Stories from market analytics platforms Glassnode and CryptoQuant recommend that Bitcoin nonetheless has room for extra substantial progress.

The report comes as Bitcoin (BTC) claims a new all-time excessive of $109,000 on the again of President Donald Trump’s inauguration. In its report, Glassnode acknowledged that Bitcoin’s present development resembles historic patterns, particularly the 2015-2018 cycle.

Bitcoin Trailing 2015-2018 Cycle

The market useful resource examined information throughout all Bitcoin cycles to verify this assertion. Significantly, on the present stage of the market, the Genesis to 2011 cycle had seen an 80.51x worth improve from cycle low, whereas the 2011 to 2015 cycle had achieved a 55.30x progress.

#Bitcoin’s present cycle continues to echo historic developments, notably aligning with the 2015-2018 cycle.#BTC efficiency for the reason that cycle low on the present stage of the cycle (no. of days since low):

⚫️2022 Cycle+: +630%

🔵2015-2018 Cycle: +562percenthttps://t.co/9YVv2m2I0p pic.twitter.com/vBSwC8qm5T— glassnode (@glassnode) January 21, 2025

In the meantime, the 2015 to 2018 and 2018 to 2022 cycles had delivered smaller however nonetheless spectacular positive factors of two.80x and three.31x from their respective cycle lows. Apparently, the 2022+ cycle is at the moment up 2.92x from its low at this stage, resembling the trajectory of the 2015 to 2018 cycle.

Information from Glassnode’s chart confirms that at this stage within the 2015 to 2018 cycle, Bitcoin had risen 562%, whereas the continued cycle has achieved a 630% improve.

Nevertheless, the chart additionally revealed that after rising 562% from its cycle low in 2015-2018, Bitcoin witnessed additional rally, with its progress finally rising to 11,374%. This represented the height of $19,666 in December 2017.

This means that, with Bitcoin now up 630% within the present cycle, it may nonetheless witness a extra substantial progress if it continues to path the 2015-2018 cycle. Nevertheless, the extent of its additional progress stays unsure.

To place issues into perspective, if the present cycle had been to duplicate the precise 2015-2018 trajectory, an 11,374% rise from this cycle’s 2022 low of round $15,000 may theoretically push Bitcoin to a peak of $1.7 million, given its 2022 low of $15,000. Nevertheless, this progress is probably going unfeasible.

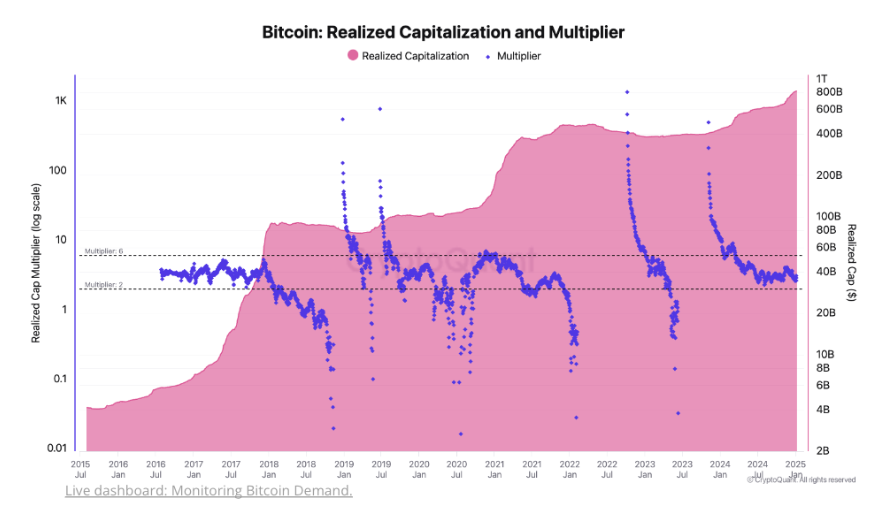

Bitcoin Realized Cap Multiplier

In the meantime, CryptoQuant’s evaluation introduced a extra real looking goal of $145,000 to $249,000 in 2025, as they agreed that Bitcoin nonetheless has extra room for progress. Their evaluation depends on the realized cap multiplier, which measures how Bitcoin’s market worth responds to capital inflows.

In keeping with the report, throughout bull markets, Bitcoin’s multiplier sometimes ranges between 2 and 6, which means each $1 of recent funding may improve market worth by $2 to $6. Based mostly on projected capital inflows of $520 billion by 2025, they calculated these worth targets as real looking.

Bitcoin Realized Cap Multiplier | CryptoQuant

Furthermore, market analyst Joohyun Ryu not too long ago famous that crypto demand is surging amongst South Korean buyers, an element that would assist propel additional progress for Bitcoin. The “Kimchi Premium,” which exhibits increased native crypto costs, signifies elevated home curiosity.

On the similar time, Ryu famous that rising unemployment charges in the US current a possible threat to world financial stability. Notably, such developments have preceded recessions, suggesting the necessity for warning regardless of optimistic market circumstances. At the moment, Bitcoin trades for $104,637, down 2.82% over the previous 24 hours.