Main altcoin Ethereum is exhibiting indicators of underperformance in opposition to Bitcoin (BTC) as its relative power with the main digital asset has weakened over the previous few classes.

Regardless of BTC reaching new all-time highs yesterday, ETH’s value has struggled to observe, buying and selling sideways during the last 4 days. Technical indicators level to muted shopping for curiosity, elevating considerations that the coin may see additional draw back if momentum fails to choose up.

Ethereum Weakens Towards Bitcoin

ETH’s ratio in opposition to BTC (ETH/BTC) has been trending decrease over the previous few days, highlighting that Ethereum is dropping floor to Bitcoin in relative efficiency. At press time, this at present stands at 0.036.

ETH/BTC Ratio. Supply: TradingView

The ETH/BTC ratio measures the relative power of ETH in comparison with BTC, exhibiting how a lot the previous is price when it comes to the latter and indicating which asset outperforms the opposite.

When it falls like this, it indicators that ETH is underperforming Bitcoin. In consequence, BTC’s current rally to new all-time highs is probably not sufficient to elevate ETH. This leaves the altcoin’s value extra weak to sideways or downward strain over the subsequent few buying and selling classes.

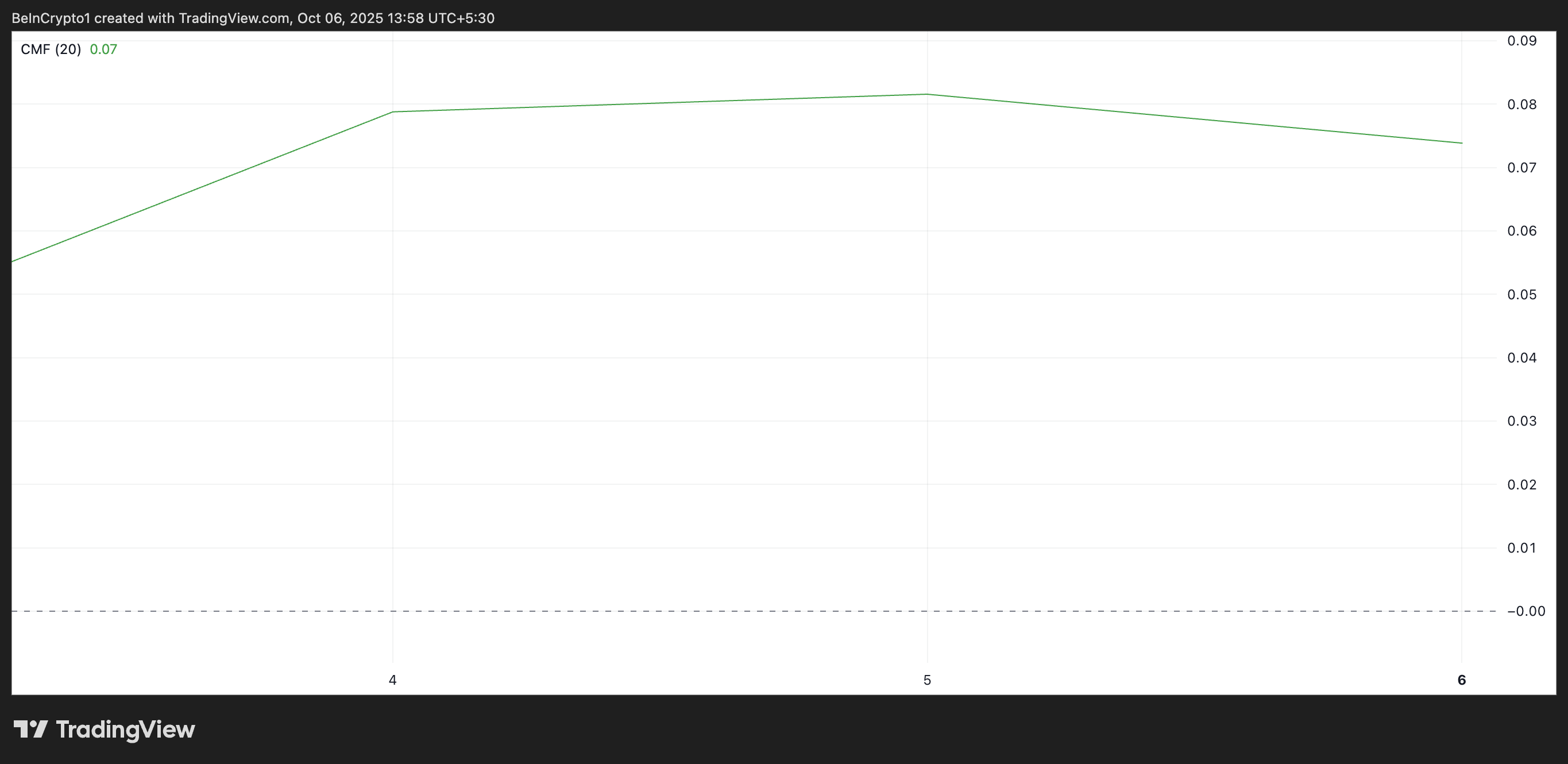

Furthermore, ETH’s Chaikin Cash Movement (CMF) on the each day chart has flattened over the previous few classes and has begun trending downward. This indicators that capital inflows into ETH have slowed, additional delaying the chance of a surge towards $5000.

ETH Chaikin Cash Movement. Supply: TradingView

The CMF indicator measures how cash flows into and out of an asset. When it flattens, then falls, it indicators weakening shopping for strain and potential promoting momentum. This additional confirms that ETH might wrestle to realize upward traction whilst BTC rallies.

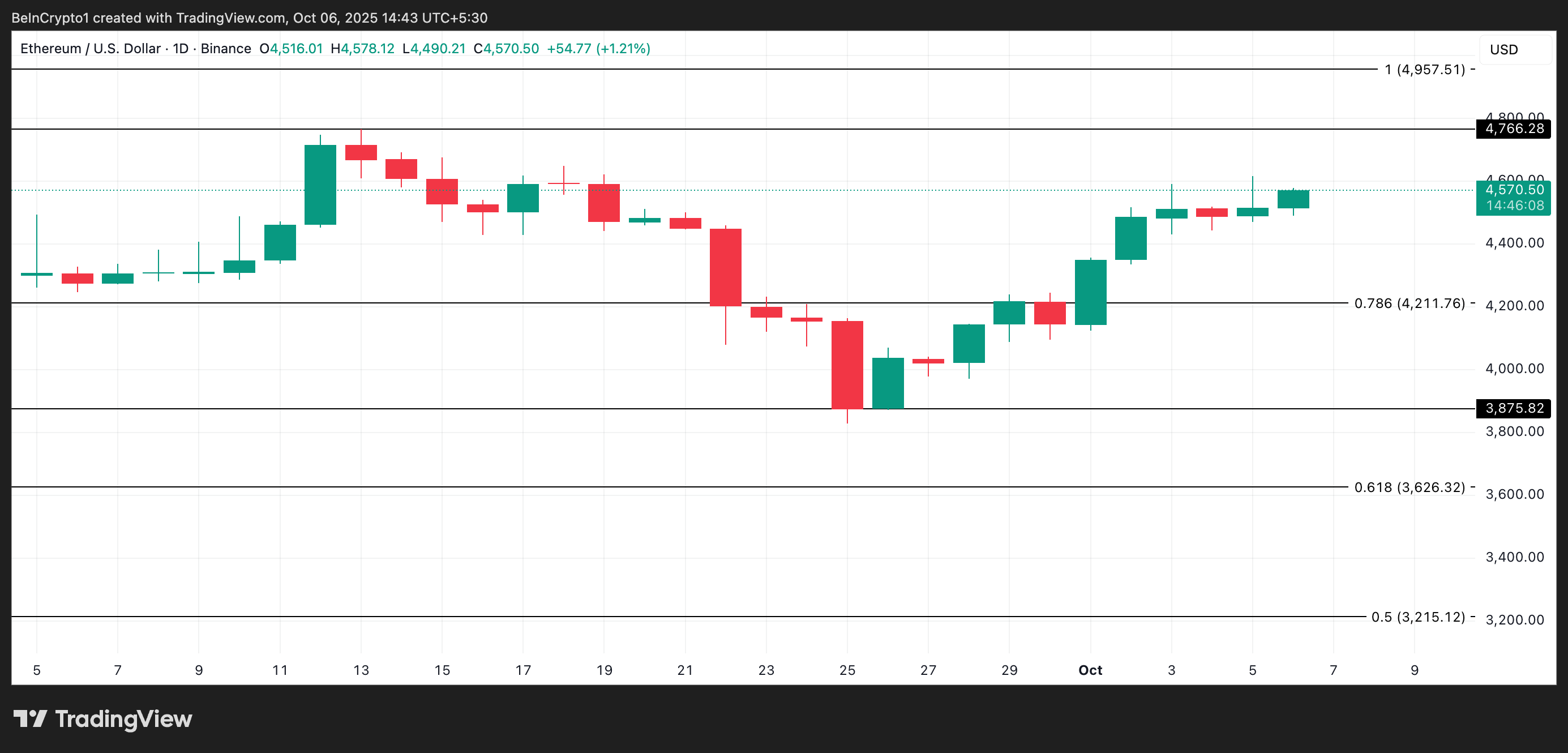

Ethereum Stalls Amid Market Uncertainty: $4,211 or $4,957 Subsequent?

A sideways pattern accompanied by a flattening momentum indicator displays indecision amongst merchants, with neither patrons nor sellers absolutely in management. If downward strain strengthens, this might set the stage for a bigger correction.

On this state of affairs, the coin’s value may plummet towards $4,211.

ETH Value Evaluation. Supply: TradingView

Then again, if the bull-side energy grows, ETH may try a rally towards its all-time excessive of $4,957, final reached on August 24. However for this to occur, ETH’s value should first breach the instant resistance at $4,766.

The publish Ethereum’s Momentum Stalls as ETH Lags Behind Bitcoin – $5,000 Goal on Maintain appeared first on BeInCrypto.