Bitcoin institutional holdings have reached unprecedented ranges proper now, with simply 216 centralized entities now controlling over 30% of your entire Bitcoin provide. This staggering focus represents a formidable 924% enhance in institutional Bitcoin holdings over the previous decade, and these entities collectively maintain 6,145,207 BTC price roughly $668 billion on the time of writing. The cryptocurrency market cap multiplier impact implies that each single greenback invested can really set off as much as $25 in short-term market influence, which is essentially reshaping how institutional buyers method Bitcoin ETF methods and in addition altering the sport fully.

How Bitcoin’s 924% Institutional Progress Creates Market Multiplier Results

Unprecedented Bitcoin Institutional Holdings Focus

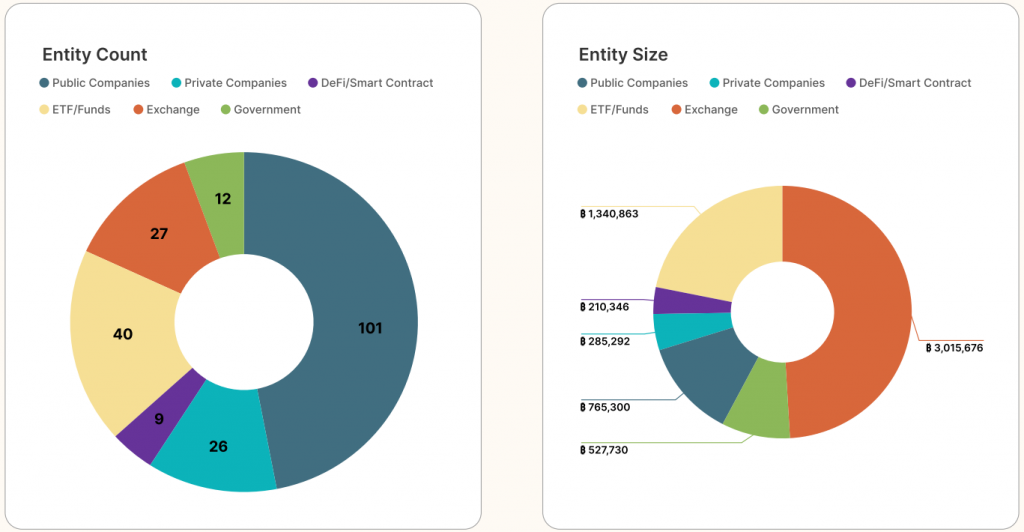

The info reveals a rare transformation in Bitcoin institutional holdings distribution, and the numbers are fairly exceptional whenever you take a look at them. Since early 2015, centralized exchanges and in addition institutional custodians have elevated their cryptocurrency positions by 924%, rising from underneath 600,000 BTC to over 6.1 million BTC. Among the many 216 entities that had been analyzed, exchanges maintain the biggest Bitcoin institutional holdings at 3,015,676 BTC, adopted by ETFs controlling 1,340,863 BTC.

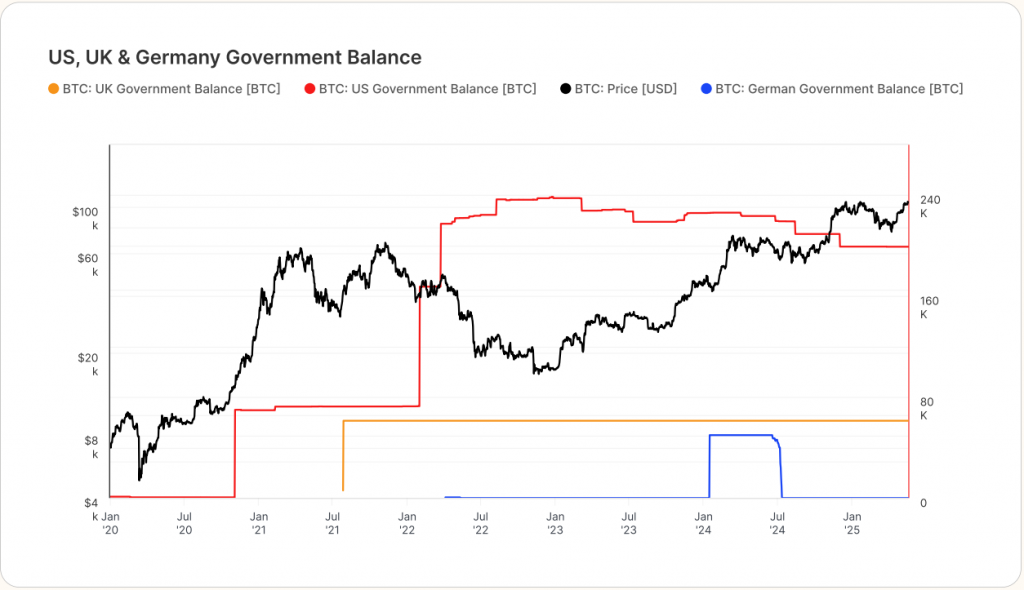

The Strategic Bitcoin Reserve institution by Government Order 14096 on March 6, 2025, really remodeled seized property into federally managed reserves. As said within the government order:

“America is not going to promote bitcoin deposited into this Strategic Bitcoin Reserve, which might be maintained as a retailer of reserve property.”

Market Cap Multiplier Creates Amplified Funding Affect

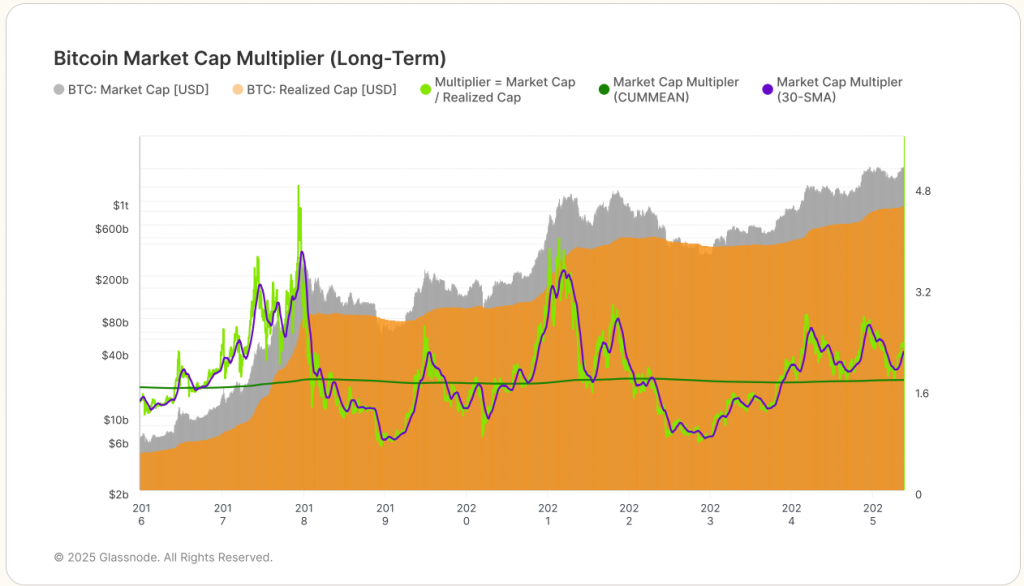

What’s most fascinating in regards to the holdings of establishments regarding Bitcoins is the multiplier impact on market caps and that is the place it turns into very thrilling to patrons. Every greenback of capital that will get deployed into cryptocurrency can enhance whole Bitcoin market capitalization by as much as $25 short-term and in addition roughly $1.70 over full cycles. This reflexive energy demonstrates how institutional buyers create amplified market responses that go manner past the precise capital invested.

The 30-day Market Cap Multiplier is being near-zero to 25x, particularly the present high-volatility phases. Brief-term multiplier averages about 8x that means that the market can quickly have an effect on with every greenback invested by institutional Bitcoin holdings adjustments. These dynamics describe why comparatively small shopping for in Bitcoin ETF can produce vital shifts in cryptocurrency markets.

Authorities and Company Bitcoin Institutional Holdings

The federal government treasuries have amassed big holding of cryptocurrencies primarily by taking authorized course in opposition to the identical and the figures are extremely spectacular as soon as you are taking a better look. The US reportedly owns about 288,000 BTC, together with 69,369 BTC confiscated from the Silk Street and 94,643 BTC recovered by Bitfinex operations. China seized greater than 194,888 BTC of PlusToken scheme, then the UK stacked up Bitcoin within the work of Nationwide Crime Company.

Bitcoin ETFs have turned out to turn into sturdy institutional buyers with management over 1,390,267 BTC at about 150 billion USD price on the writing. The treasuries in public firms comprise 765,300 BTC and the quantity in privately owned corporations contains 285,292 BTC. These institutional piles of focus correspond to the increasing use of cryptocurrency as portfolio diversification methods by institutional buyers.