Ethereum’s (ETH) dominance has seen a pointy decline this yr, pushed by broader market consolidation that has saved the altcoin’s value beneath $3,800 since January.

At current, Ethereum’s market share stays low, with its each day chart displaying no clear indicators of an imminent restoration.

Ethereum’s Market Share Plunges

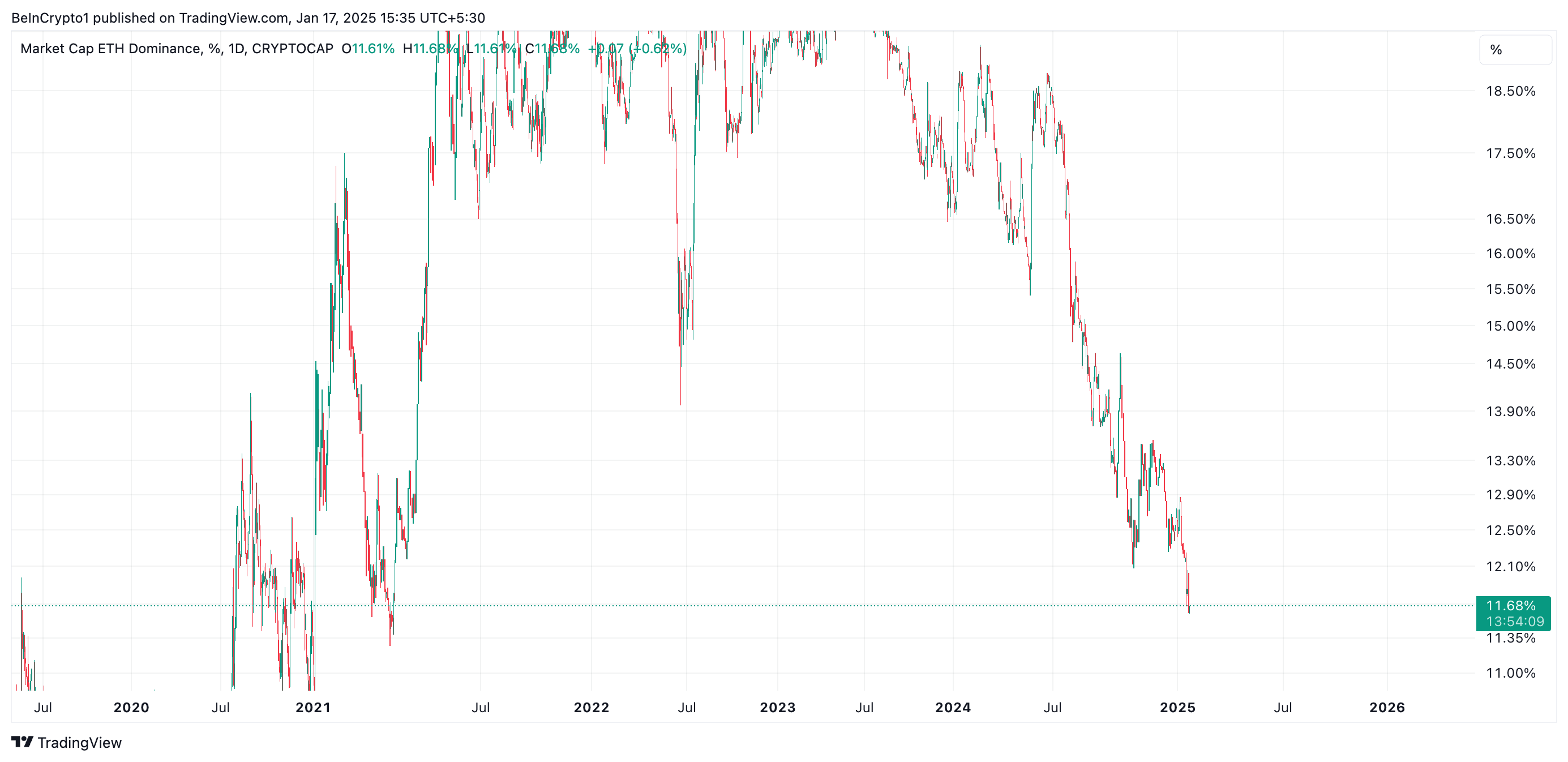

Ethereum dominance (ETH.D), which tracks the relative worth of ETH in comparison with different cryptocurrencies, has been on a downward development for the reason that starting of the yr. It now sits at a four-year low of 11.68%, having declined 6% since January 1.

This decline signifies that ETH’s general worth is shrinking relative to the broader cryptocurrency market. Readings from its technical indicators additional affirm the bearish outlook, suggesting that the coin’s value may proceed to plummet.

Ethereum Dominance. Supply: TradingView

As an illustration, ETH is at present buying and selling beneath the dots of its Parabolic Cease and Reverse (SAR) indicator.

The Parabolic SAR screens value traits and highlights potential reversal factors. When the value falls beneath the indicator’s dots, it alerts a bearish development, suggesting that downward momentum is lively and the market may see additional declines.

Ethereum Parabolic SAR. Supply: TradingView

Moreover, the setup of ETH’s Tremendous Development indicator reinforces this bearish outlook. At press time, it rests above the coin’s value, forming resistance at $3,677.

This indicator tracks the course and energy of an asset’s value development. It’s displayed as a line on the value chart, altering shade to indicate the present market development: inexperienced for an uptrend and crimson for a downtrend.

Ethereum Tremendous Development. Supply: TradingView

When an asset’s value trades beneath the Tremendous Development indicator, it’s in a bearish development. This alerts that promoting stress outweighs shopping for exercise amongst market individuals.

ETH Value Prediction: Will $3,182 Maintain?

With broader market consolidation and the waning demand for ETH, the coin’s value decline may lengthen within the brief time period. On this situation, the coin’s value may plummet to $3,182. If the bulls fail to defend this stage, its value may drop additional to $2,944.

Ethereum Value Evaluation. Supply: TradingView

However, if market sentiment improves and ETH accumulation resurges, it may drive its value previous the dynamic resistance at $3,677 and towards $4,096.