the cryptocurrency traded inside a descending triangle between June and November. A descending triangle is a generally acknowledged bearish chart sample outlined by a falling trendline connecting a collection of progressively decrease highs and aflatter trendline types alongside a constant worth degree, performing as assist because the asset worth assessments it a number of instances.

The descending triangle usually signifies that sellers are gaining management, doubtlessly resulting in a breakdown beneath the assist line. Nevertheless, ETH’s worth has damaged out of this channel, suggesting that the cryptocurrency’s worth would possibly commerce increased.

Ethereum 3-Day Evaluation. Supply: TradingView

If this pattern continues, then Ethereum might climb above $4,096 and hit $4,200 within the quick time period. Nevertheless, if promoting strain will increase and the Ethereum TVL drops, this prediction won’t come to cross. In that state of affairs, ETH would possibly lower to $3,175.