The Ethereum validator exit queue grows by the day, reaching all-time excessive ranges. As ETH rallied, the community skilled its greatest outflow of validators.

Validators are leaving the Ethereum community, with a document variety of unstaking requests as of July 25. Previously 10 days, the Ethereum community began an unprecedented withdrawal, as merchants tried to unlock ETH. The validator exodus comes as ETH trades round $3,465.55.

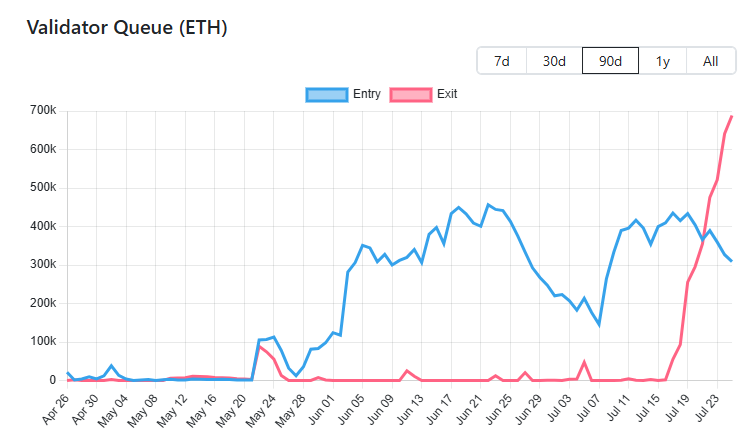

The sudden enhance in requests to free ETH from the Beacon Chain contract began on July 16, and initially seemed like common validator turnover. Quickly, the queue grew to 688,356 ETH ready to be freed up, valued at over $2.6B.

Requests to withdraw ETH accelerated since July 16, pushed by the market rally and the rising publicity of treasury firms. | Supply: Validator Queue

Any Ethereum freed up at this charge is not going to hit the marketplace for just a few days. At the moment, the ready time has grown to 11 days, additionally a document excessive. The present unstaking episode additionally reveals that establishments might face obstacles when utilizing the Beacon Chain, resulting from unpredictable unstaking episodes.

The Ethereum community nonetheless has over 2M validators, with no important risk to community safety. The ultimate impact for ETH could also be near having just a few giant whales promoting. A few of the early holders can also put together the free ETH for treasuries or promote it to treasury firms in OTC offers.

Early Ethereum validators might search to take earnings

The chief purpose for the push to unstake could also be to take earnings, as ETH recovered as excessive as $3,800. Lots of validators have staked their cash at a a lot lower cost, and will wish to unlock the worth of their ETH.

The rollover in validators could also be partially resulting from this yr’s community improve, which permits for validators to deposit 2,048 ETH, as a substitute of a number of deposits of 32 ETH.

The validator exodus additionally occurred simply as a number of firms began saying ETH treasuries. The affect of SharpLink Gaming and Bitmine boosted demand for Ethereum as a long-term retailer of worth.

One other 308,713 ETH are able to be staked on the Beacon Chain, exhibiting demand for passive earnings. Ethereum validator staking is seen as a viable possibility for a group of ETF, and a few company treasuries can also be partially locked for staking.

Lido DAO unstaking accelerates

The Lido DAO unstaking queue can also be close to an all-time peak. Greater than 223K ETH are ready to be unstaked. Previously few days, ready occasions for Lido DAO have greater than doubled from 70 hours to over 150 hours on common.

At this level, virtually all ETH is days away from coming into the spot market. Nonetheless, there are different use instances for the freed-up cash.

For one, a number of the share of Lido DAO has flowed over to Binance’s staking program. Binance carries round 20% of staked ETH, with its personal vigorous commerce between liquid staking tokens and L1 ETH.

At the moment, a market anomaly is elevating demand for Binance’s liquid staking token. The value of WBETH is rising, with a major premium of $3,957.52. Round 80% of the WBETH volumes depend on Binance, and merchants can swap into Ethereum, thus not needing to undergo the withdrawal queue.

Whereas WBETH can be utilized for arbitrage, it’s a restricted alternative, which can take days to finish.