An ether $ETH$2,048.66 bull was caught leaning exhausting into the upside this week because the cryptocurrency tanked, turning the whale guess right into a multi-million greenback horror story.

That bull is Development Analysis, a buying and selling agency headed by Liquid Capital founder Jack Yi. The agency spent current months constructing a bullish (lengthy) guess value $2 billion on ether by borrowing stablecoins from DeFi big Aave, which have been reportedly collateralized by ether.

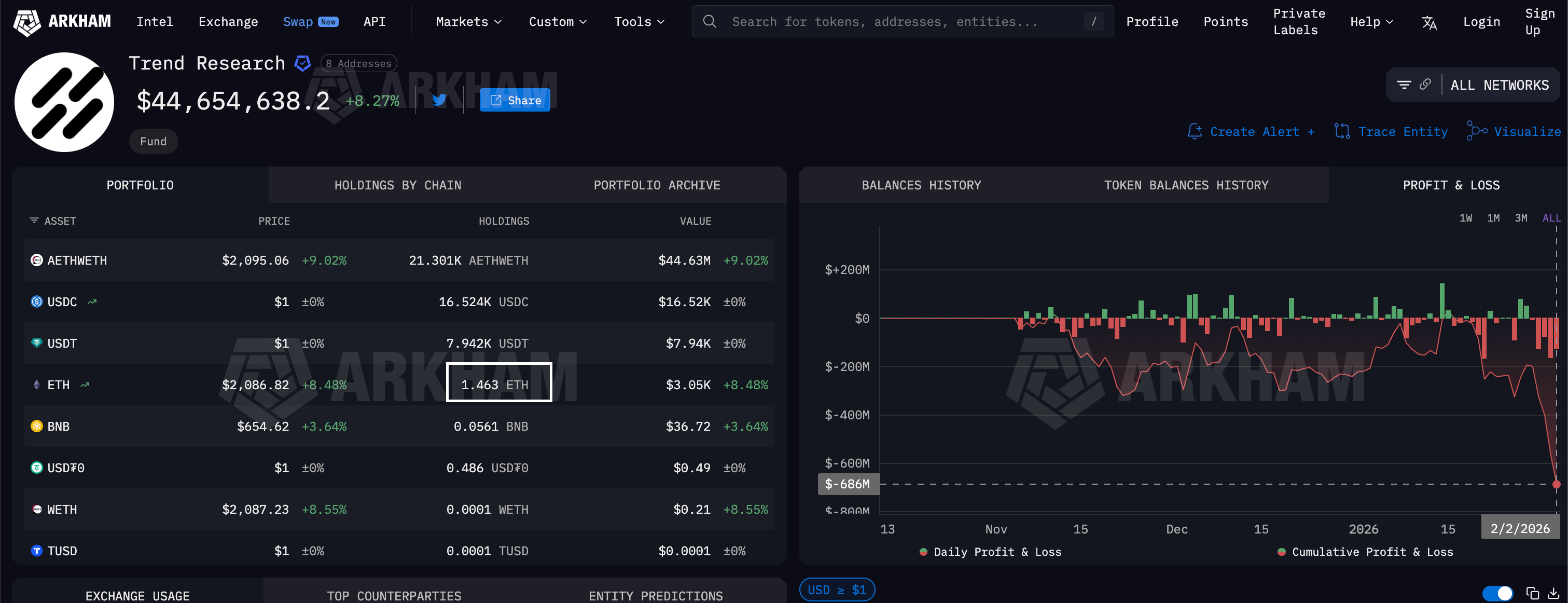

The place blew up this week, leaving the agency with a $686 million loss, based on Arkham.

The blow up underscores the crypto market’s unchanged actuality: Volatility can nonetheless make or break merchants in a single week. It additionally exhibits how merchants hold chasing dangerous leveraged loop performs – borrowing stablecoins in opposition to $ETH collateral – regardless of these bets exploding spectacularly each downtrend.

Development Analysis’s multi-million greenback loss. (Arkham)

The way it went down

The workforce was satisfied of ether’s long-term potential and anticipated a fast rebound from its October drop under $4,000.

However that by no means materialized – ether stored sliding, endangering their “looped ether” lengthy place. As costs fell, the stablecoin collateral backing the leveraged guess shrank, whereas the fastened debt loomed massive in basic leveraged style.

The ultimate blow got here this month as ether began falling quickly with bitcoin $BTC$68,811.85 and on Feb. 4 costs tanked to $1,750, the weakest degree since April 2025. Development Analysis responded by liquidating over 300,000 ether, based on information supply Bubble Maps.

“Development Analysis began sending massive quantities of $ETH to Binance to repay debt on AAVE In complete, this cluster moved 332k $ETH value $700M to Binance over 5 days,” Bubble Maps stated on X. The agency now holds simply 1.463 $ETH.

Jack Yi described these gross sales as a risk-control measure.

“As multi-heads on this spherical, we stay optimistic in regards to the efficiency of the brand new bull market: $ETH reaching over $10,000, $BTC exceeding $200,000 USD. We’re simply making some changes to regulate threat, with no change in our expectations for the long run mega bull market,” Yi stated in a publish on X.

He added that now’s the most effective time to purchase tokens, calling volatility as the largest characteristic of the crypto circle. “Traditionally, numerous bulls have been shaken off by this volatility, however typically what follows is a doubled rebound,” he famous.