Solana now processes a median of 60 million each day transactions in comparison with Ethereum’s 1 million, proving that scalability issues greater than status in immediately’s blockchain wars. Is Ethereum useless?

Ethereum’s struggle for relevance

From being celebrated as a pioneer in good contracts to now going through relentless competitors and inner discord, Ethereum’s (ETH) journey has began to look much less like a gradual climb and extra like a rocky descent.

To grasp Ethereum’s predicament, let’s rewind to November 2021, when its complete worth locked hit an all-time excessive of $107 billion, driving a wave of optimism as ETH’s worth surged to a lifetime excessive of $4,890.

Ethereum lifetime TVL chart | Supply: DeFi Llama

Quick ahead to the top of 2023, and that quantity had dwindled to only $30 billion — a staggering decline. Though 2024 provided a glimmer of restoration, with TVL climbing to $66 billion by mid-year, as of January 2025, Ethereum stays caught at $64.5 billion.

In the meantime, its closest competitor, Solana (SOL), has scripted a much more compelling comeback story. After plunging from a TVL of $10 billion in late 2021 to a mere $210 million in early 2023, Solana roared again to life, hitting an all-time excessive of over $12 billion this month — outpacing Ethereum’s restoration in each velocity and scale.

Solana lifetime TVL chart | Supply: DeFi Llama

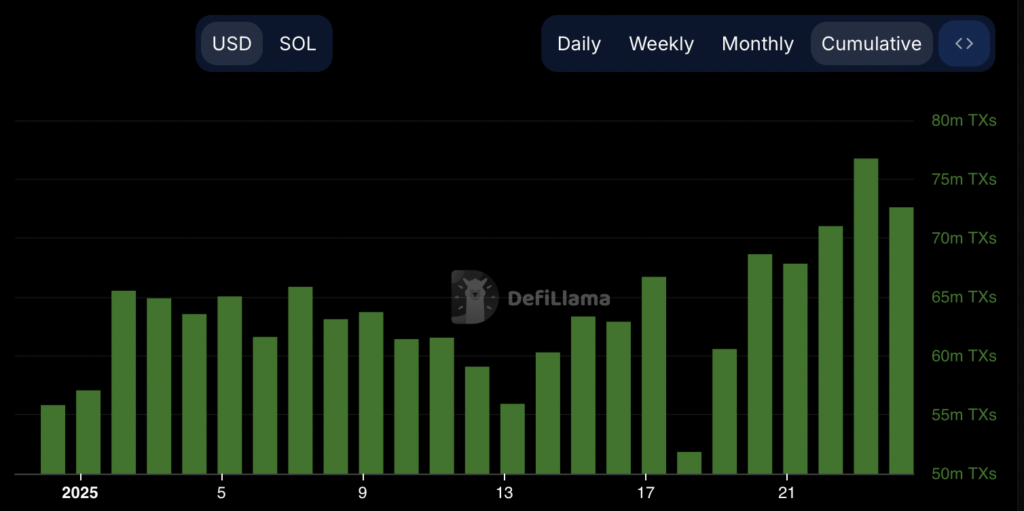

Past TVL, Ethereum seems to be dropping floor on important metrics like transaction quantity and consumer charges. Whereas Ethereum processes a median of 1-1.2 million each day transactions as of early 2025, Solana dwarfs this with a jaw-dropping 60-65 million transactions per day.

Solana each day transaction rely chart (2025) | Supply: DeFi Llama

Ethereum each day transaction rely chart (2025) | Supply: DeFi Llama

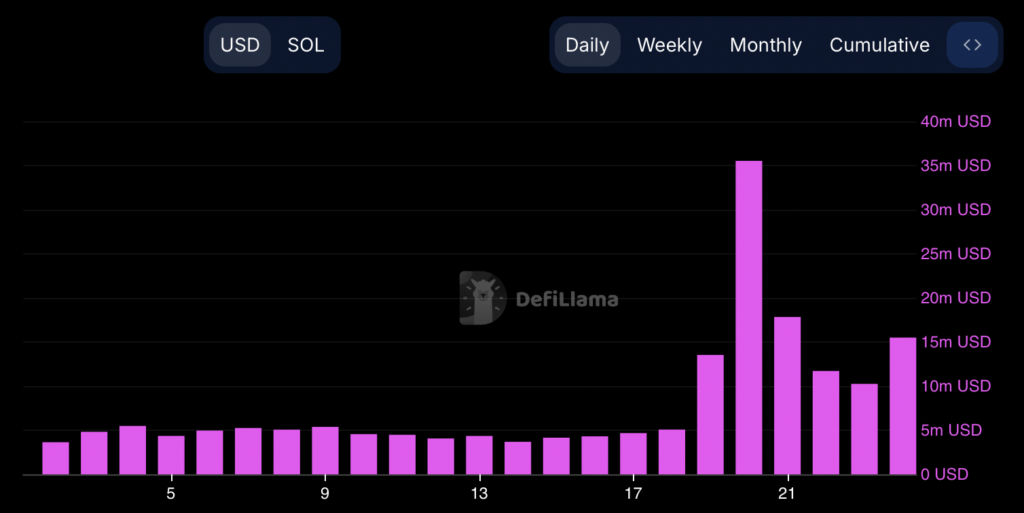

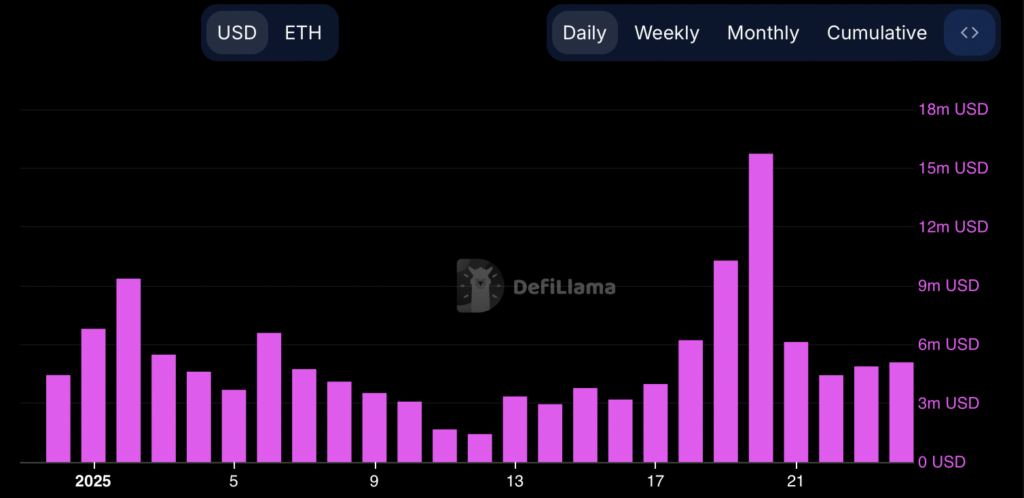

And regardless of Ethereum charging increased charges per transaction, Solana’s each day price quantity is persistently increased, averaging $5-6 million this month and peaking at $35 million throughout the buzz surrounding the inauguration of Donald Trump because the forty seventh U.S. president. As compared, Ethereum’s price quantity hovered round $3-4 million on common, with a modest spike to $15 million on the day Trump was inaugurated.

Solana each day charges chart (2025) | Supply: DeFi Llama

Ethereum each day charges chart (2025) | Supply: DeFi Llama

Let’s dive deeper into the issues surrounding Ethereum and the way this once-blockchain pioneer is having a run for its life.

The Ethereum Basis’s identification disaster

Ethereum’s struggles aren’t restricted to technological hurdles. The Ethereum Basis (EF), a nonprofit group lengthy seen because the spine of Ethereum’s improvement, is itself in a state of upheaval.

Inner discontent, rising competitors, and questions in regards to the basis’s imaginative and prescient have left the EF grappling with its identification at a time when Ethereum’s future has by no means been extra precarious.

The stress has led Ethereum’s co-founder, Vitalik Buterin, to step in with sweeping plans to overtake the EF’s management construction.

For over a 12 months, Buterin has been quietly engaged on a restructuring initiative geared toward addressing inefficiencies and enhancing communication between the EF and Ethereum’s builders.

“We’re within the course of of enormous modifications to EF management construction,” Buterin revealed in a current X publish, including that the last word objective is to determine a “correct board” to information the muse.

We’re certainly at present within the course of of enormous modifications to EF management construction, which has been ongoing for near a 12 months. A few of this has already been executed on and made public, and a few remains to be in progress.

What we’re attempting to realize is primarily the next…

— vitalik.eth (@VitalikButerin) January 18, 2025

But, this effort has not been with out controversy. Critics argue that Buterin’s central function within the course of undermines Ethereum’s ethos of decentralization. Others see it as a mandatory intervention to salvage the EF’s declining status.

One of many EF’s most polarizing methods is its reliance on a “rollup-centric” roadmap, which prioritizes scaling Ethereum by means of layer-2 options.

Whereas these rollups have improved transaction speeds and lowered prices, they’ve additionally launched new dangers, reminiscent of diminished safety ensures and declining base price revenues for Ethereum’s core community.

Critics argue that these trade-offs spotlight the EF’s incapacity to ship a long-term scaling answer that rivals like Solana have already achieved.

Solana’s skill to deal with hundreds of thousands of transactions per day with near-zero charges has grow to be a evident benchmark, leaving Ethereum struggling to maintain tempo.

Including to the turbulence is the controversy surrounding Aya Miyaguchi, the EF’s government director since 2018. Accusations of inefficiency and conflict-of-interest scandals have dogged her management, resulting in a wave of on-line criticism and even a social media marketing campaign calling for her resignation.

Whereas Miyaguchi stays in her function, the backlash has grown poisonous, with some critics resorting to private assaults and threats.

Buterin, visibly annoyed, took to X to sentence these actions as “pure evil,” warning that they’re driving prime builders away from Ethereum.

Pure evil. pic.twitter.com/mzCmOteu5r

— vitalik.eth (@VitalikButerin) January 21, 2025

“A few of Ethereum’s greatest devs have been messaging me not too long ago, expressing their disgust with the poisonous social media atmosphere,” Vitalik tweeted not too long ago, pushing again in opposition to requires management modifications on the EF.

No. This isn’t how this sport works.

The particular person deciding the brand new EF management group is me. One of many targets of the continuing reform is to present the EF a “correct board”, however till that occurs it is me.

In case you “hold the stress on”, then you’re creating an atmosphere that’s…

— vitalik.eth (@VitalikButerin) January 21, 2025

He sharply critiqued, “YOU ARE MAKING MY JOB HARDER,” slamming the social media trollers and disgruntled customers, as frustrations over stalled improvements and a hostile on-line group take middle stage.

The Second Basis: A competing imaginative and prescient for Ethereum’s future?

In December 2024, Konstantin Lomashuk, the founding father of Lido — a protocol managing over 28% of Ethereum’s staked ETH — dropped a touch on X about plans to reshape Ethereum’s ecosystem.

In your remark about Lido: I actually consider it’s attainable to construct a real DAO that retains Ethereum decentralized, censorship-resistant, and with out introducing new downsides. That’s why Lido is planning to launch twin governance in Q1 2025, an answer that mitigates LDO… https://t.co/stuyQfRaVr

— Konstantin Lomashuk cyber/acc (@Lomashuk) December 10, 2024

The thought, which he known as the “Second Basis,” was initially teased as a strategy to introduce competitors to Ethereum’s management and decision-making processes.

On Jan. 22, Lomashuk doubled down on this imaginative and prescient, sharing an official web page for the Second Basis on X, signalling that this wasn’t simply an thought.

👀 https://t.co/o1pgQ8J3mC

— Konstantin Lomashuk cyber/acc (@Lomashuk) January 22, 2025

The Second Basis is designed to decentralize energy inside Ethereum by making a parallel entity that challenges the Ethereum Basis. Lomashuk has been important of the EF’s insular construction, describing it as “tremendous deep” and inaccessible to outsiders with out years of analysis experience.

“With out competitors, we threat dropping the best path,” he wrote in a December publish. The Second Basis, he believes, will carry recent views and quicker innovation to Ethereum.

One of many foundational ideas of the Second Basis is to protect Ethereum’s decentralization and censorship resistance whereas introducing extra sturdy governance mechanisms.

Lomashuk has highlighted plans to implement twin governance inside Lido, beginning in Q1 2025, for example of the form of innovation the Second Basis would champion.

The Second Basis’s imaginative and prescient additionally consists of addressing Ethereum’s staking mechanism, a important part of its proof-of-stake safety mannequin.

Lomashuk has proposed that Ethereum intention for at the very least 66% of its complete provide to be staked, arguing that this threshold is significant to stop validators from being concentrated in centralized custodians.

“If there must be a restrict, it ought to come from the Ethereum protocol itself and apply uniformly to all liquid staking protocols,” he stated in response to ongoing debates about Lido’s staking dominance.

Outstanding figures take intention at Ethereum’s path ahead

Whereas the EF works to reform its management and scale its ecosystem, critics argue that the platform lacks urgency, imaginative and prescient, and a coherent technique to take care of its dominance.

Two key figures within the crypto world — Kyle Samani, Managing Companion at Multicoin Capital, and Justin Solar, founding father of Tron — have taken to social media to spotlight Ethereum’s shortcomings and recommend daring, if polarizing, methods for its revival.

Because the founding father of Multicoin Capital, an funding agency deeply targeted on blockchain, Samani credit Ethereum for igniting his ardour for crypto. “ETH was my first significant supply of wealth,” he tweeted.

Ethereum was my entry into crypto in 2016. I fell in love with the imaginative and prescient for permissionless finance and good contracts.

ETH was my first significant supply of wealth

In 2017 Ethereum was the middle of crypto. Up 100x in a 12 months. ICOs. Way forward for finance. Fuel charges spiking.…

— Kyle Samani (@KyleSamani) January 21, 2025

Regardless of its early promise, his optimism has soured. The breaking level, he revealed, was Devcon 3, Ethereum’s annual developer convention held in November 2017.

Regardless of apparent scaling challenges — skyrocketing fuel charges and growing community congestion — Samani was shocked that scaling wasn’t even a spotlight of Buterin’s keynote.

“How are you going to not acknowledge what’s happening round you and set forth a reputable plan with concrete and aggressive timelines?” he wrote. That second, Samani defined, was when he “misplaced religion in Ethereum.”

Seven years later, Samani believes little has modified. He factors to what he calls Ethereum’s “complete lack of urgency” and its failure to align management with the wants of its core constituents. With out a clear “North Star,” as he places it, Ethereum dangers being overtaken by opponents that prioritize velocity, scalability, and consumer expertise.

In the meantime, Solar, identified for his provocative type, went a step additional by providing a radical five-point plan for Ethereum’s revival, claiming his management might push ETH to $10,000.

If EF and Ethereum Had been Beneath My Management

“#ETH to $10,000”

My First Week Plan

1. Halt ETH Gross sales instantly and Optimize Income

EF will instantly stop promoting ETH for at the very least three years. Operational prices will probably be lined by means of AAVE lending, staking yields, and…

— H.E. Justin Solar 🍌 (@justinsuntron) January 22, 2025

The plan consists of halting all ETH gross sales for 3 years, taxing Layer-2 options to generate $5 billion yearly, and drastically downsizing the EF employees to create a merit-based, high-performance group.

Solar’s plan additionally emphasizes growing price burns and decreasing node rewards to strengthen Ethereum’s deflationary tokenomics whereas abandoning layer-2 rollups to focus solely on layer-1 scalability.

Whereas Solar’s concepts could appear radical, they faucet into real frustrations about Ethereum’s inefficiencies. The EF has lengthy been criticized for its gradual decision-making and perceived detachment from group issues.

But, the feasibility of Solar’s imaginative and prescient is questionable. Taxing layer-2 options dangers undermining Ethereum’s rollup-centric roadmap, a key scaling technique, whereas downsizing the EF might strip it of the assets wanted to take care of its innovation pipeline.

Neighborhood and builders flip their again on Ethereum

Ethereum’s challenges are now not confined to management controversies or competitor assaults — its very group is fracturing.

Beanie, a widely known crypto enterprise capitalist, not too long ago critiqued, “Ethereum Basis is run by a highschool instructor from Japan that hates competitors, believes in equality of final result over alternative, and doesn’t acknowledge blockchain consensus as a way of governance.”

Ethereum Basis is run by a highschool instructor from Japan that hates competitors, believes in equality of final result over alternative and doesn’t acknowledge blockchain consensus as a way of governance. Ethereum has a woke tradition drawback. And due to that Solana is profitable. pic.twitter.com/BAbwv0V1d5

— Beanie (@beaniemaxi) January 21, 2025

His critique of EF’s management tradition as “woke” and overly ideological has resonated with those that really feel the muse is prioritizing philosophical beliefs over sensible innovation.

The requires management reforms have additionally reached a boiling level. “If Aya Miyaguchi doesn’t step down, I’ll re-evaluate my funding thesis on $ETH,” declared Hedgex, a crypto investor, whereas publicly eradicating the “.eth” from his username — reflecting a rising disillusionment inside the group.

If @AyaMiyagotchi doesn’t step down I’ll re-evaluate my funding thesis on $ETH the asset.

Within the meantime, I’ve eliminated .eth from my title.

The folks need change. It’s time for change.

— Hedgex (🔥,🔥) (@hedge__x) January 20, 2025

His sentiment was echoed by Eric Conner, a former Ethereum maximalist, who lamented, “I’m now not a dot eth. Maybe sometime these in management roles will realign with the group, however for now, I’m out.”

I’m now not a dot eth

Maybe some day these in management roles will realign with the group however for now, I’m out

Deep down, I actually hope Ethereum succeeds

Good luck

— Eric Conner (@econoar) January 21, 2025

The seeds of discontent have been planted nicely earlier than 2025. In October 2023, Mike Alfred, a price investor, stated, “Ethereum appears sick. The world laptop and ultrasound cash narratives have failed. DeFi and NFTs have largely been deserted. Vitalik and different insiders are looting the protocol.

Ethereum appears sick. The world laptop and ultrasound cash narratives have failed. Defi and NFTs have largely been deserted. Vitalik and different insiders are looting the protocol and transactions are simply censored by governments. It’s a catastrophe. Right this moment I’m promoting my ETH.

— Mike Alfred (@mikealfred) October 9, 2023

The sentiment has solely worsened over time, with John E. Deaton, a crypto lawyer and longtime observer of the house, stating, “I’ve by no means witnessed ETH sentiment so low. Submit after publish reveals individuals who was ETH’s greatest supporters transferring on.”

I’ve been in crypto for nearly 9 years. I’ve by no means witnessed ETH sentiment so low. I’m not simply speaking about Kyle’s publish alone. I hold see publish after publish of people that was ETH’s greatest supporters transferring on. https://t.co/WqrFKOfVlk

— John E Deaton (@JohnEDeaton1) January 21, 2025

At a time when belief and unity are important, the Ethereum management should act decisively. Whether or not by means of reforms, higher communication, or a stronger concentrate on its decentralized ideas, the community must bridge the widening hole between its beliefs and the group’s expectations.

If it fails to adapt, Ethereum dangers ceding its management place to opponents higher outfitted to fulfill the second.