A widely known Ethereum whale is betting in opposition to the current ETH value restoration. On-chain analyst @ai_9684xtpa reported through X that this whale borrowed 4,000 ETH (price about $7.25 million) from the DeFi lending platform Aave. The analyst famous the whale borrowed this ETH particularly to open a brand new brief place, signaling a cautious or bearish outlook.

「04.13 以来 $ETH 波段获利 102.9 万美元巨鲸」也是头很铁啊,再空一次 ETH!这次能拿回属于他的一切吗🤣

04.22-04.25 借币做空 ETH 亏损 38.2 万美元后,11 小时前他再次从 Aave 借出 4000 枚 ETH 并以 $1,808.62 卖空,价值 725 万美元

钱包地址 https://t.co/COpoOVctZC

本文由 #Gateio |… https://t.co/5U3CpK5FJa pic.twitter.com/hYaLCIxu1l

— Ai 姨 (@ai_9684xtpa) April 26, 2025

Whale’s Rocky Current Trades: Income Adopted by Losses

This isn’t the whale’s first large transfer currently. They’ve been actively swing buying and selling ETH since mid-April. Earlier trades reportedly netted them over $1 million in revenue. Nevertheless, their luck appeared to show between April twenty second and twenty fifth.

Throughout that point, the whale shorted ETH however bought caught out when the worth went up, forcing them to purchase again greater. This resulted in losses totaling round $382,000 on these current shorts. Now, regardless of these losses, they’re putting one other massive brief guess

Information confirmed that the whale’s common brief promoting value was $1,731, whereas the closing value reached $1,778.70, culminating in a realized lack of $14.23 million from an earlier 8,000 ETH place.

Associated: What Do Ethereum Whales Know That We Don’t

How ETH Worth Reacted This Time

Regardless of these actions, Ethereum traded greater in the course of the newest session, buying and selling at round $1,806 after registering a 1.85% day by day achieve. CoinMarketCap information confirmed an increase in Ethereum’s market capitalization to $218.05 billion, whereas day by day buying and selling quantity climbed 5.05% to $15.88 billion. The community’s circulating provide remained secure at 120.72 million ETH, aligning with complete provide figures.

Supply: CoinMarketCap

A volume-to-market cap ratio of 6.95% pointed to lively buying and selling situations. Throughout the session, ETH dipped to $1,773 earlier than the shopping for strain pushed the worth to just about $1,820, displaying a unstable however strengthening market atmosphere.

What Alternate Flows Inform Us About ETH Provide

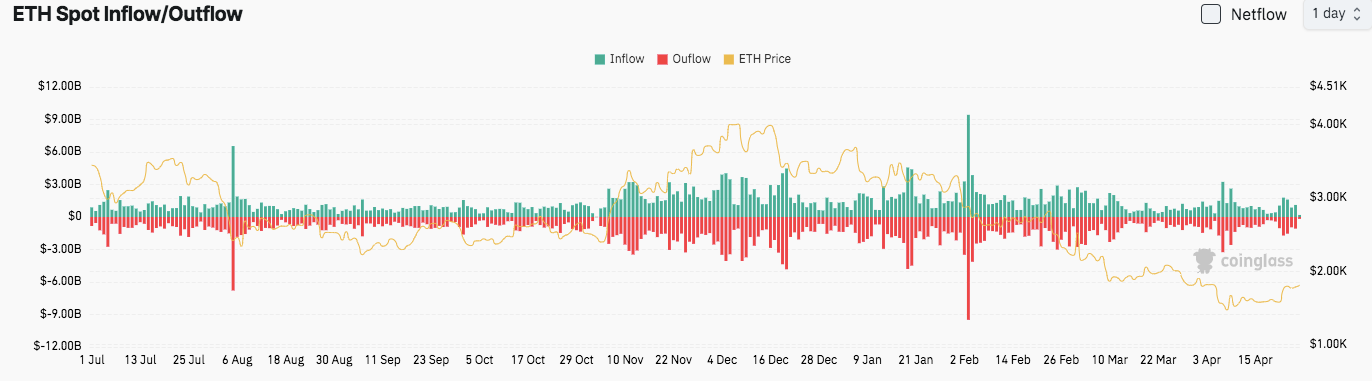

Taking a look at broader on-chain information gives extra context. Current CoinGlass figures present that Ethereum flowing into exchanges and out of exchanges has been roughly balanced currently. That is completely different from late 2023/early 2024 when extra ETH was constantly leaving exchanges (usually seen as bullish, that means much less provide out there to promote).

Supply: Coinglass

Now, with flows balanced close to the $1,800 value stage, it raises questions on whether or not promoting strain from exchanges would possibly decide up once more if the worth tries to maneuver a lot greater.

Associated: Whale Buys $5.88M Price of Ethereum Amid Market Panic: A Golden Alternative?

Are Extra Customers Participating with the Ethereum Community?

In the meantime, consumer exercise on Ethereum appears to be selecting up. CryptoQuant information confirmed a resurgence in Ethereum’s lively addresses.

After intervals of fluctuating exercise between mid-2022 and early 2024, the variety of lively addresses is climbing once more. Nevertheless, previous information confirmed that spikes in consumer engagement didn’t flip into sustained value positive aspects, leaving the potential impression of this pattern unsure.

Disclaimer: The data offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any sort. Coin Version will not be liable for any losses incurred on account of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.