Trade consultants are reportedly calling for Hong Kong and mainland China regulators to collaborate extra on advancing the crypto sector throughout the two areas.

Abstract

- Trade leaders on the World Blockchain Summit in Shanghai emphasised the necessity for better collaboration between Hong Kong and mainland China, which may considerably advance Asia’s crypto and fintech sectors.

- Regardless of China’s ongoing crypto buying and selling ban, rising curiosity in yuan-pegged stablecoins and potential joint initiatives recommend that each areas could also be shifting towards nearer cooperation in digital finance and blockchain innovation.

In response to a current report by South China Morning Put up, the 2 areas may probably elevate the crypto and monetary know-how sector in Asia by teaming up. Trade consultants who attended the eleventh World Blockchain Summit in Shanghai said that the 2 markets would profit vastly from joint collaborations.

Regardless of implementing a ban on cryptocurrency within the mainland since 2021, China has allowed for the particular administrative area of Hong Kong to develop itself right into a crypto hub. The area has seen a surge in investor curiosity, significantly in stablecoins, ever because it handed the Stablecoin Ordinance on August 1.

In response to the report, whereas Hong Kong has established itself as a digital belongings hub, China has been making strikes into the digital finance sector by growing digital funds and capitalizing on synthetic intelligence know-how.

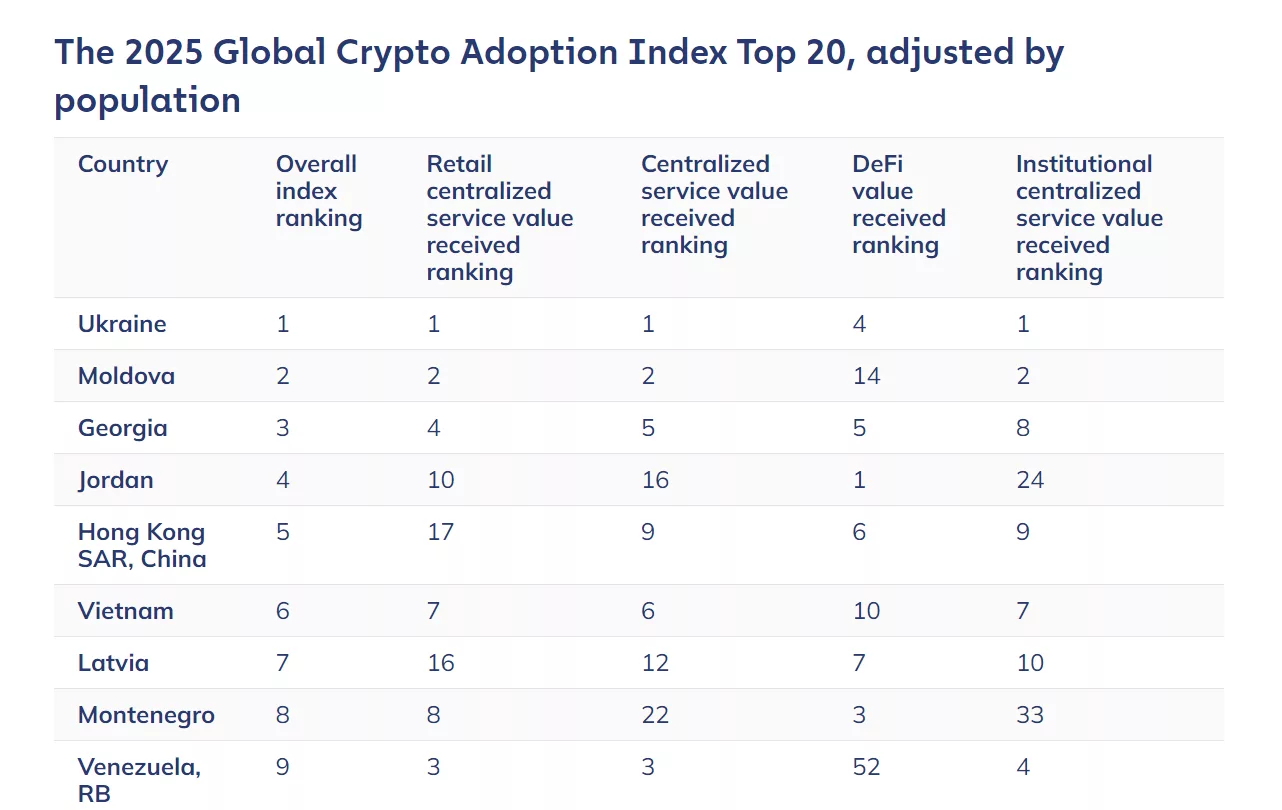

Nonetheless, the 2 areas nonetheless rank decrease in crypto adoption in comparison with different Asian nations resembling India, Japan, Vietnam and Indonesia in keeping with knowledge from Chainalysis. India is at the moment ranked first by way of retail and institutional service worth in crypto, whereas Vietnam is in third place. In the meantime, Hong Kong and China rank in seventeenth place by retail centralized service worth obtained.

Hong Kong and China are ranked decrease in comparison with different Asian areas by way of international crypto adoption | Supply: Chainalysis

You may additionally like: China Retailers Financial institution unit ventures into crypto via Hong Kong gateway

Chairman of Shanghai-based Wanxiang Blockchain and Hong Kong crypto change Hashkey Group, Xiao Feng, declared in his keynote speech that he want to see better joint efforts in making “extra requirements and guidelines” within the crypto business because it continues to develop at a fast tempo.

“Blockchain know-how has moved from the preliminary levels of technological growth to the stage of large-scale purposes,” stated Xiao.

He additionally highlighted the elevated pleasure surrounding the convention because it mirrored the hype round crypto belongings. He stated that tickets for the occasion had been offered out inside a couple of days earlier than the occasion kicked off, which “has not occurred in years.”

Rising crypto curiosity in Hong Kong and China

On the summit, Director of Blockchain and Digital Property at Hong Kong-based Cyberport, Rachel Lee said that the agency hopes to work extra carefully with stakeholders from mainland China to foster developments within the crypto business.

In 2023, the corporate obtained an funding of $50 million from the Hong Kong authorities in a bid to help the sector’s progress.

Alternatively, President of Solana Basis, Lily Liu stated that the group has been investing closely in China’s developer ecosystem. Liu said that the muse hopes to discover collaboration in areas resembling decentralized funds and synthetic intelligence.

She considered China as “a pacesetter” by way of how huge the nation’s funds business is, because the area has a inhabitants of over a billion.

Though China has remained agency in its stance in opposition to crypto buying and selling within the mainland, a number of regulators have known as for an easing of the ban in gentle of current developments concerning the push for yuan-pegged stablecoins. Some Chinese language corporations have even expressed curiosity in making use of for a Hong Kong-issued stablecoin license, earlier than pausing because of authorities warnings.

As well as, a current doc from the Hong Kong Legislative Council appears to trace at future collaboration with the mainland authorities. The particular bulletin said that Hong Kong is at the moment looking for help from the central Chinese language authorities in exploring the issuance of an offshore Renminbi-backed stablecoin.

By issuing RMB-backed stablecoins, Hong Kong may strengthen its place as a worldwide hub for digital belongings and web3 innovation. In the meantime, Beijing may gain advantage from growing their very own stablecoins to advertise cross-border commerce settlement and problem the U.S greenback’s domination over the stablecoin market.

You may additionally like: Hong Kong council hints at RMB stablecoin growth