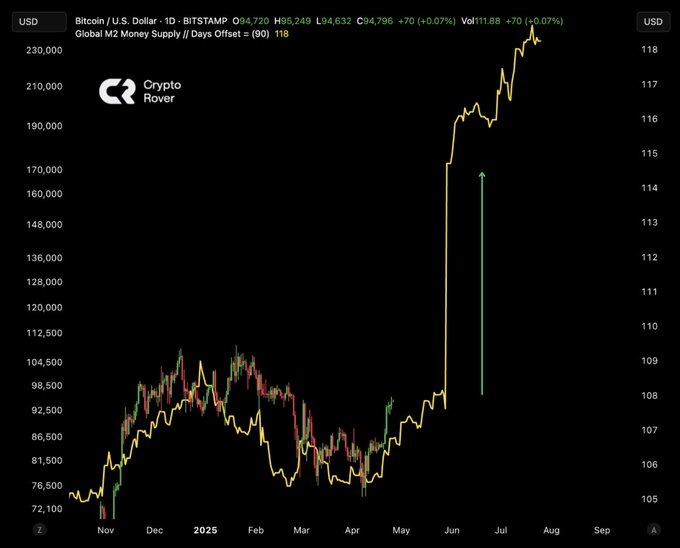

Bitcoin is nearing a crucial value level of $96,000, a resistance stage that has repeatedly challenged its upward momentum in the course of the consolidation part. Nonetheless, sentiment amongst analysts stays firmly bullish, fueled by a quickly increasing international cash provide.

Crypto analyst Rover acknowledged that “international liquidity is exploding” as the quantity of circulating monetary capital continues to increase. Digital property expertise elevated demand as a result of rising market liquidity, which in flip boosts Bitcoin costs. The inflow of capital into the market creates favorable situations for Bitcoin to probably surpass the $96,000 resistance mark throughout a sustained breakout.

Supply: X

Bitcoin Faces Key Resistance at $96,000

The earlier makes an attempt of Bitcoin to surpass the $96,000 resistance stage attracted vital consideration amongst buyers. The market has proven assist at this zone, making it difficult for the worth to interrupt by means of.

Associated: Crypto Marketing campaign Urges Swiss Nationwide Financial institution to Diversify with Bitcoin Reserves

The following main targets for Bitcoin’s upward motion after a possible break of $96,000 might be $101,000, adopted by $111,000, suggesting an ongoing bullish sample. If Bitcoin can’t surpass $96,000, then there exists a risk that its value will fall.

Supply: X

The motion in Bitcoin’s market sentiment relies upon largely on funding charges alongside rising liquidity. Funding charges flip unfavorable when the vast majority of futures merchants open quick positions, reflecting bearish sentiment. Traditionally, such intervals of unfavorable funding have preceded Bitcoin value will increase, indicating that present tendencies could trigger an upward motion.

Institutional Curiosity Strengthens Bitcoin’s Outlook

The curiosity stage from monetary establishments towards Bitcoin has surged dramatically as a result of rising demand for Bitcoin ETFs. BlackRock’s latest $240 million Bitcoin buy, together with its institutional belief, signifies constructive prospects for Bitcoin. The rising institutional assist and rising liquidity point out that the digital asset potential of Bitcoin stays robust, which helps its favorable value pattern over the following interval.

Associated: Coinshares: Bitcoin All-In Mining Price Reached $137K for Listed Miners in This fall ’24

Bitcoin’s market worth is immediately correlated with international monetary enlargement, as elevated liquidity drives demand for cryptocurrencies. The cryptocurrency market signifies that Bitcoin will surpass key obstacles on its path to producing substantial value appreciation.

Disclaimer: The data introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any form. Coin Version will not be accountable for any losses incurred on account of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.