Gemini IPO priced $28 with oversubscribed demand has raised $425 million, and it’s representing one of the profitable cryptocurrency trade IPO launches in current market historical past proper now. The IPO priced $28 per share, which was considerably above what they initially anticipated, whereas oversubscribed demand reached over 20 instances the out there shares. The NASDAQ itemizing will begin Friday beneath ticker image “GEMI.”

Gemini IPO Priced $28 With Oversubscribed Demand & Nasdaq Itemizing Surge

The Gemini IPO attracted large investor curiosity, and the oversubscribed demand truly pressured the corporate to cap proceeds at $425 million. Based by Cameron and Tyler Winklevoss again in 2014, the cryptocurrency trade IPO initially focused a $17-$19 value vary earlier than it was raised to $24-$26, finally settling on the IPO priced $28 stage.

File-Breaking Subscription Ranges

The Gemini IPO obtained greater than 20 instances as many orders as there have been out there shares, which created unprecedented oversubscribed demand within the crypto sector proper now. Goldman Sachs and Citigroup, who’re serving as lead bookrunners, truly stopped accepting new orders because of the overwhelming curiosity. The cryptocurrency trade IPO demonstrates some robust institutional urge for food for digital asset corporations.

On the time of writing, NASDAQ itemizing companion invested $50 million in a non-public placement alongside the providing, additional validating the Gemini IPO alternative.

Monetary Efficiency and Market Place

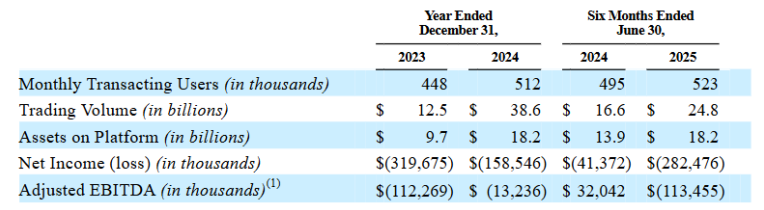

Gemini operates throughout 60+ international locations with $285 billion lifetime buying and selling quantity and 1.5 million transacting customers truly utilizing the platform. The platform holds over $18 billion in crypto belongings beneath custody, together with 4,002 Bitcoin and 10,444 Ethereum as of June 2025.

The corporate posted a web lack of $282.5 million in H1 2025, in comparison with $41.4 million the earlier 12 months. Income declined to $68.61 million from $74.32 million, although the profitable cryptocurrency trade IPO suggests investor confidence in long-term development potential.

Market Impression and Buying and selling Debut

The Gemini IPO will start NASDAQ itemizing Friday, and as much as 30% of shares have been reserved for retail traders by way of platforms like Robinhood and Webull. On the IPO priced $28 stage, the corporate truly achieves a market valuation of roughly $3.3 billion proper now.

The oversubscribed demand displays broader momentum in crypto listings, following profitable debuts by Circle Web Group and Determine Know-how this 12 months.