Bitcoin traded at $68,729 at 4:30 p.m. EST on Sunday, Feb. 15, 2026, and the derivatives market is something however sleepy. With $43.81 billion in futures open curiosity (OI) and call-heavy choices positioning, merchants seem like bracing for motion — simply not all in the identical route.

Bitcoin Futures OI Dips 2.3% as Choices Merchants Lean Into Calls

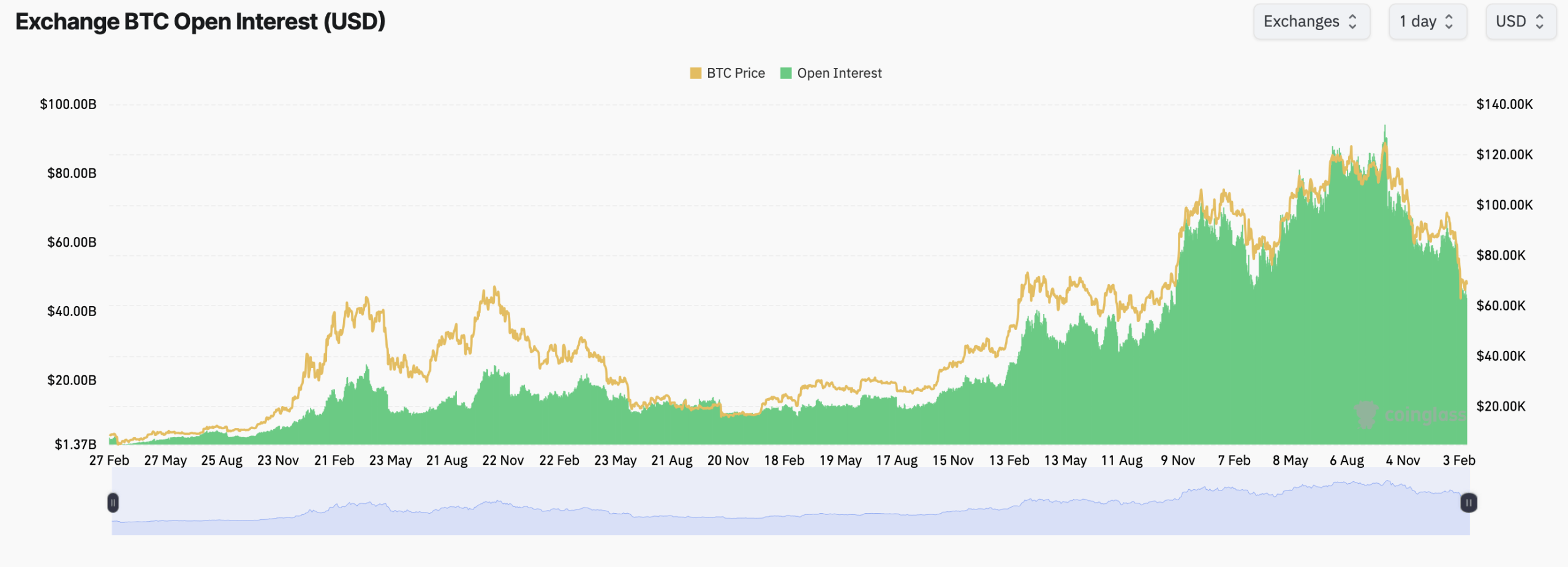

In response to coinglass.com metrics, complete bitcoin futures open curiosity throughout exchanges stands at 639,780 $BTC, or $43.81 billion. Over the previous 24 hours, combination OI slipped 2.32%, even because the one-hour change rose 0.16%, signaling short-term repositioning fairly than a broad exodus from leveraged bets.

The Chicago Mercantile Change (CME) leads the pack with 118,450 $BTC in open curiosity, valued at $8.11 billion, giving it an 18.5% market share. Binance follows with 110,770 $BTC, or $7.58 billion, accounting for 17.3%. OKX holds 45,340 $BTC price $3.10 billion. Elsewhere, BingX stood out with a 20.56% improve in OI over 24 hours, a pointy distinction to the broader pullback.

Bitcoin futures open curiosity on Sunday, Feb. 15, 2026, in line with coinglass.com stats.

Zooming out, futures open curiosity surged to almost $90 billion in late 2025 earlier than cooling alongside value. Even after the latest retracement, positioning stays elevated in comparison with earlier phases of the cycle, exhibiting that merchants are nonetheless deeply engaged in directional trades and hedges.

Bitcoin Choices Skew Bullish With 60% Name Quantity Benefit

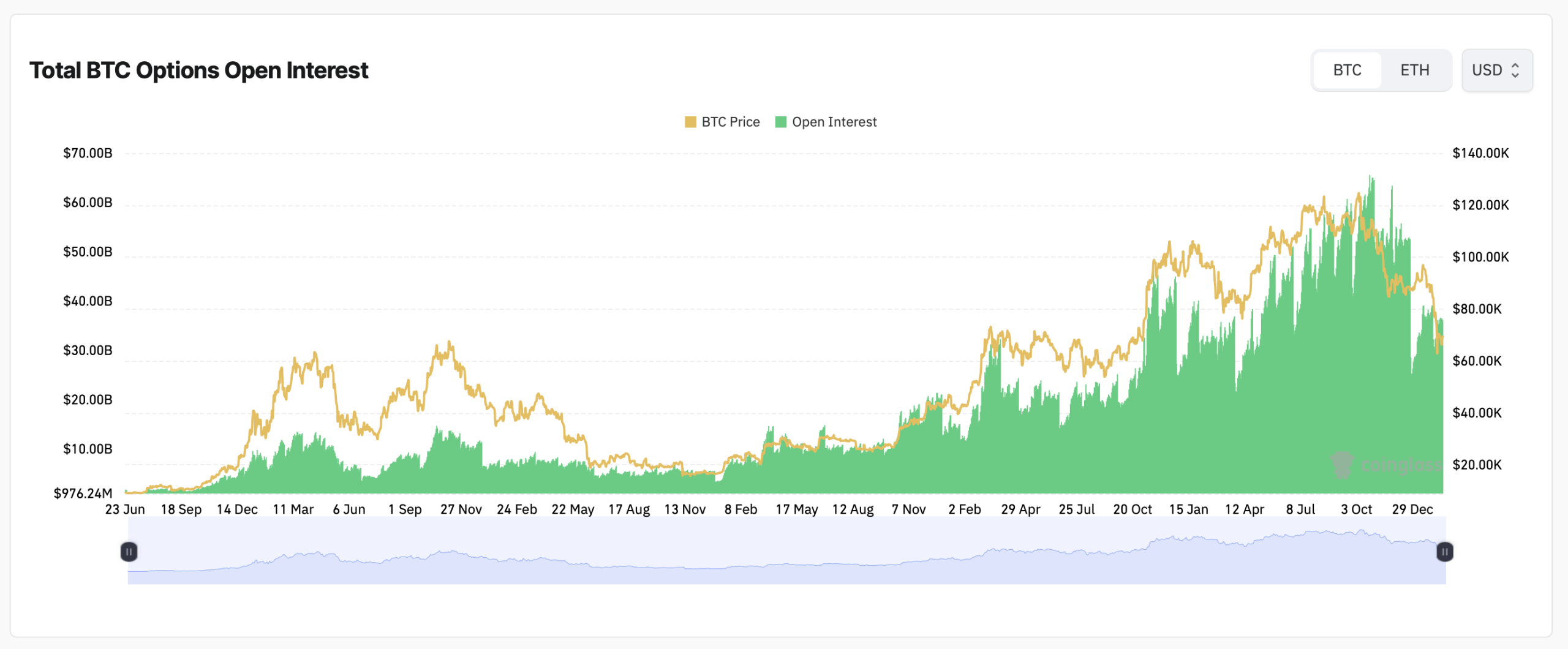

In choices markets, the lean favors the bulls — not less than on paper. Whole bitcoin choices open curiosity exhibits 56.21% in calls versus 43.79% in places, translating to 276,172 $BTC in calls towards 215,135 $BTC in places. Over the previous 24 hours, quantity skews much more closely towards calls at 60.07%, or 14,603 $BTC, in comparison with 9,707 $BTC in places.

Deribit dominates the choices board, and the largest positions inform a narrative in plain English. The only largest contract is a put possibility expiring Feb. 27, 2026, with a $40,000 strike value, overlaying 7,409 $BTC. That contract pays off if bitcoin falls beneath $40,000 — greater than $28,000 beneath right this moment’s $68,429 value — successfully serving as crash insurance coverage.

Bitcoin choices open curiosity on Sunday, Feb. 15, 2026, in line with coinglass.com stats.

On the other finish, merchants are stacking aggressive upside bets. The second-largest place is a Dec. 25, 2026, name at a $120,000 strike, totaling 5,930 $BTC. That wager solely features actual worth if bitcoin climbs greater than $50,000 from present ranges. Shut behind is a March 27, 2026, name at $90,000, representing 5,665 $BTC — a wager that bitcoin may rally roughly $21,500 from right here.

Collectively, these positions reveal a layered technique: hedge the autumn to $40,000 whereas holding publicity to a run towards $90,000 and even $120,000. Max ache ranges — the worth at which the biggest variety of choices expire nugatory — add one other dimension. On Binance, near-term expirations cluster within the $70,000 to $80,000 vary, barely above spot.

OKX exhibits the same gravity level close to $70,000 for February contracts, rising towards $82,000 for March and round $85,000 for later dates. Deribit’s curve stretches increased, with March close to $85,000 and September peaking near $90,000 earlier than easing towards roughly $85,000 into December 2026.

In sensible phrases, many choices writers would profit most if bitcoin drifts modestly increased from the present $68,729 vary, however stays beneath the higher strike clusters. That doesn’t assure value route, but it surely highlights the place incentives are stacked.

At present, the derivatives knowledge displays a market that’s nonetheless cautious but bold at sure junctions. Futures open curiosity stays substantial regardless of a short-term dip, calls outpace places, and main strike concentrations sit each far beneath and nicely above spot. Bitcoin could also be buying and selling slightly below $70,000, however the derivatives crowd is clearly mapping out situations that stretch from $40,000 all the best way to $120,000.

FAQ ❓

- What’s bitcoin futures open curiosity proper now?Whole bitcoin futures open curiosity stands at 639,780 $BTC, valued at $43.81 billion.

- Are calls or places dominating bitcoin choices markets?Calls lead with 56.21% of complete open curiosity and 60.07% of 24-hour quantity.

- What are the biggest bitcoin choices positions on Deribit?The largest contracts are a $40,000 put for Feb. 27, 2026, a $120,000 name for Dec. 25, 2026, and a $90,000 name for March 27, 2026.

- The place are present max ache ranges for bitcoin choices?Max ache ranges cluster between roughly $70,000 and $90,000 throughout Binance, OKX, and Deribit.