Bloomberg Intelligence commodity strategist Mike McGlone has outlined a state of affairs through which Bitcoin (BTC) finally retraces towards the $10,000 stage.

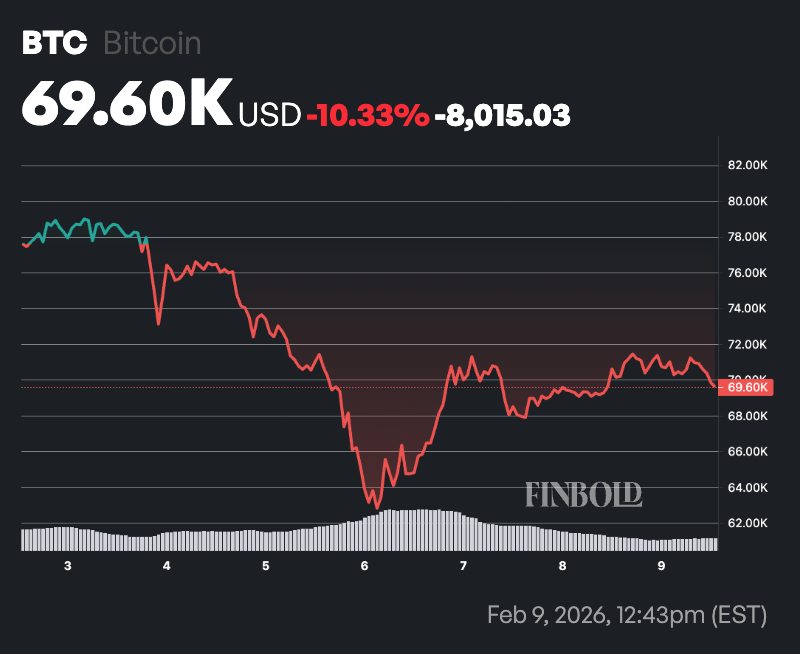

McGlone’s outlook comes as Bitcoin makes an attempt a average restoration from the February 5 crash that noticed the asset take a look at $61,000 earlier than rebounding and now aiming to maintain beneficial properties above $70,000.

In an X submit on February 8, McGlone famous that his framework suggests the $64,000 space represents a key inflection level slightly than a sturdy ground.

He views this stage as a short lived pause in a broader decline, reflecting what he considers the most typical value zone throughout 2024, a yr he characterizes as the height of speculative extra.

Moreover, a rebound towards roughly $72,000 would nonetheless qualify as a typical bear-market bounce, amounting to an ordinary 20% restoration slightly than the beginning of a brand new bull cycle.

“$64,000 is a speedbump on the way in which again down, roughly the mode from 2024, the yr that fueled the ultimate silliness stage. <…> Future generations will exchange tulip mania with crypto frenzy as the first analogy for markets that merely went up an excessive amount of. <…> A traditional 20% bear-market bounce is $72k, from $64k,” he stated.

The skilled argued that Bitcoin has not established itself as digital gold or a dependable market proxy, remaining a extremely speculative asset with no intrinsic anchor and rising competitors from 1000’s of other tokens.

He added that billions of {dollars} in ongoing outflows from crypto copycat merchandise point out the sector’s cleaning section continues to be in its early levels.

Whereas skeptical of speculative cryptocurrencies, he distinguished Bitcoin and stablecoins, which he views as a extra sensible software of the know-how.

Impression on inventory market

In the meantime, McGlone’s base case expects rising equity-market volatility to stress danger belongings, together with cryptocurrencies.

He warned that unusually low volatility within the S&P 500 is unlikely to persist and {that a} return towards historic norms, mixed with stretched U.S. fairness valuations relative to GDP, may set off a broader risk-off transfer that leaves Bitcoin uncovered.

On this context, Bitcoin holding above $90,000 would problem the bearish outlook. Failing that, McGlone expects additional drawdowns throughout high-beta belongings, pushed not by a single catalyst however by extra valuations, fading hypothesis, and a shifting world market regime.

As reported by Finbold, the strategist has beforehand warned that Bitcoin is reverting towards its historic imply close to $64,000.

He argued that the liquidity-fueled rally is fading and {that a} decisive break decrease may intensify draw back stress and spill over into broader danger markets.

Bitcoin value evaluation

This bearish outlook comes as Bitcoin has recorded losses over the previous week, fueling considerations of a possible cryptocurrency winter. These fears have been strengthened by giant web outflows from spot Bitcoin exchange-traded funds (ETFs), with BlackRock’s product alone seeing over $300 million in outflows in the course of the interval, signaling weakening institutional demand.

At press time, Bitcoin was buying and selling at $69,600, down greater than 10% over the previous week.

For now, Bitcoin’s near-term upside depends upon reclaiming the $70,000 stage, which may open the door to a transfer towards the $72,500 resistance. Continued buying and selling beneath this threshold would sign additional draw back danger.

Featured picture through Shutterstock