Constancy Digital Belongings’ newest report on Ethereum outlines three distinct growth trajectories for the market’s largest good contract platform.

It additionally positions Ethereum’s decentralization method as a center floor between Bitcoin’s excessive safety and Solana’s speed-centric mannequin.

Three Eventualities for Ethereum from Constancy

Within the bull situation, good contract platforms may reshape how folks collaborate and construct belief, positioning Ethereum as a worldwide coordination infrastructure because of its transparency, censorship resistance, and safety. Due to dense transaction exercise on Layer-2, person prices stay low.

Within the base situation, good contracts improve sure monetary and non-financial sectors, appearing as a “checks and balances protocol” inside conventional methods dominated by governments and enormous firms.

Ethereum retains its lead because the dominant platform, although development slows amid monetary constraints and growing competitors. Its market share consolidates in sectors demanding excessive safety and belief.

Within the bear situation, good contract platforms fall into speculative cycles, struggling to create merchandise that meet mainstream wants; sluggish person development weakens money circulation accumulation for ETH holders, and market share could erode to opponents providing cheaper, quicker experiences.

Modular Scaling and Its Impression on Worth: Ethereum vs. Solana

Constancy emphasizes that as software demand grows, demand for ETH (gasoline charges, safety, staking) will doubtless rise. Nevertheless, Ethereum’s modular scaling technique (offloading processing to Layer-2 and utilizing “blobs” for knowledge) sacrifices some worth seize at Layer-1.

“The requirement of ether to make use of the community is on the core of its funding thesis. In concept, if the demand to make use of functions on the Ethereum community will increase over time, so ought to the demand for the token, ether,” the report said.

Information following current upgrades exhibits that Layer-2 charges now account for under ~1% of whole prices, reflecting that financial worth more and more “stays” with rollups. On the similar time, Ethereum deliberately maintains its function as an open, safe, and decentralized knowledge layer. Whereas this advantages customers via decrease charges, it raises considerations for buyers about whether or not Layer-2 development can compensate for diminished Layer-1 worth seize.

This worth tradeoff results in an essential comparability with Solana, which takes a essentially totally different method. Ethereum prioritizes decentralization and safety, whereas Solana optimizes uncooked efficiency (TPS/value) on Layer-1.

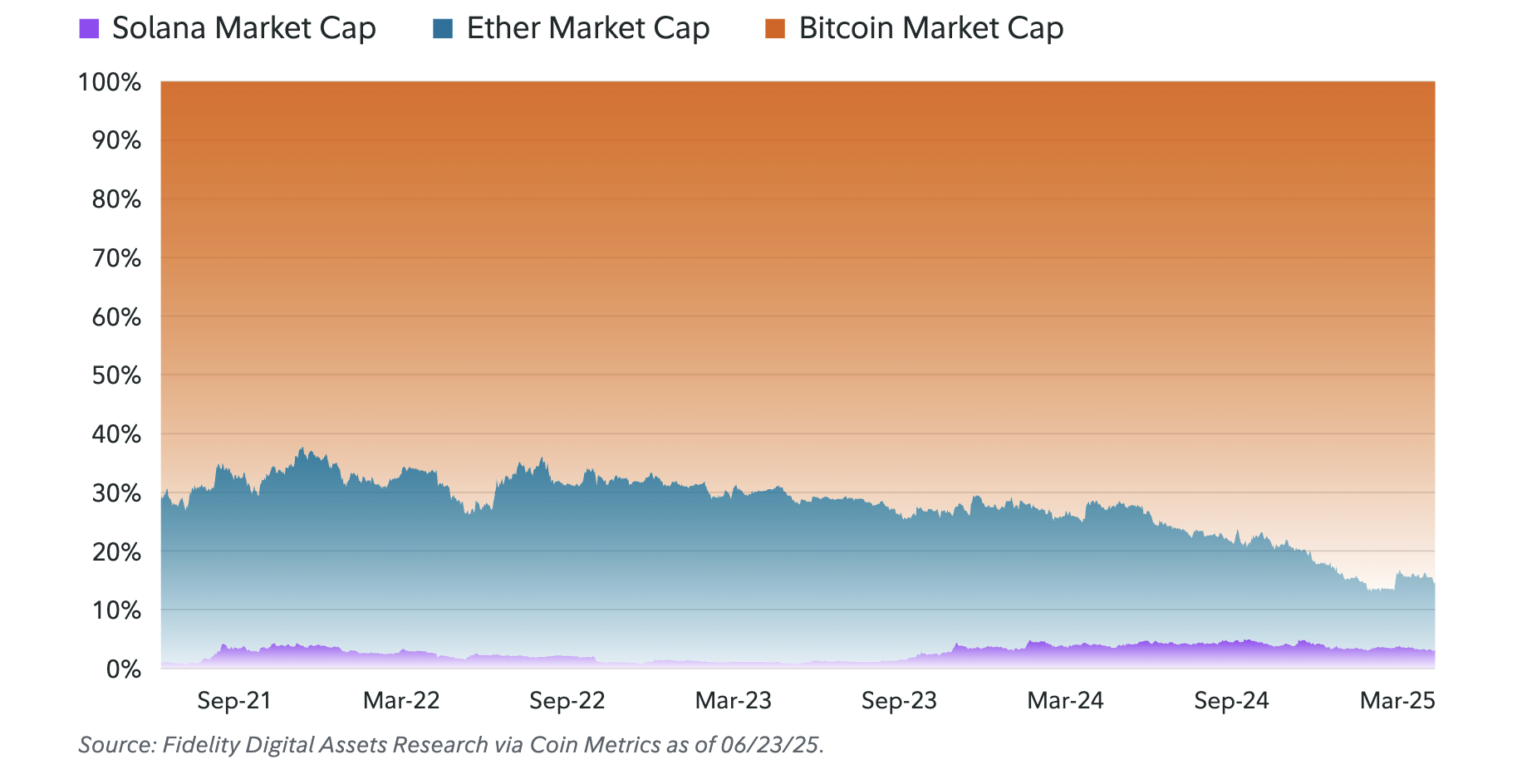

Market cap of Bitcoin, Ethereum & Solana. Supply: Constancy

The price of this method is that Ethereum “cedes” some worth accrual (web charges) to the rollup layer. In the meantime, Solana’s uncooked efficiency can straight translate into worth for SOL holders. This poses an actual aggressive danger within the brief time period, as Solana beneficial properties market share with its cheaper, quicker expertise, albeit at the price of decentralization.

In the long run, the important query is which facet of the “blockchain trilemma” the market will worth most: decentralization, safety, or scalability.

The put up Constancy Highlights Ethereum’s Distinctive Place Between Bitcoin and Solana appeared first on BeInCrypto.