Gold’s run is beginning to look much less like a gradual development and extra like a crowding occasion.

The yellow steel pushed by means of $5,500 an oz late Wednesday, and at that tempo its notional worth rose by roughly $1.6 trillion in a single day — or concerning the dimension of bitcoin’s complete market cap.

It’s a punchy comparability that comes with effective print, as gold “market cap” is an estimate primarily based on above-ground provide, not a float-adjusted equity-style measure.

But it surely captures the temper: available in the market’s model of a debasement commerce, money goes to the previous hedge first.

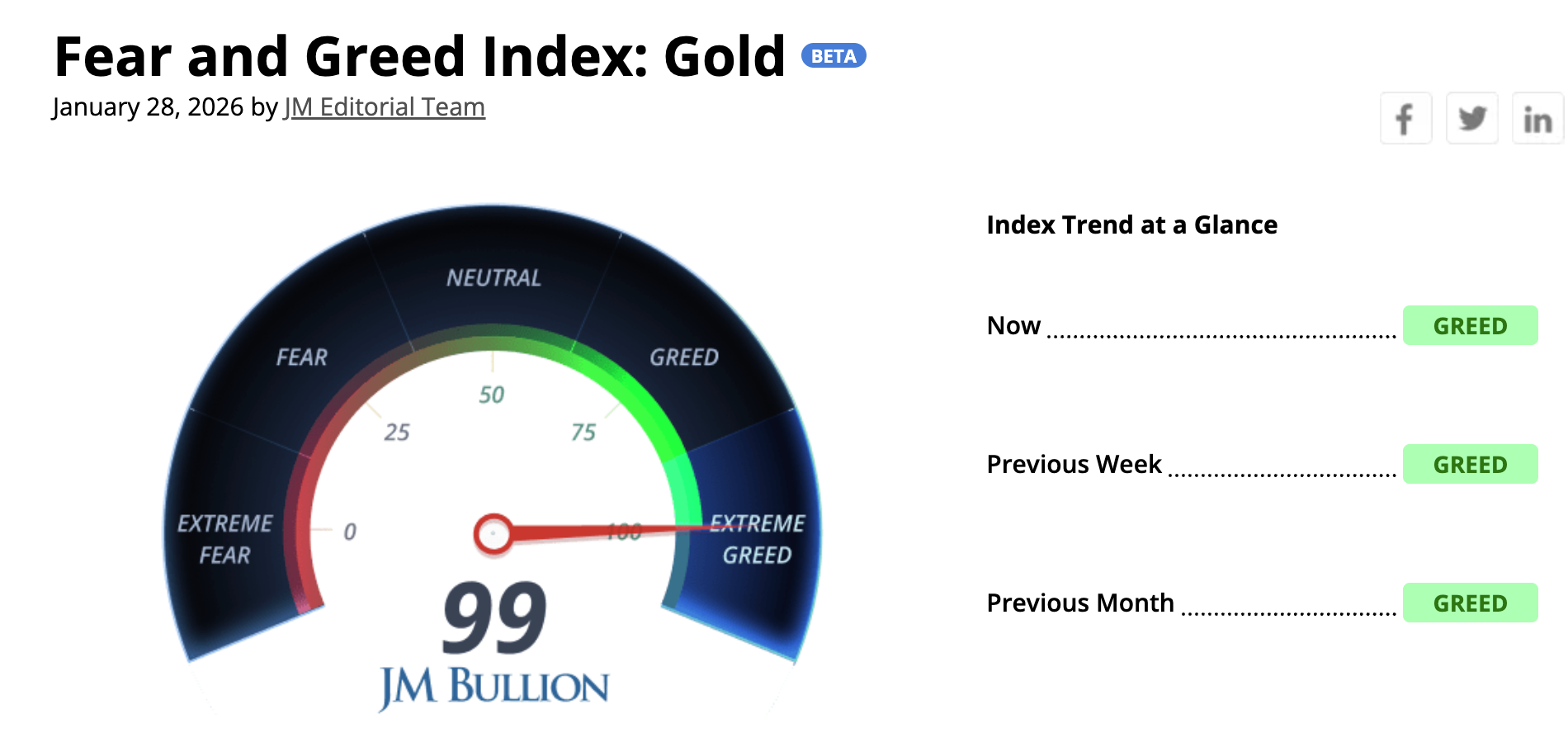

Sentiment displays that break up. Gold-focused gauges are actually flashing “excessive greed,” whereas crypto’s personal fear-and-greed readings have been caught within the reverse zone for a lot of the month.

JM Bullion’s Gold Concern & Greed Index is a 0–100 sentiment gauge constructed from 5 inputs: bodily gold premiums, spot-price volatility, social media tone, JM Bullion retail shopping for/promoting, and Google Developments curiosity. Low readings counsel concern and capitulation whereas excessive readings counsel crowded bullishness. It’s meant as a contrarian sign and never a worth forecast.

Silver is including gasoline to the precious-metals narrative too, with sharp weekly features and sharp intraday swings that really feel extra like a positioning squeeze than a gradual accumulation story.

Bitcoin, against this, remains to be buying and selling like a high-beta threat asset that wants clear liquidity circumstances and a transparent catalyst.

It hovered across the high-$80,000s, nonetheless nicely under October’s peak, at the same time as metals ripped and headlines saved feeding the “laborious belongings” body. That’s awkward for the macro pitch many crypto traders have leaned on — that bitcoin ought to act like digital gold when confidence in currencies and monetary coverage begins to wobble.

The hole doesn’t imply the thesis is useless, nevertheless. Bitcoin has outperformed most belongings throughout longer home windows and it might probably transfer quick when flows return.

However the previous couple of weeks have been a reminder that “retailer of worth” is as a lot about who’s shopping for, and why, as it’s concerning the narrative.

Proper now the marginal purchaser in search of shelter is selecting bars and cash — not tokens and wallets — and bitcoin is being made to show, once more, what it’s for.