After a violent washout throughout crypto markets, merchants are watching the Bitcoin worth as we speak for indicators of whether or not this can be a late-stage flush or the beginning of a deeper leg decrease.

Bitcoin worth as we speak: the place we’re

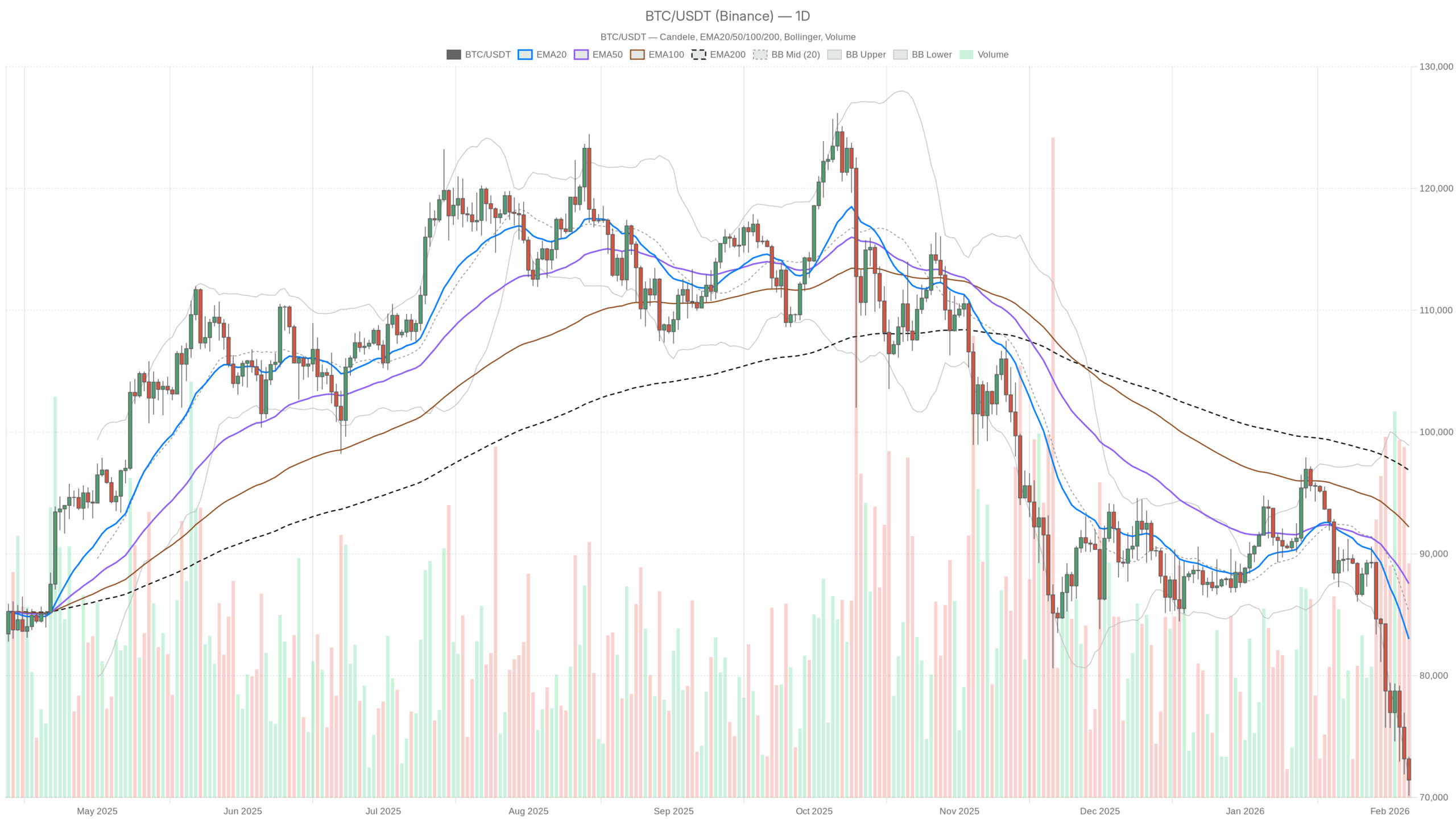

Bitcoin (BTCUSDT) is buying and selling round $71,400–71,500 after a brutal washout that has knocked whole crypto market cap down greater than 5% in 24 hours and roughly half a trillion {dollars} over the previous week. BTC dominance is again close to 57%, which tells you this can be a Bitcoin-led risk-off transfer, not simply random altcoin noise.

The backdrop is straightforward: the market is in an excessive worry part (worry & greed index at 12) with mainstream headlines speaking a few “disaster of religion.” That’s the form of sentiment you normally see after huge drawdowns, not earlier than them. The important thing query now could be whether or not we’re getting into a deeper distribution part or a late-stage flush that can arrange a bigger bounce.

On the upper timeframe (day by day), the primary situation is firmly bearish. The construction is trending down, momentum is oversold, and worth is buying and selling effectively under all key transferring averages. On the decrease timeframes, nevertheless, the bleeding has slowed; the 1H and 15M present the very early levels of potential imply reversion, however nothing greater than that for now.

Each day chart (D1): major development & fundamental thesis – clearly bearish

Major situation: Bearish

The day by day chart defines the macro bias, and there the message is obvious: BTC is in a powerful downtrend, at present hovering simply above the decrease fringe of its current volatility envelope.

EMAs (development construction)

- Worth (shut): $71,426.69

- EMA 20: $83,006.95

- EMA 50: $87,558.81

- EMA 200: $96,876.82

- Regime flag: bearish

Interpretation: BTC is buying and selling far under all main EMAs, with the 20, 50 and 200-day stacked firmly above worth. That’s basic bear-trend anatomy. The gap to the 20-day EMA (~$11,500 above) is large sufficient to name this transfer prolonged: development is down, however we’re additionally stretched away from imply worth. That mixture is the place sharp, counter-trend bounces typically originate. Nonetheless, till worth begins reclaiming no less than the 20-day EMA, any bounce is only a rally inside a downtrend.

RSI 14 (momentum & exhaustion)

Interpretation: Each day RSI within the low 20s indicators heavy draw back momentum but additionally short-term exhaustion. Sellers have clearly been in management, but readings this low traditionally don’t persist for lengthy with out both a volatility spike decrease (remaining flush) or a pointy rebound. In different phrases, the development is bearish, however we’re getting into territory the place chasing shorts blindly turns into harmful.

MACD (development momentum)

- MACD line: -4,466.03

- Sign line: -2,755.38

- Histogram: -1,710.65

Interpretation: MACD is deeply unfavourable with the road effectively under the sign and the histogram strongly pink. That is per a longtime downtrend that has picked up velocity not too long ago. There isn’t a signal of a day by day bullish cross or clear histogram contraction but, so from a day by day standpoint, the impulse continues to be down even when circumstances are technically oversold.

Bollinger Bands (volatility & positioning)

- Center band (20SMA proxy): $85,250.41

- Higher band: $98,889.72

- Decrease band: $71,611.11

- Worth: $71,426.69 (simply under the decrease band)

Interpretation: Worth is basically pinned to the decrease Bollinger Band, barely exterior it. That’s what sturdy development legs appear like, however additionally it is the place you begin to see mean-reversion merchants stepping in. Sustained closes under the band would sign panic-style promoting and open the door to a sharper leg down. A fast snap again contained in the band would affirm the concept of a capitulation flush being purchased.

ATR 14 (volatility)

Interpretation: A day by day buying and selling vary of roughly $3,868 tells you volatility is elevated however not at “full capitulation” extremes seen in previous crashes. There may be sufficient vary for intraday merchants to function, however that is nonetheless comparatively managed promoting. If ATR spikes additional whereas worth breaks under $70,000, that’s the form of surroundings the place draw back strikes can overshoot all ranges.

Each day pivots (near-term map)

- Pivot level (PP): $71,635.96

- Resistance 1 (R1): $73,131.91

- Assist 1 (S1): $69,930.73

Interpretation: BTC is buying and selling slightly below the day by day pivot, successfully in a tug-of-war zone. R1 at roughly $73,100 is the primary significant intraday ceiling for any bounce. On the draw back, S1 round $69,900 is the instant line within the sand. A decisive day by day shut under there would affirm continuation of the bearish day by day development and certain carry $68,000 after which the mid-$60,000s onto the radar.

1-hour chart (H1): bears in cost, however momentum is fraying

The hourly chart stays aligned with the day by day development: nonetheless bearish. Nonetheless, intraday momentum is beginning to present the earliest indicators of stabilizing.

EMAs (short-term development)

- Worth (shut): $71,481.87

- EMA 20: $72,335.23

- EMA 50: $74,227.70

- EMA 200: $79,385.47

- Regime flag: bearish

Interpretation: On H1, worth is buying and selling under all three EMAs, with the 20 underneath the 50 and each effectively underneath the 200. Intraday development is down, and rallies into the 20/50 EMA zone (~$72,300–74,200) are prone to face promoting stress. For bulls, the very first thing they want is to reclaim the 20 EMA and maintain above it. Till that occurs, each uptick is suspect.

RSI 14 (intraday momentum)

Interpretation: Hourly RSI has crawled up from oversold to the excessive 30s. Sellers are nonetheless in management, however the instant draw back stress has eased. That is basic “bearish however not falling off a cliff” conduct, which is fertile floor for uneven consolidation, short-covering bounces, or each.

MACD (short-term momentum shift?)

- MACD line: -1,126.29

- Sign line: -1,177.92

- Histogram: +51.63

Interpretation: MACD continues to be unfavourable, however the histogram has flipped barely constructive because the MACD line edges above the sign line. That’s an early signal that the draw back momentum is stalling and could also be making an attempt to reverse on the 1H timeframe. Importantly, this can be a counter-trend sign in opposition to a clearly bearish day by day development. It typically results in a bounce into resistance somewhat than a full development change.

Bollinger Bands (intraday volatility)

- Center band: $72,255.31

- Higher band: $74,503.77

- Decrease band: $70,006.85

- Worth: $71,481.87 (between mid and decrease band)

Interpretation: Worth has backed away from the decrease band and is now drifting within the decrease half of the band vary. The prior band experience decrease is cooling off, which inserts with the MACD and RSI story: nonetheless weak, however not in free fall. The $70,000 zone aligns carefully with the decrease band and day by day S1, reinforcing it as a key intraday help cluster.

ATR 14 (intraday volatility)

Interpretation: A median hourly vary of about $1,000 is elevated however manageable. It factors to lively two-way buying and selling with significant intraday swings, which is good for short-term merchants however punishing for over-leveraged positions.

Hourly pivots

- Pivot level (PP): $71,481.04

- Resistance 1 (R1): $71,650.63

- Assist 1 (S1): $71,312.27

Interpretation: Worth is sitting virtually precisely on the hourly pivot. That tells you the short-term tape is undecided after the current drop. A sustained transfer above R1 would open a path towards the mid-band and 20 EMA close to $72,000–72,500. Dropping S1 would doubtless power one other check of the $70,000 space.

15-minute chart (M15): execution context, not a development change

The 15-minute chart is impartial, reflecting intraday noise inside a bigger downtrend.

EMAs (micro-structure)

- Worth (shut): $71,476.65

- EMA 20: $71,369.24

- EMA 50: $71,871.41

- EMA 200: $74,282.12

- Regime flag: impartial

Interpretation: Worth is buying and selling barely above the 20 EMA however nonetheless under the 50 and 200 on M15. That may be a small stabilization after the dump, not a structural reversal. Brief time period, patrons are defending dips across the 20 EMA, whereas the 50 EMA close to roughly $71,900 is the primary micro-resistance to observe.

RSI 14 (micro momentum)

Interpretation: RSI close to 50 on 15M is textbook impartial: momentum is balanced. This matches a consolidation or determination zone the place the market is digesting the transfer somewhat than trending.

MACD (very short-term impulse)

- MACD line: -29.05

- Sign line: -135.19

- Histogram: +106.14

Interpretation: MACD on 15M has turned constructive on the histogram with the MACD line rising towards or above the sign from under. That reveals a short-term push from patrons, basically a neighborhood bounce throughout the context of a much bigger downtrend. For intraday merchants, that is the sign to search for pullbacks somewhat than chasing shorts at this precise second. Once more, it’s a tactical nuance, not a brand new bull development.

Bollinger Bands (micro volatility)

- Center band: $71,175.59

- Higher band: $71,882.05

- Decrease band: $70,469.13

- Worth: $71,476.65 (simply above mid-band)

Interpretation: Worth is sitting barely above the mid-band with bands reasonably expanded. That may be a garden-variety consolidation after enlargement, typical of a market catching its breath.

15-minute pivots

- Pivot level (PP): $71,465.94

- Resistance 1 (R1): $71,510.71

- Assist 1 (S1): $71,431.87

Interpretation: Worth is hugging the 15M pivot virtually completely. Very brief time period, meaning the market is balanced, ready for the following impulse. Breaks above R1 or under S1 on this timeframe are solely significant insofar as they sign which facet is taking management of the following leg throughout the broader hourly construction.

Market context: risk-off, however not whole capitulation

Complete crypto market cap is round $2.51 trillion, down about 5.6% in 24 hours, whereas 24-hour quantity is up over 21%. BTC dominance at practically 57% confirms Bitcoin is main the sell-off. In DeFi, main DEXs like Uniswap V3 and others are exhibiting sturdy will increase in charges over the past days and weeks. This displays elevated on-chain exercise as merchants rebalance, lower danger, or rotate.

The mainstream narrative from shops comparable to Bloomberg, Reuters and CNBC is now locked onto Bitcoin’s drawdown and the check of the $70,000 space, framing it as a possible disaster of confidence. That sometimes coincides with late-stage worry phases somewhat than early ones, however worth motion nonetheless has to verify any bottoming try.

Situations for Bitcoin worth as we speak

Bias: Dominant situation continues to be bearish

Given the day by day downtrend, oversold momentum, and worth location close to the decrease Bollinger Band, the dominant thesis is:

- Main bias: Bearish development, with rising odds of a counter-trend bounce or consolidation as an alternative of an instantaneous straight-line collapse.

- Key battleground: The $70,000–73,000 vary.

Bullish situation (counter-trend bounce / short-covering rally)

- BTC defends the $70,000 space (day by day S1 round $69,930 plus H1 decrease band cluster) and stays inside or rapidly reclaims the day by day decrease Bollinger Band.

- On decrease timeframes, the 1H MACD bullish tilt extends, with worth reclaiming and holding above the H1 EMA 20 (round $72,300) after which difficult the H1 EMA 50 (round $74,200).

- Each day RSI begins to show up from the low 20s, and hourly RSI strikes again above 50, signaling that the worst of the instant promoting stress has handed.

Upside targets if bulls achieve traction:

- First, a transfer towards the day by day pivot and H1 mid-Bollinger area round $72,500–73,000.

- If that space is cleared and held, extension towards $75,000–77,000 turns into believable as imply reversion towards the far-off day by day EMA 20 begins.

What invalidates the bullish situation:

A decisive break and day by day shut under $69,900–70,000 with increasing ATR and renewed stress on the day by day decrease band would point out this was not a bottoming try however the begin of a deeper leg decrease. That will put the mid-to-high $60,000 area in play.

Bearish situation (development continuation / deeper flush)

- BTC fails to carry the $70,000 cluster and loses day by day S1 with power, turning that zone into resistance on any retest.

- Each day MACD stays deeply unfavourable and RSI stays pinned close to oversold whereas worth grinds or spikes decrease, a basic “bleed then flush” sample.

- On 1H and 15M, EMAs proceed to cap each bounce, with the 20 and 50 EMAs performing as dynamic ceilings and intraday RSI unable to maintain above 50.

Draw back targets if bears keep in management:

- First part: a measured extension past day by day S1 may drag worth into the $67,000–69,000 space.

- In a full risk-off extension with rising ATR, a deeper probe towards the mid $60,000s wouldn’t be out of character for this sort of market reset.

What invalidates the bearish situation:

If BTC reclaims and holds above the $73,000 area (over day by day pivot and into or above H1 EMA 20), turns that space into help, and day by day RSI curls greater from oversold whereas the day by day MACD histogram contracts, then the instant bearish continuation thesis loses edge. The broader development would nonetheless be down so long as worth sits effectively under the day by day EMA 20 (round $83,000), however it could shift expectations towards a multi-day vary or corrective up-move somewhat than a clear continuation decrease.

Positioning, danger, and the way to consider this tape

Bitcoin worth as we speak is sitting at an uncomfortable intersection: the development is clearly bearish, however short-term circumstances are stretched and sentiment is extraordinarily fearful. That blend is precisely the place merchants get trapped on either side, with late shorts promoting into the opening and impatient dip-buyers front-running confirmations.

Key factors to bear in mind:

- Each day development and construction argue for warning on aggressive lengthy publicity till BTC can no less than reclaim and maintain above close by intraday resistance zones, beginning round $73,000 on the 1H chart.

- On the identical time, day by day oversold readings and worth urgent the decrease Bollinger Band imply draw back entries are not as clear as they have been a couple of days in the past. Danger-reward for contemporary shorts is much less forgiving until you might be buying and selling very brief time period with tight danger controls.

- Volatility is elevated throughout timeframes, so place sizing and leverage matter greater than traditional. Even comparatively small intraday strikes can translate into massive P&L swings.

On this surroundings, buying and selling selections hinge much less on calling the precise backside or prime and extra on respecting the dominant day by day downtrend whereas recognizing the potential for violent, counter-trend rallies. The $70,000 stage and the $73,000 space above are the instant reference factors to guage whether or not present motion is simply one other leg down or the beginning of a extra significant bounce.