The US Federal Reserve is getting into right into a “gradual” period of cash printing that may stimulate asset costs “mildly” however is not going to be as dramatic because the “massive print” that many within the Bitcoin ($BTC) group anticipated, in accordance with economist and Bitcoin advocate Lyn Alden.

“My base case is roughly according to what the Fed expects: to develop its steadiness sheet roughly on the similar proportional tempo as whole financial institution property or nominal gross-domestic product (GDP),” Alden mentioned in her Feb. 8 funding technique e-newsletter, including:

“Total, it means I proceed to wish to personal high-quality scarce property, with an inclination to rebalance away from extraordinarily euphoric areas and towards under-owned areas.”

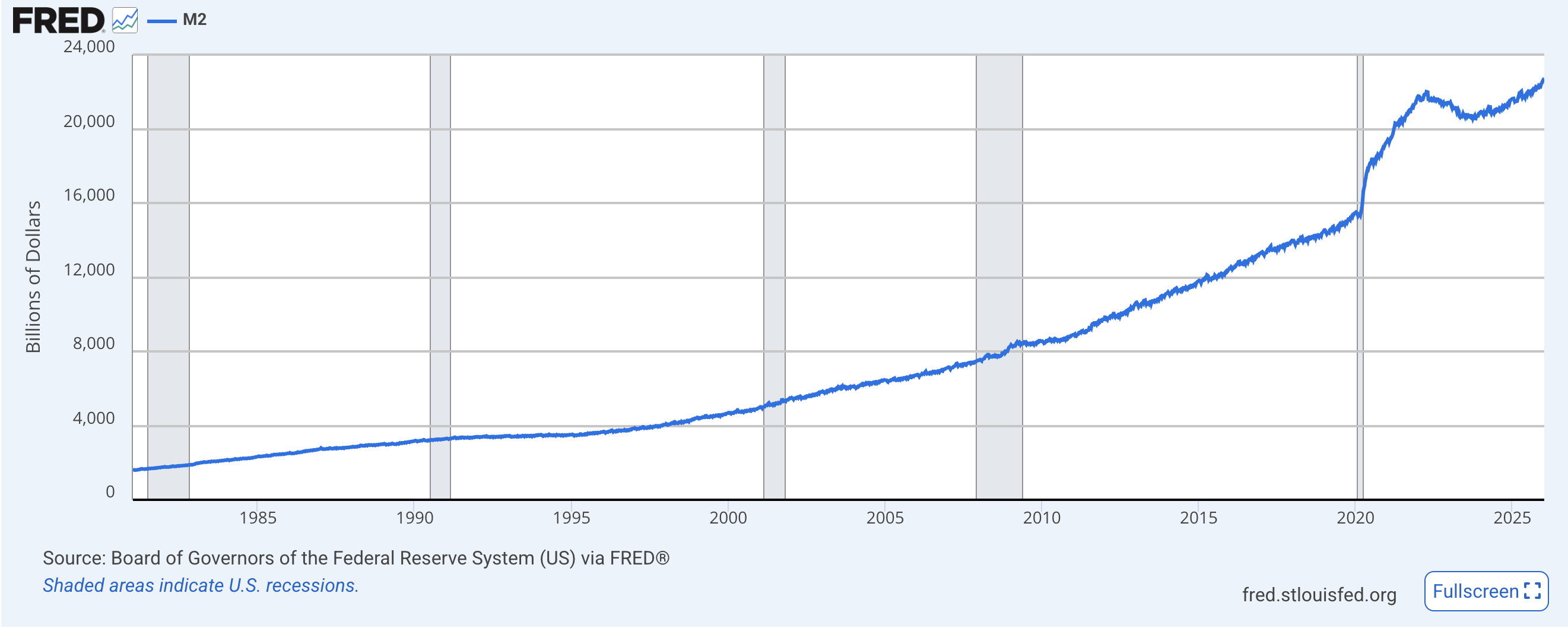

Federal Reserve M2, a measure of the cash provide, continues to increase with time. Supply: FRED

The feedback adopted US President Donald Trump’s nomination of Kevin Warsh to be the following Federal Reserve Chairman, which brought on a furor amongst market merchants, who perceived Warsh as extra hawkish on rates of interest than different potential Fed picks.

Rate of interest coverage can affect crypto costs. Increasing credit score by growing the cash provide is often seen as bullish for property, and a contraction of the cash provide by increased rates of interest sometimes results in financial slowdown and decrease costs.

Associated: Bitcoin investor sentiment cools amid US shutdown fears, Fed coverage jitters

No fee reduce anticipated at subsequent FOMC assembly

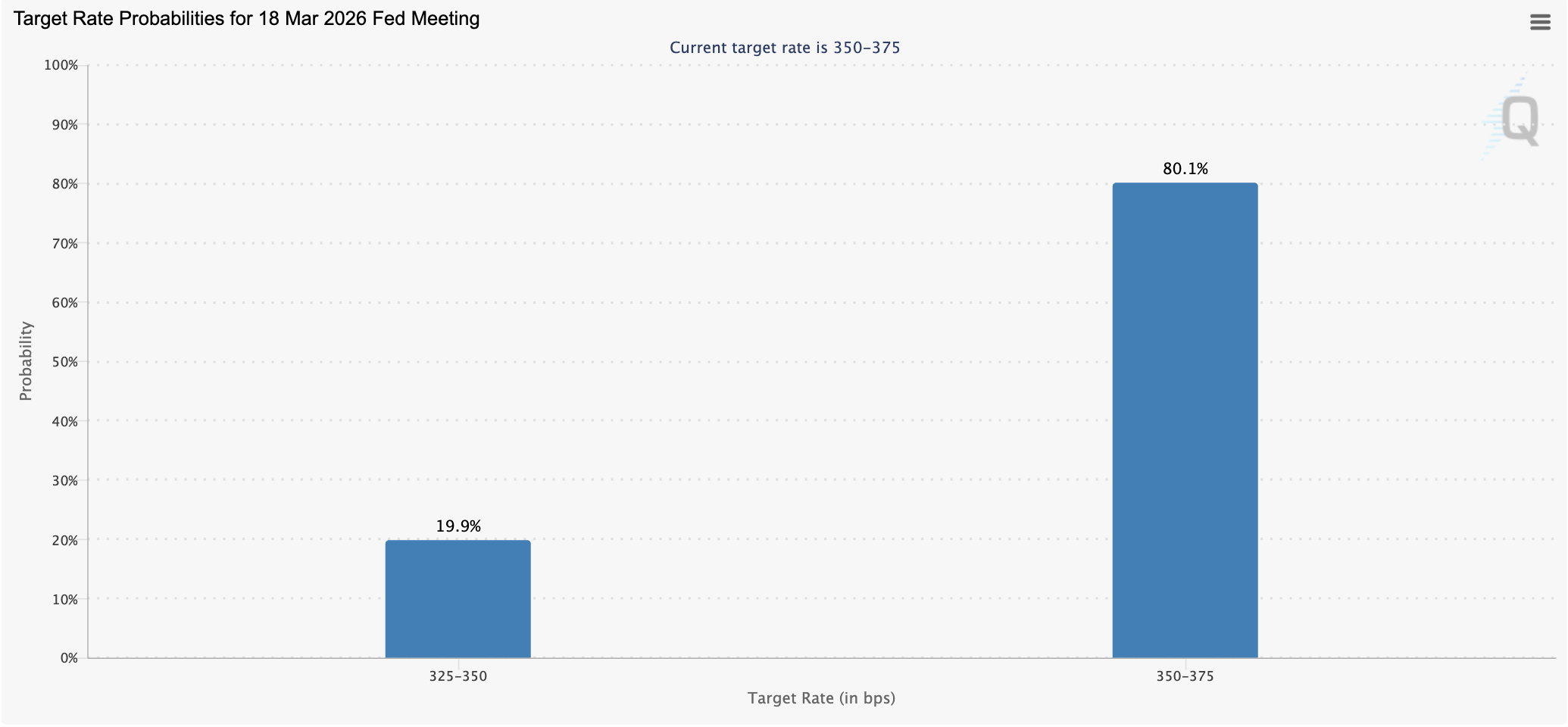

Some 19.9% of merchants anticipate an rate of interest reduce on the subsequent Federal Open Market Committee (FOMC) assembly in March, down from Saturday, when CME Fedwatch confirmed 23% of respondents forecast a fee reduce.

Goal fee possibilities forward of the March FOMC assembly. Supply: CME Group

Present Federal Reserve Chairman Jerome Powell has repeatedly issued combined ahead steering about rate of interest coverage regardless of slashing charges a number of instances in 2025.

“Within the close to time period, dangers to inflation are tilted to the upside and dangers to employment to the draw back, a difficult state of affairs. There is no such thing as a risk-free path for coverage,” Powell mentioned following the December FOMC assembly.

Powell’s time period as Federal Reserve chairman expires in Might 2025, and Warsh has but to be confirmed as the following chairman by the US Senate, fueling investor uncertainty in regards to the route of rate of interest insurance policies in 2026.

Journal: TradFi followers ignored Lyn Alden’s $BTC tip — Now she says it’ll hit 7 figures: X Corridor of Flame