Markets are deep in a risk-off part, with Bitcoin value at the moment displaying aggressive promoting, pressured de-risking, and the primary indicators that draw back momentum could also be tiring.

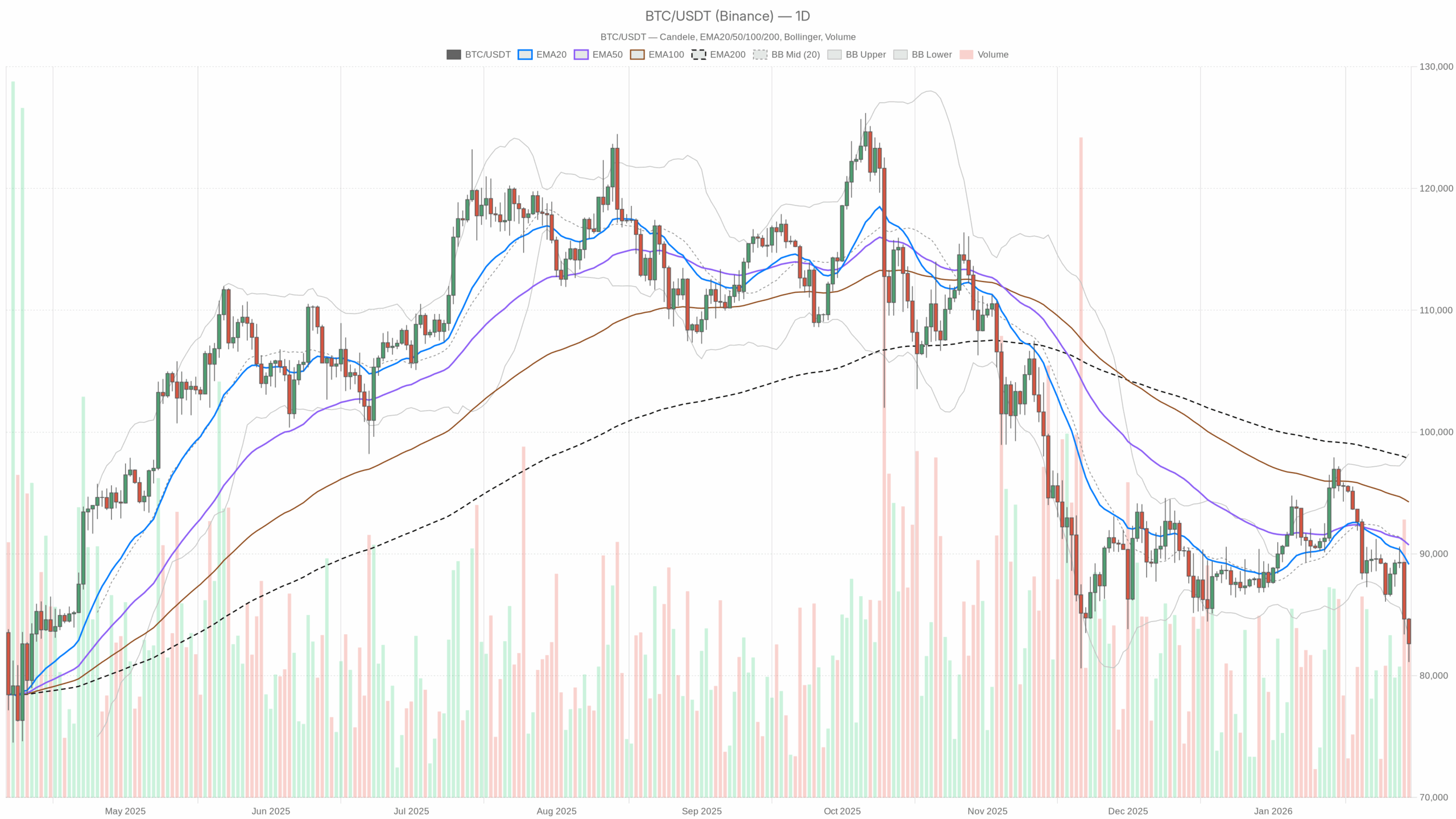

Each day chart (D1): macro bias – bearish, however approaching exhaustion

Development construction: EMAs

– Worth: $82,623

– EMA 20: $89,136

– EMA 50: $90,731

– EMA 200: $97,809

Bitcoin is buying and selling properly under the 20, 50 and 200-day EMAs, with a clear bearish stack (value < EMA20 < EMA50 < EMA200). That may be a textbook downtrend. The hole of roughly 7–8k between spot and the 20-day EMA reveals how sharp the sell-off has been; the market isn’t merely drifting decrease, it has been repricing rapidly.

Interpretation: Development followers are in management. Furthermore, any bounce into the $89k–91k space is, by default, a possible rally into resistance except BTC can reclaim and maintain above the 20-day EMA for a number of periods.

Momentum: RSI (14)

– RSI 14 (D1): 30.75

Each day RSI is sitting proper on the sting of oversold territory. We’re not in a panic capitulation zone but, however promoting stress is heavy and chronic.

Interpretation: Bears are clearly in cost, however they’re beginning to lean on the identical facet of the boat. From right here, every further leg down has the next chance of triggering a reactionary bounce as short-term sellers get exhausted and worth consumers begin to step in.

Development high quality: MACD

– MACD line: -1457.54

– Sign line: -563.08

– Histogram: -894.45

The each day MACD is deeply detrimental, with the MACD line properly under the sign line and a large detrimental histogram.

Interpretation: The medium-term downtrend has sturdy momentum behind it. There isn’t any confirmed slowdown on the each day MACD but; sellers are nonetheless pushing arduous. For a sustainable development reversal, we might first want the histogram to contract towards zero; proper now it’s nonetheless telling us the bears should not carried out.

Volatility & vary: Bollinger Bands and ATR

– Bollinger mid-band (20 SMA): $90,720

– Higher band: $98,213

– Decrease band: $83,226

– Worth: $82,623

– ATR 14 (D1): $2,645

Worth is now buying and selling just under the decrease Bollinger Band. Mixed with an elevated ATR above $2.6k, that tells us the market is in a high-volatility, stretched-down transfer.

Interpretation: When value lives under the decrease band with ATR this excessive, the market is in a liquidation / pressured unwind zone. That’s the place sharp, short-lived imply reversion bounces usually begin. Nevertheless, so long as BTC can’t get again contained in the bands (above roughly $83.2k) after which again towards the mid-band, the macro stays decisively bearish.

Brief-term ranges: each day pivots

– Pivot level (PP): $82,826

– First resistance (R1): $84,533

– First help (S1): $80,916

BTC is hovering proper across the each day pivot, barely under it. R1 at $84.5k is the primary actual intraday line the bulls have to reclaim; S1 close to $81k is the rapid danger degree under.

Interpretation: So long as value holds between PP and S1, we’re in a fragile stability zone. A decisive break under $81k would probably unlock one other wave of promoting, whereas a transfer again above $84.5k could be the primary proof {that a} short-term bounce is getting traction.

1-hour chart (H1): bears nonetheless in management, early stabilization makes an attempt

Development: EMAs

– Worth: $82,664

– EMA 20: $84,094

– EMA 50: $85,971

– EMA 200: $88,441

On the hourly chart, value stays under all fundamental EMAs, with the identical bearish alignment we see on the each day. The hole to the 20-EMA is smaller right here than on D1, which is typical after a robust flush. The market is attempting to consolidate under resistance somewhat than waterfall straight down.

Interpretation: The H1 construction confirms the each day bearish bias. Any bounce towards $84k–86k is, for now, only a transfer again towards hourly development resistance.

Momentum: RSI (14)

– RSI 14 (H1): 30.07

The hourly RSI is sort of an identical to the each day: proper on the fringe of oversold.

Interpretation: Intraday promoting has been heavy, however momentum is now not accelerating. That is the sort of setup the place you usually see uneven, sideways-to-slightly-up value motion because the market digests the transfer.

Development high quality: MACD

– MACD line: -1295.98

– Sign line: -1310.55

– Histogram: +14.57

Curiously, whereas each MACD line and sign are deep in detrimental territory, the histogram has simply turned barely constructive.

Interpretation: Bears are nonetheless forward general, however the draw back momentum on the hourly is beginning to lose steam. This isn’t a purchase sign by itself, however it’s the first technical trace of potential short-term basing.

Volatility & vary: Bollinger Bands and ATR

– Bollinger mid-band: $84,021

– Higher band: $86,000 (approx, precise $86,999)

– Decrease band: $81,043

– ATR 14 (H1): $825

BTC is buying and selling near the decrease hourly band, with an intraday ATR close to $800. That may be a extensive hourly vary, in keeping with elevated volatility and stop-driven strikes.

Interpretation: On the 1-hour chart, promoting stress continues to be dominant, however the band construction mixed with a slowing MACD histogram favors sideways chop with violent spikes somewhat than a easy new leg straight down.

Intraday ranges: hourly pivots

– Pivot level (PP): $82,699

– First resistance (R1): $82,960

– First help (S1): $82,403

Worth is sitting nearly on high of the hourly pivot.

Interpretation: The intraday battlefield may be very slim. A push above $82,960 opens the best way towards $84k+ retests, whereas a slip below $82,400 will increase the percentages of probing $81k each day help. It is a market the place intraday merchants want to just accept swift invalidations on both facet.

15-minute chart (M15): execution zone – fragile bounce try

Development: EMAs

– Worth: $82,685

– EMA 20: $82,781

– EMA 50: $83,385

– EMA 200: $86,010

On the 15-minute chart, value is now barely under the 20-EMA however attempting to reclaim it. The 50-EMA and particularly the 200-EMA stay a lot larger.

Interpretation: Very short-term, BTC is now not in free fall; it’s attempting to carve out a native ground just below $83k. Nevertheless, any bounce into $83.3k–84k continues to be counter-trend and more likely to meet provide from trapped longs and new shorts.

Momentum: RSI (14)

– RSI 14 (M15): 46.37

The 15-minute RSI has recovered to mid-range.

Interpretation: Intraday momentum has shifted from one-sided promoting to a extra impartial, two-way market. This helps the concept of a short-term consolidation band somewhat than a right away extension decrease.

Development high quality: MACD

– MACD line: -148.67

– Sign line: -193.89

– Histogram: +45.23

The 15-minute MACD continues to be detrimental general, however the MACD line is above the sign line and the histogram is distinctly constructive.

Interpretation: On the micro timeframe, sellers have clearly misplaced the higher hand for now. That is what an early-stage bounce or base-building part usually appears to be like like. It’s nonetheless inside a bigger downtrend, however short-term merchants are beginning to purchase dips as a substitute of dumping each candle.

Very short-term vary: Bollinger Bands, ATR, pivots

– Bollinger mid-band: $82,802

– Higher band: $83,304

– Decrease band: $82,300

– ATR 14 (M15): $319

– Pivot level (PP): $82,643

– First resistance (R1): $82,727

– First help (S1): $82,602

Worth is nudging the 15-minute pivot and attempting to commerce again contained in the mid-upper half of the bands, with a 15m ATR round $300.

Interpretation: Very short-term, BTC is making an attempt a grind larger inside a good however unstable band. Breaks above $83.3k would sign that the intraday bounce has some actual power; failure to carry above $82.3k would put the draw back again in play rapidly.

Market context: risk-off, excessive concern and rotation into defensives

Whole crypto market cap is round $2.89T, down nearly 5.8% in 24h, whereas BTC dominance is above 57%. That mixture tells you capital is fleeing alts quicker than Bitcoin and crowding into perceived safer giant caps or out of crypto altogether.

On the similar time, mainstream protection is specializing in Bitcoin holders equities and gold as options, whereas giant institutional-style consumers are nonetheless including BTC on weak spot, in response to the latest information stream. Layer on high the Excessive Worry sentiment studying of 16, and also you get a market the place the marginal vendor is emotional, not strategic.

Interpretation: Structurally, this can be a risk-off surroundings with Bitcoin nonetheless the relative winner inside a shedding asset class. Furthermore, that is usually the place medium- to long-term accumulation quietly begins, however for short-term merchants, it stays an surroundings dominated by whipsaws and liquidation spikes.

Situations from right here

Essential bias: bearish with oversold bounce danger

The each day chart defines the principle situation: bearish development, with a rising danger of a counter-trend bounce resulting from stretched circumstances. Decrease timeframes present early makes an attempt at stabilization, however they haven’t flipped the general construction.

Bullish situation (counter-trend bounce / begin of a bottoming course of)

Within the constructive situation, BTC defends the $81k S1 each day help space and builds a base between $81k and $84k. The indicators to observe:

1. On the 15m and 1h, value holds above the native pivots ($82.6k–82.7k) and begins printing larger lows.

2. H1 MACD histogram continues to show extra constructive, and RSI climbs again into the 40–50 vary as a substitute of residing close to 30.

3. Worth reclaims the decrease each day Bollinger Band and stabilizes above ~$83.3k, signalling that the rapid liquidation part is cooling off.

4. Extension goal for a fundamental imply reversion could be the area across the H1 EMA 50 / each day pivot cluster within the $86k–89k zone, with the each day EMA 20 at ~$89k because the higher certain of a standard corrective rally.

What invalidates the bullish situation?

A clear break and each day shut under $81k, particularly if accompanied by a brand new enlargement in each day MACD draw back and RSI pushing decisively under 30, would argue the bounce has failed and the downtrend is resuming with pressure.

Bearish situation (development continuation / deeper leg down)

Within the dominant situation, BTC fails to construct a strong base right here and the oversold situation merely fuels transient, weak bounces that get offered into.

Key indicators that is enjoying out:

1. Worth repeatedly rejects the $84k–85k space (each day R1 and H1 mid-band) and can’t maintain above intraday EMAs.

2. H1 and M15 MACD histograms roll again detrimental after this transient enchancment, and RSI on H1 stays pinned near 30.

3. BTC loses $81k help with sturdy quantity and trades comfortably under the decrease each day Bollinger Band, with ATR staying elevated or increasing.

In that case, the market could be pricing in a deeper flush. The following logical zones are prior structural helps and round-number magnets under. Ranges just like the high-$70k area would come into focus, the place longer-term contributors could have curiosity and the place RSI would probably dip into clear oversold territory.

What invalidates the bearish situation?

A sustained reclaim of the each day EMA 20 round $89k, backed by a transparent contraction within the each day MACD histogram and RSI recovering towards the mid-40s, would weaken the trend-following bearish case. It might not flip the market right into a full bull by itself, however it will mark a transition from a trending-down regime to a extra range-bound or base-building one.

How to consider positioning now

It is a market dominated by volatility, concern and compelled positioning. The each day development is down; any power is responsible till confirmed harmless. On the similar time, we’re shut sufficient to oversold territory and shut sufficient to the decrease Bollinger Band that urgent completely new, unhedged shorts carries significant squeeze danger.

Brief-term merchants will probably concentrate on the $81k–84k band because the rapid determination zone. Breaks outdoors this vary, particularly throughout excessive quantity durations, can result in quick, directional strikes. Longer-term contributors pays extra consideration to how BTC behaves across the $89k each day EMA 20 on any rebound: does it get offered aggressively, or can or not it’s reclaimed and defended?

No matter bias, place sizing and danger limits matter greater than common right here. With each day ATR above $2.6k and intraday ATRs within the tons of of {dollars}, the market can transfer towards a place in a short time. Assumptions about truthful worth imply far much less, within the brief run, than respecting the degrees the place a commerce thought is clearly incorrect. On this context, monitoring Bitcoin value at the moment may help merchants align their danger with the prevailing volatility regime.

If you wish to monitor markets with skilled charting instruments and real-time information, you possibly can open an account on Investing utilizing our accomplice hyperlink:

Open your Investing.com account

This part comprises a sponsored affiliate hyperlink. We could earn a fee at no further price to you.

Disclaimer: This evaluation is for informational and academic functions solely and is predicated on the info offered. It’s not funding, buying and selling, or monetary recommendation, and it doesn’t have in mind your particular person circumstances. Markets are unstable and unpredictable; at all times do your individual analysis and take into account your danger tolerance earlier than making any buying and selling selections.