Technique’s govt chairman, Michael Saylor, sparked debate with a ballot suggesting Gamestop should purchase over $3 billion in bitcoin to earn BTC legitimacy.

Michael Saylor Turns up the Warmth With Ballot—Can Gamestop Meet BTC Expectations?

Michael Saylor, co-founder and govt chairman of software program intelligence agency Microstrategy (Nasdaq: MSTR), which just lately rebranded as Technique, launched a ballot on March 26 on social media platform X asking how a lot bitcoin Gamestop Corp. (NYSE: GME) would wish to accumulate to be able to achieve legitimacy amongst bitcoin lovers.

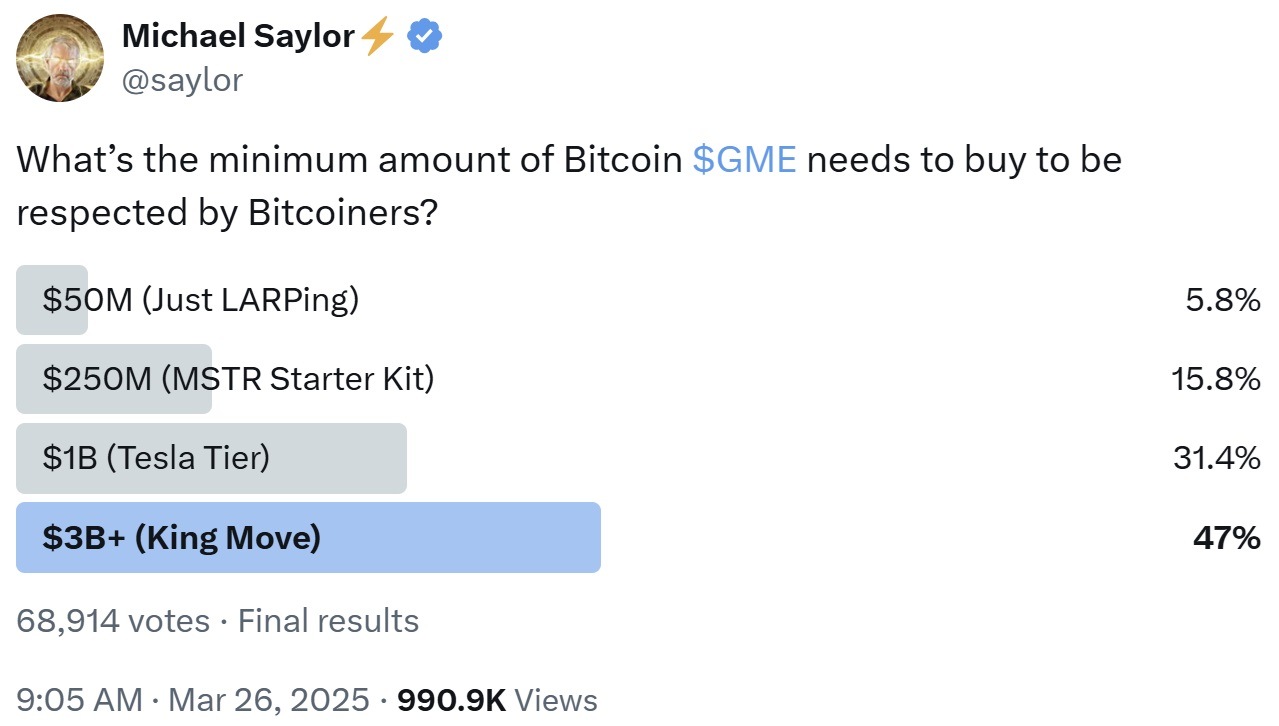

Saylor requested his 4.2 million followers how a lot bitcoin Gamestop would wish to purchase to achieve credibility amongst bitcoin supporters. The 24-hour ballot, which drew 68,914 votes, provided 4 escalating buy tiers. The $3 billion-plus choice, which Saylor referred to as the “King Transfer,” led with 47% of the vote. The $1 billion “Tesla Tier” obtained 31.4%, indicating many see a billion-dollar funding as the edge for company seriousness. The $250 million “MSTR Starter Package,” referencing Microstrategy’s 2020 entry, garnered 15.8%, whereas simply 5.8% backed the $50 million “Simply LARPing” choice. Saylor’s put up attracted almost 1 million views.

Gamestop introduced its bitcoin technique on March 25, revealing that its board of administrators had “unanimously permitted an replace to its funding coverage so as to add bitcoin as a treasury reserve asset.” The corporate acknowledged {that a} portion of its present money steadiness, together with proceeds from future capital raises, may very well be used to accumulate BTC. “The corporate’s funding coverage permits investments in sure cryptocurrency belongings, together with bitcoin and U.S. dollar-denominated secure cash.”

The next day, Gamestop mentioned it might elevate $1.3 billion by way of a non-public providing of convertible senior notes, with the choice to situation an extra $200 million. “Gamestop expects to make use of the online proceeds from the providing for common company functions, together with the acquisition of bitcoin in a fashion in line with Gamestop’s Funding Coverage,” the corporate detailed. On March 27, Gamestop’s inventory skilled a major decline of over 20% following the corporate’s announcement of a $1.3 billion convertible bond providing geared toward financing bitcoin acquisitions.

In the meantime, Technique has continued its aggressive bitcoin accumulation. On March 24, it disclosed the acquisition of 6,911 BTC for $584.1 million at a mean worth of $84,529 per coin. Saylor acknowledged that the corporate has achieved a year-to-date bitcoin yield of seven.7% in 2025. As of March 23, Technique holds 506,137 BTC acquired for roughly $33.7 billion at a mean worth of $66,608 per coin.