Ethereum’s transition from Proof of Work (PoW) to Proof of Stake (PoS) in 2022 was heralded as a serious technological shift. It decreased the community’s vitality consumption by over 99%.

Nonetheless, Meltem Demirors, Basic Accomplice at Crucible Capital and former CoinShares government, argues that this transition was a pricey mistake.

Ethereum Missed A $1 Trillion Opportunity

In keeping with Demirors, Ethereum’s transfer to PoS has devalued the community by enabling the proliferation of Layer-2 (L2) options. She believes L2 scaling options dilute the core Ethereum ecosystem. In her opinion, Ethereum may have develop into a $1 trillion protocol had it remained on PoW, leveraging a robust energy-computation ecosystem akin to Bitcoin’s.

In distinction, had Ethereum retained its PoW mannequin, it may have pushed innovation in GPU computing. She likened this to how Bitcoin miners propelled developments in {hardware} expertise.

“Proof of Stake was a mistake. Ethereum may have been a trillion-dollar protocol with its personal strong vitality to compute ecosystem. As a substitute, MEV extracts billions in worth from customers and apps,” she defined.

Her argument means that beneath PoW, Ethereum may have sustained a stronger, extra centralized Layer-1 (L1) community with out the fragmentation launched by Layer-2 scaling options.

In 2022, Ethereum made headlines as ultra-sound cash, attaining ‘zero internet issuance’ 55 days after The Merge. It got here following the London Arduous Fork in 2021, which launched EIP-1559, burning a portion of transaction charges and decreasing ETH’s whole provide over time.

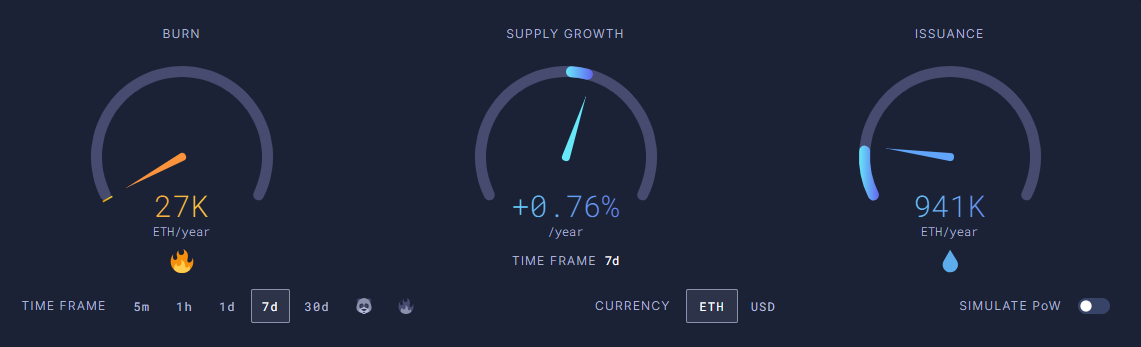

Nonetheless, latest information means that Ethereum has been experiencing its longest inflationary interval because the shift to PoS. In keeping with Ultrasound Cash, Ethereum’s annual inflation fee is now 0.76%. As of this writing, the community points 943,000 ETH yearly whereas burning solely 27,000 ETH yearly.

Ethereum Provide and Burn Charges. Supply: UltraSound.Cash

This contradicts the sooner deflationary narrative that positioned ETH as a greater retailer of worth than Bitcoin.

“On the present fee of community exercise, Ethereum is not going to be deflationary once more. The narrative of ‘ultra-sound’ cash has most likely died or would want a lot greater community exercise to return again to life,” CryptoQuant analysts just lately highlighted.

Was Ethereum Ever Meant to Be Cash?

Not too long ago, Peter Szilagyi, a key Ethereum workforce lead, acknowledged that ETH was by no means meant to be cash. This assertion challenges the elemental narrative of Ethereum’s transition to PoS, which, partly, was meant to make ETH extra precious and deflationary.

“ETH was by no means meant to be cash. ETH was meant to help a decentralized world, which does entail ETH having worth. That stated, not one of the OGs wished ETH to be cash, ever. Convey forth the tar and feathers,” Szilágyi wrote.

What would its final function be if ETH was not meant to be cash? Critics argue that this lack of a transparent imaginative and prescient weakens Ethereum’s long-term worth proposition. Regardless of these adjustments, the Ethereum community is witnessing important scaling exercise.

Vince Yang, CEO of zkLink, famous that the EIP-4844 improve stays helpful for Ethereum, particularly for Layer 2 networks.

“Scaling exercise on Ethereum is at its highest due to the numerous discount of gasoline prices to execute transactions on Layer-2s. In comparison with earlier this month, Ethereum’s mixed transactions have exploded to an all-time excessive from 140 to 285 TPS,” Yang advised BeInCrypto.

This scaling exercise is essential for growing new blockchain functions and strategically positioning Layer 2 and Layer 3 options.

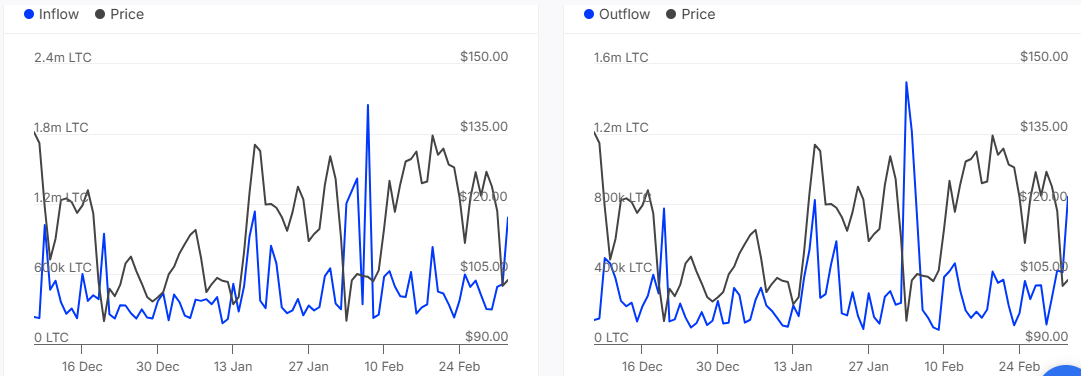

ETH Worth Efficiency. Supply: BeInCrypto

BeInCrypto information reveals ETH was buying and selling for $1,971 as of this writing, down by over 2% within the final 24 hours.