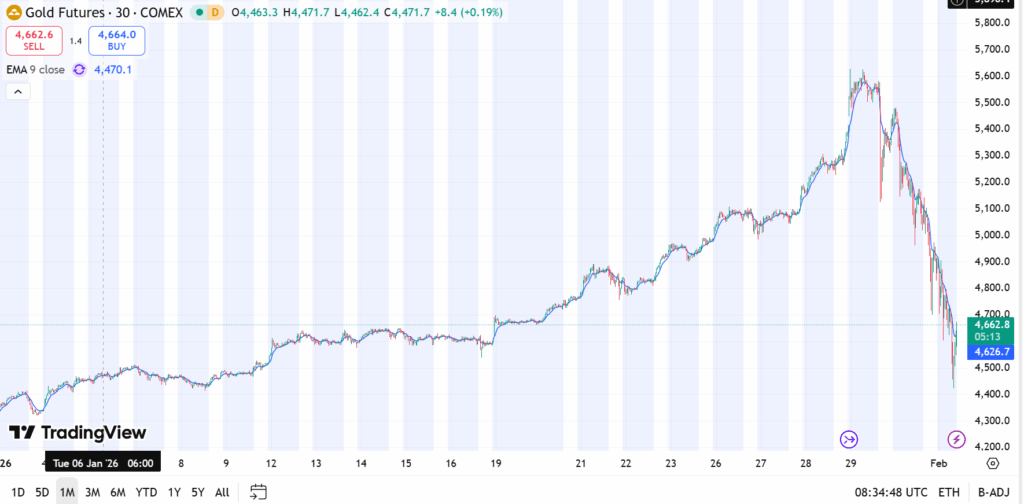

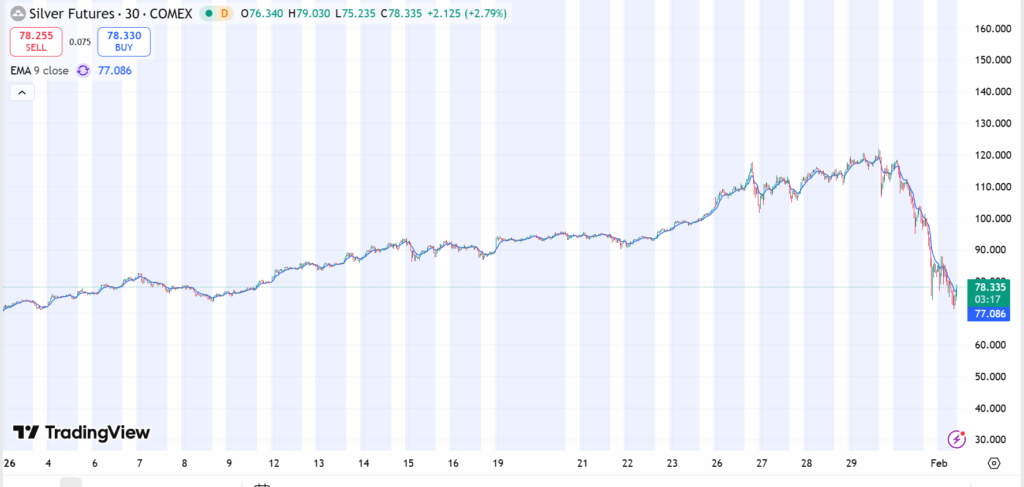

A drastic fall within the costs of valuable metals brought about the gold and silver market cap loss to achieve the trillions in a single buying and selling session. The market cap loss replace was posted on social media and indicated a swift decline within the cumulative values of each gold and silver. The event brought about gold and silver to be among the many worst-performing main belongings within the buying and selling session. Market contributors tracked the event as costs of metals adjusted on world exchanges.

The tweet posted by way of @coinbureau indicated that over $4 trillion had been wiped off the gold and silver market capitalization. Though the tweet didn’t point out any calculations, it indicated adjustments in market values as a result of costs. The magnitude of the event attracted consideration in monetary and digital asset circles. Market contributors adopted metals alongside crypto belongings, that are identified to react to the identical macro indicators.

Gold and Silver Market Cap Loss Follows Broad Worth Adjustment

The market capital loss for gold and silver got here after spot costs for every commodity fell at main exchanges. As costs decreased, market capitalization responded to those adjustments. Market capitalization represents the full out there provide for every market primarily based on spot costs. Market capitalization can fluctuate rapidly if buying and selling quantity is excessive.

Throughout the session, spot costs for gold decreased, and silver noticed a better share lower. The end result for every market was a lower in total valuation. Market analysts identified that adjustments to market capitalization for every market have a tendency to not end result from bodily actions. Slightly, they replace in real-time style primarily based on trades executed all through every market.

Social Submit Attracts Consideration to Metals Valuation Shift

Coin Bureau communicated this replace by a tweet posted publicly, the place the occasion has been characterised as a major decline within the valuation of metals on a single day. This tweet gained traction amongst varied social media customers, particularly these targeted on cryptocurrency or commodities.

The tweet targeted in the marketplace capitalization discount relatively than the proportion adjustments within the worth of the belongings. This has drawn extra consideration to the general market capitalization of the belongings relatively than particular person performances. It has been acknowledged that the market capitalization of belongings, particularly in a bigger market like gold, could also be magnified.

There was no reference made to the reason for this occasion.

Market Cap Declines Mirror Pricing, Not Pressured Liquidation

The discount in market capitalization of gold and silver may be defined as a change in worth relatively than a sale of belongings. It is because market capitalization varies in response to cost fluctuations, even when traders maintain their belongings. Buyers who’ve invested in these belongings for lengthy intervals of time is probably not affected until they commerce throughout such intervals of excessive volatility.

The marketplace for gold and silver consists of futures, choices, and bodily contracts. Worth discovery for these belongings takes place throughout areas. During times of excessive quantity, valuation can happen quickly. That is the rationale for the fluctuation in market capitalization and not using a corresponding quantity of trades.

Metals Motion Monitored Alongside Digital Asset Markets

Crypto merchants additionally observe valuable metals as a part of their total threat evaluation course of. Gold and silver have sometimes served as a reference throughout adjustments in financial coverage expectations. The gold and silver market cap loss was a subject of dialogue on varied crypto-focused platforms.

Market contributors have been seen observing valuable metals pricing alongside digital belongings and equities. The session additionally noticed how valuation metrics can fluctuate quickly amongst massive markets.