Ethereum value stays beneath stress in early February as promoting momentum builds throughout each on-chain and technical indicators. The token has slipped under key assist ranges following a confirmed chart breakdown, whereas contemporary information reveals massive holders and long-term traders starting to cut back publicity.

With Vitalik Buterin promoting $ETH and accumulation slowing, the $1,800 zone is now rising as a essential near-term draw back threat.

Head-and-Shoulders Breakdown Aligns With Vitalik’s $ETH Promoting

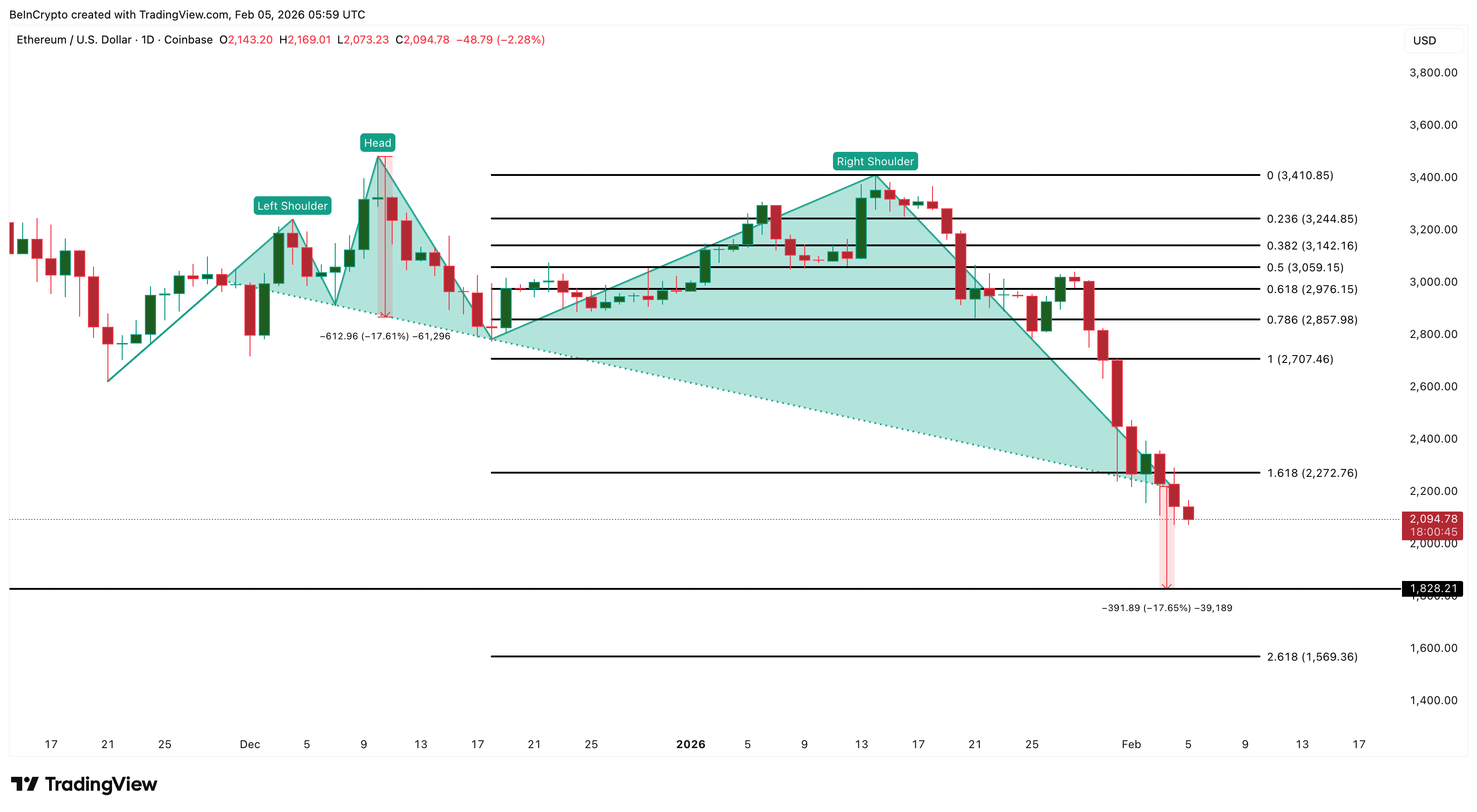

Ethereum’s newest decline accelerated after a transparent technical breakdown on February 3.

On the each day chart, $ETH accomplished a head-and-shoulders sample that had been forming since mid-November. When the $ETH value failed to carry above the neckline and broke decrease on February 3, the bearish sample was confirmed.

Bearish Value Construction: TradingView

Need extra token insights like this? Join Editor Harsh Notariya’s Day by day Crypto E-newsletter right here.

Head-and-shoulders formations sometimes sign development reversals. The projected draw back goal is calculated by measuring the peak of the sample and making use of it under the neckline. In Ethereum’s case, this factors towards the $1,820 zone.

At across the similar time, on-chain information confirmed that Vitalik Buterin had begun promoting $ETH.

vitalik.eth(@VitalikButerin) is dumping $ETH quick!

Over the previous 3 days, Vitalik has bought 2,961.5 $ETH($6.6M) at a mean value of $2,228 — and the promoting continues to be ongoing.https://t.co/Q9G1lEsdiP pic.twitter.com/C1vBn5UimJ

— Lookonchain (@lookonchain) February 5, 2026

Over the previous three days, Vitalik bought round 2,961 $ETH price roughly $6.6 million at a mean value close to $2,228. The promoting started simply as Ethereum was shedding technical assist and has continued by way of the breakdown.

This timing is vital. When a significant ecosystem determine reduces publicity throughout a chart breakdown, it typically weakens market confidence. As an alternative of stabilizing sentiment, Vitalik’s gross sales bolstered the bearish sign coming from value motion.

Consequently, the technical breakdown and high-profile promoting mixed to mark February 3 as a significant turning level for Ethereum.

Whales and Hodlers Begin Promoting After February 3 Sign

After the breakdown and Vitalik’s gross sales, massive and long-term holders additionally started altering their habits.

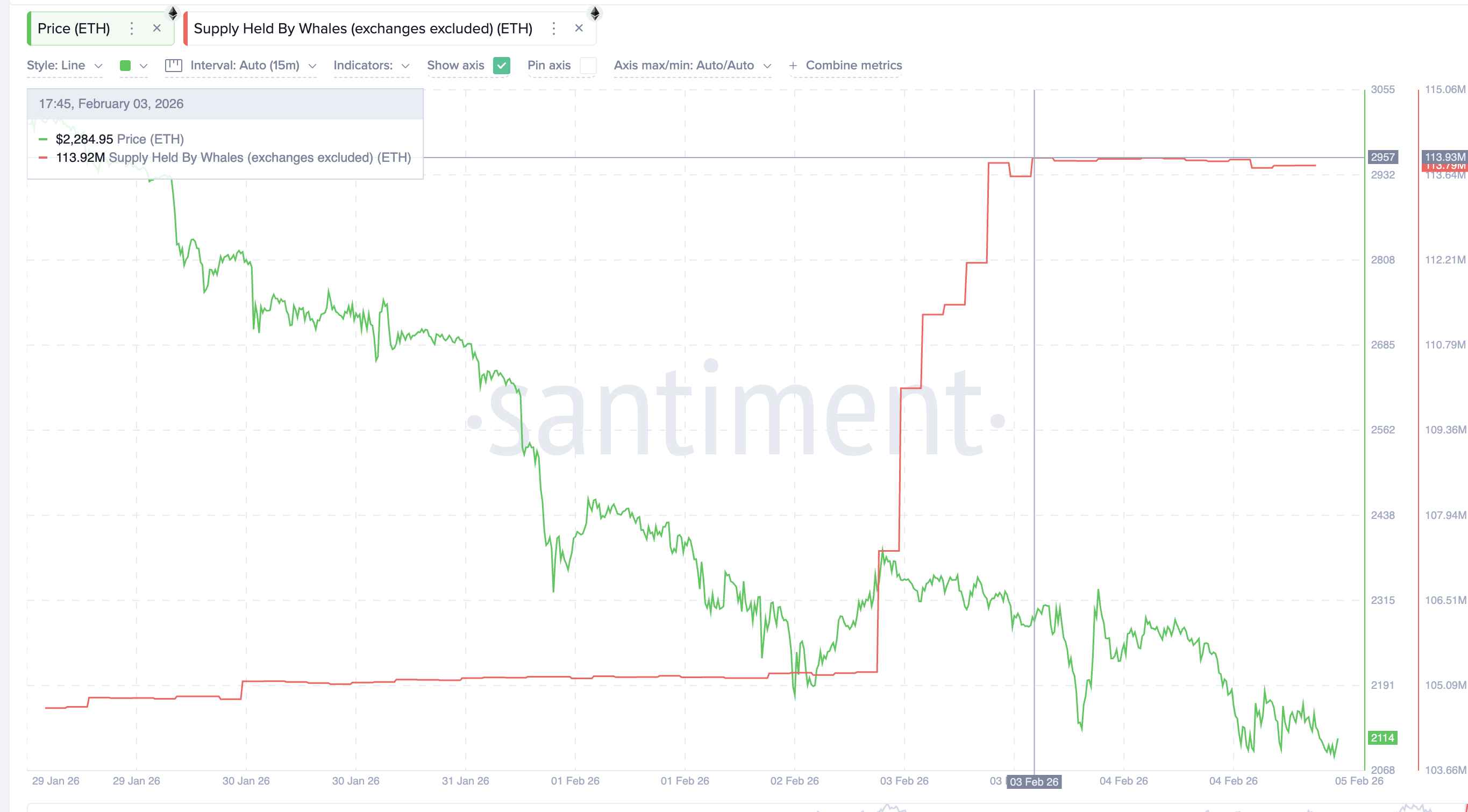

Information reveals that Ethereum whales, excluding trade wallets, elevated their holdings considerably between February 2 and February 3 as they tried to purchase the dip. Nonetheless, as soon as the value did not get better, that accumulation shortly reversed.

On February 3, whale holdings stood close to 13.93 million $ETH. They’ve since fallen to round 13.79 million $ETH, a discount of roughly 140,000 $ETH, price over $290 million. This decline suggests cautious distribution fairly than assured long-term shopping for.

$ETH Whales Begin Promoting”>

$ETH Whales Begin Promoting”>

$ETH Whales Begin Promoting: Santiment

On the similar time, long-term holders additionally began promoting.

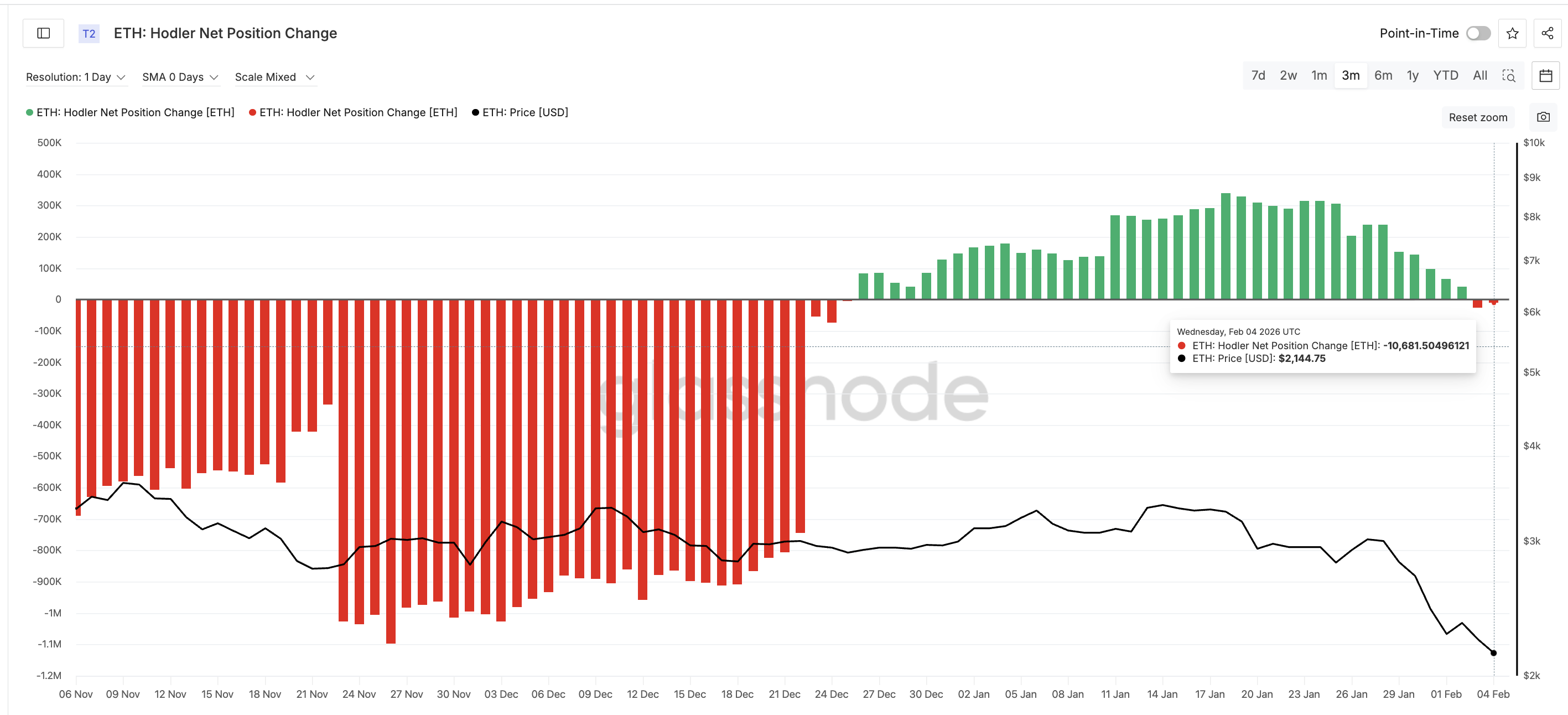

Hodler Web Place Change tracks the online motion of $ETH held by wallets that haven’t moved cash for greater than 155 days. These wallets are thought of long-term traders. Constructive readings point out accumulation, whereas adverse values present web promoting.

Since late December, this metric had remained optimistic, that means long-term holders have been steadily including to their positions. Nonetheless, on February 3 and 4, it turned adverse for the primary time in weeks.

The newest studying reveals web promoting of round 10,681 $ETH. This shift signifies that even affected person traders have begun trimming publicity following the breakdown.

Hodlers Again To Dumping $ETH: Glassnode

Collectively, these alerts present a transparent sequence. Vitalik lowered holdings, the chart construction failed, whales started promoting, and long-term holders adopted, throughout the identical time. This coordinated shift suggests weakening conviction throughout a number of investor teams.

When each massive holders and hodlers step again on the similar time, draw back dangers normally enhance.

On-Chain Value Clusters Level to $1,800 as Key Ethereum Value Zone

On-chain provide information now helps clarify the place Ethereum might discover its subsequent main assist.

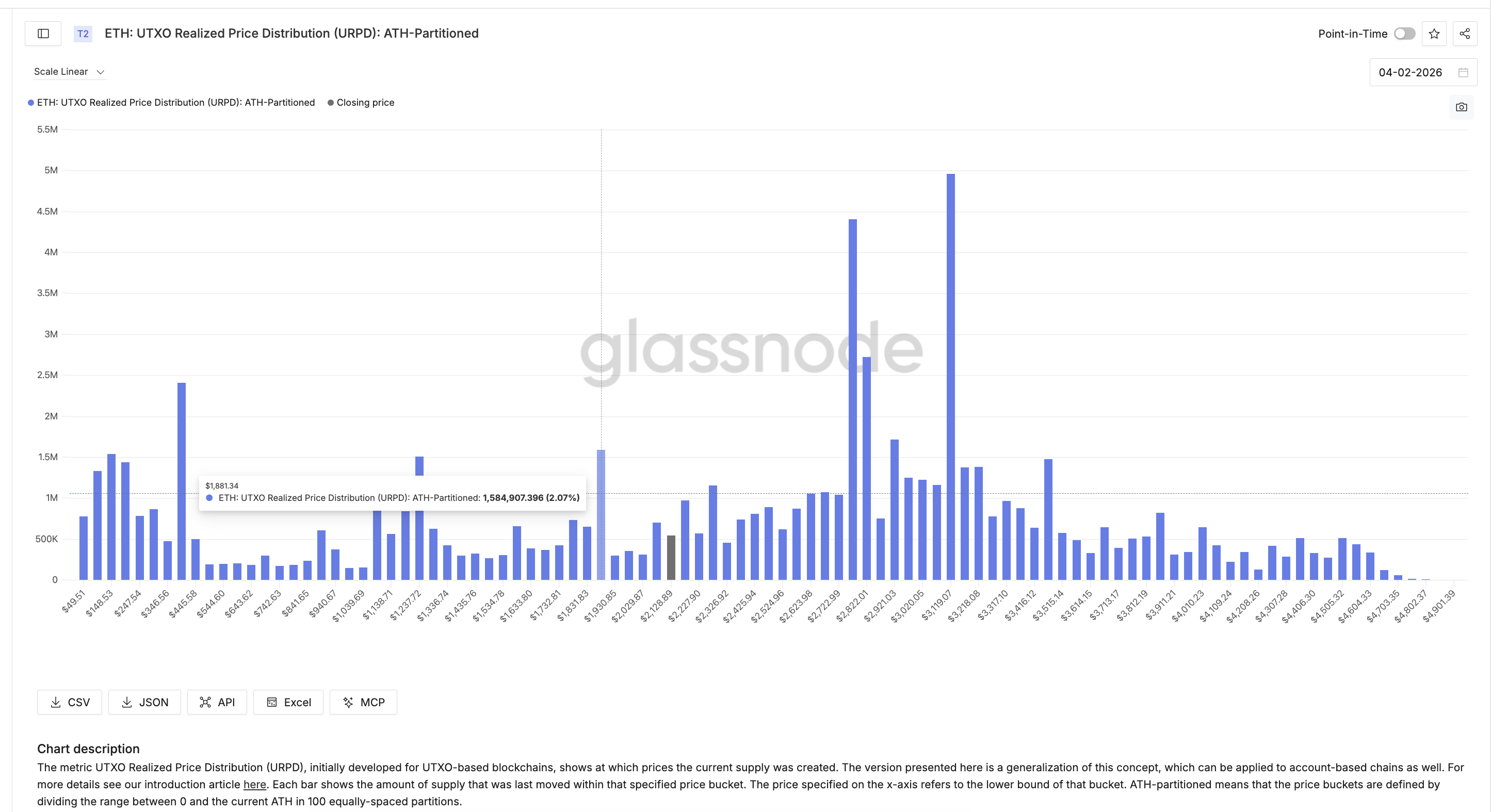

The UTXO Realized Value Distribution (URPD) reveals the place the present provide final moved on-chain. Whereas the metric was initially designed for UTXO-based blockchains like Bitcoin, Glassnode has since generalized it for account-based networks reminiscent of Ethereum.

Every bar represents how a lot $ETH final modified palms inside a particular value vary. Giant clusters typically act as assist or resistance as a result of many holders have their value foundation in these zones.

Present information reveals one of many strongest provide clusters close to $1,880. Round 2% of circulating $ETH final moved on this vary, making it a key psychological and structural assist space.

Value Foundation Clusters Generalized For $ETH: Glassnode

This aligns intently with the technical projection from the head-and-shoulders sample, which factors towards $1,820.

Ethereum has already misplaced the $2,270 assist stage. With value now buying and selling close to $2,090, the subsequent main take a look at sits between $1,880 (per the on-chain cluster)and $1,820.

If this zone fails, the subsequent $ETH draw back goal seems close to $1,560 based mostly on draw back Fibonacci extensions.

Ethereum Value Evaluation: TradingView

On the upside, the bearish setup would weaken provided that Ethereum reclaims $2,270 after which $2,700, and holds above them on the each day timeframe. With out that restoration, all Ethereum value bounces are prone to face promoting stress.

The publish Ethereum Whales And HODLers Observe Vitalik’s Cue As $1,800 Danger Grows appeared first on BeInCrypto.