Ethereum’s current worth motion highlights a mixture of bullish momentum and cautious consolidation, with the worth approaching a vital resistance at $3.5K.

A breakout above this degree might pave the best way for a major rally, however the potential for a continuation of the consolidation part stays.

Technical Evaluation

By Shayan

The Every day Chart

Ethereum’s upward trajectory has been marked by corrective retracements, which discovered assist close to the 200-day transferring common at $3K. This zone acted as a major assist, with elevated shopping for exercise pushing the asset again towards the essential $3.5K resistance, a area aligning with earlier swing highs.

The $3.5K threshold represents a decisive provide zone regardless of the renewed bullish momentum. If consumers overcome this resistance, Ethereum will possible proceed climbing towards its all-time excessive. Nevertheless, failure to breach this degree might end in an prolonged consolidation part because the market digests current positive aspects.

The 4-Hour Chart

The 4-hour timeframe supplies a clearer image of Ethereum’s bullish construction, showcasing a considerable surge main as much as the $3.5K resistance. Following this transfer, the worth consolidated, forming an ascending wedge sample. This sample is commonly thought-about bearish, suggesting a possible distribution stage.

Moreover, a bearish divergence between the worth and the RSI indicator indicators waning momentum. Mixed with the provision stress at $3.5K, this might enhance the chance of a consolidation or minor pullback.

Nonetheless, the cryptocurrency market stays unpredictable, and the substantial inflow of contributors might set off sudden worth surges. Such actions may end in brief liquidation cascades, quickly pushing the worth increased. Given these dynamics, merchants ought to train warning and intently monitor market situations throughout this vital part.

By Shayan

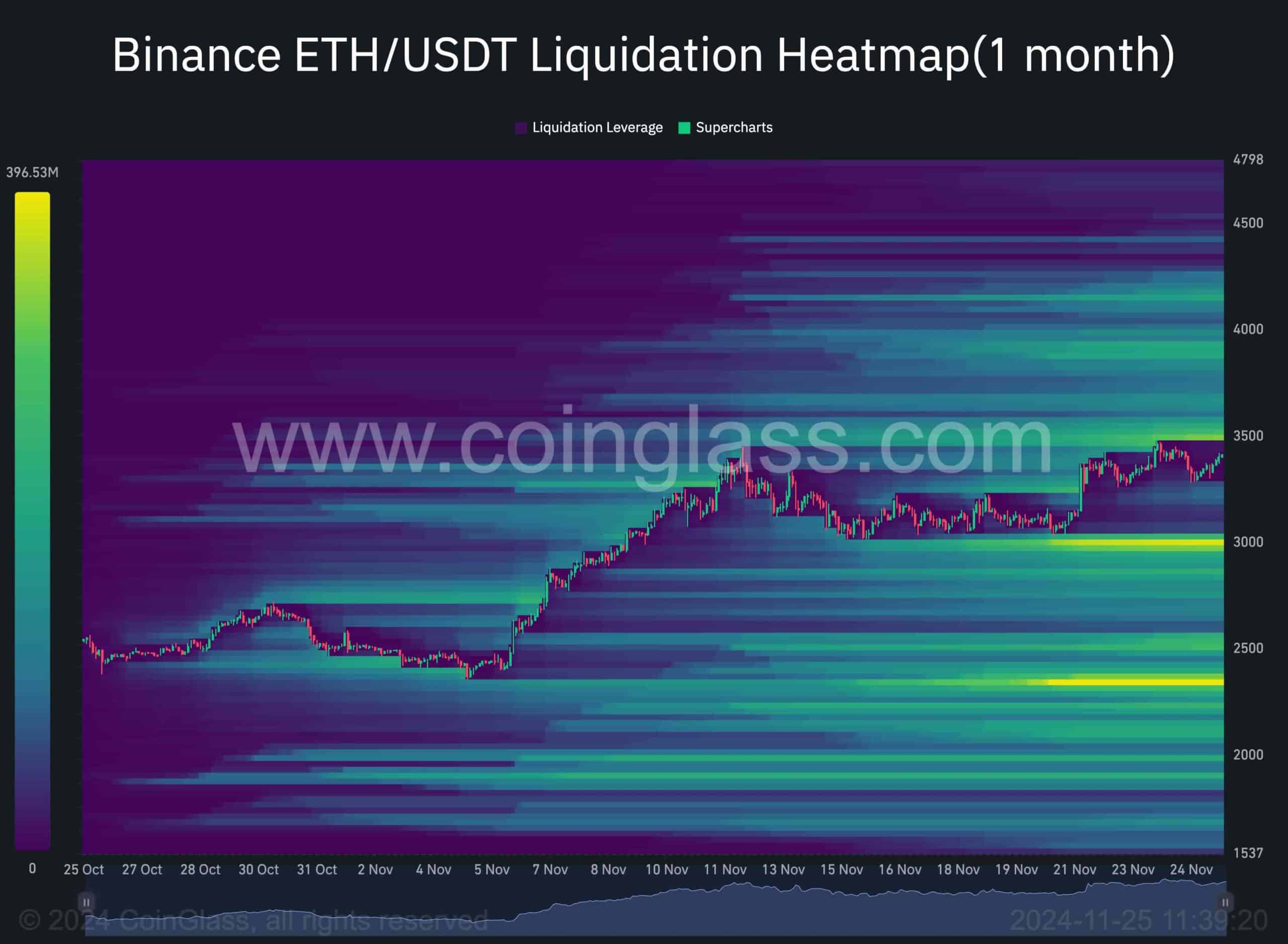

Ethereum has continued to type increased highs and better lows, edging nearer to the $3.5K resistance degree. Nevertheless, its incapacity to breach these key ranges, both above $3.5K or beneath $3K, strongly influences market liquidity.

The heatmap signifies that substantial liquidity resides beneath the $3K degree, possible stemming from giant market contributors’ stop-loss orders and liquidation factors, together with whales. This explains why the worth has been staunchly defended above this degree. Whales and different vital gamers appear to be actively stopping a breach, as such an occasion would set off a liquidation cascade, forcing them to incur losses.

Equally, the $3.5K zone additionally holds appreciable liquidity, representing a focus of promote orders and liquidation ranges for brief positions. This liquidity has turned the $3.5K mark right into a formidable resistance, with sellers and profit-takers dominating close to this degree. A breakout above it, nonetheless, might set off a cascade of brief liquidations, fueling a speedy surge in Ethereum’s worth. Ethereum’s worth is at present oscillating between these two vital liquidity zones, making a consolidation part. A breakout in both course might dramatically amplify market volatility.