Ethereum has prolonged its rally to a brand new all-time excessive of $4,960, however momentum has began to weaken. Bearish divergences on RSI counsel that patrons could also be dropping energy, elevating the chance of a corrective section except ETH can reclaim its highs with conviction.

Technical Evaluation

By Shayan

The Each day Chart

On the each day chart, ETH broke barely above its earlier peak, recording a touch larger ATH. Nevertheless, the RSI did not make a brand new excessive, forming a bearish divergence that displays waning momentum.

Following this, the asset pulled again towards the ascending channel’s midline, now discovering help within the $4,400–$4,450 area. If this stage holds, ETH might consolidate earlier than one other retest of the $4.9K zone. Conversely, a breakdown beneath $4,400 would expose the $4K help vary, which aligns with a previous swing excessive and marks the subsequent main demand space.

General, Ethereum is buying and selling inside a decent and dynamic vary, and a decisive breakout in both route is prone to set off an impulsive transfer.

The 4-Hour Chart

On the decrease timeframe, ETH just lately carried out a liquidity sweep above $4.8K, solely to reverse sharply. This rejection coincided with distribution within the Bitcoin market, confirming short-term exhaustion throughout majors.

Ethereum has since retraced to the $4.4K Fibonacci cluster (0.618–0.702 retracement), the place it at the moment hovers above trendline help. This confluence zone is a essential battleground. Whereas holding above $4.4K may gas a retest of the $4.9K highs, dropping this stage would seemingly open the door for a deeper correction towards $4K.

Onchain Evaluation

By ShayanM

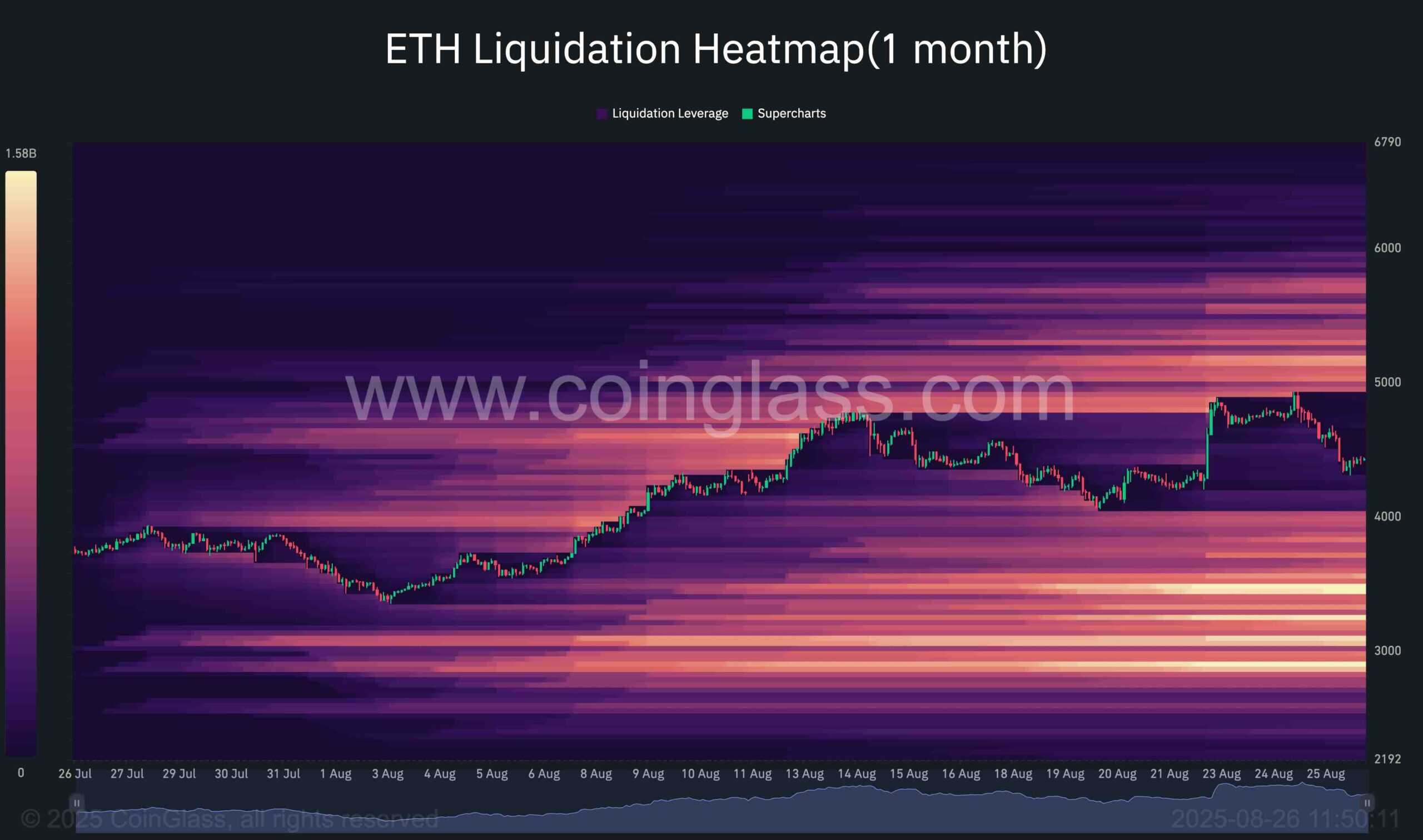

Ethereum has skilled excessive volatility in August, marked by sharp rallies adopted by equally aggressive reversals. The liquidation heatmap sheds gentle on the place leveraged lengthy and quick positions are clustered, highlighting the degrees that act as liquidity magnets for the worth motion.

Throughout its surge towards $4.9K, ETH triggered a dense cluster of quick liquidations, wiping out aggressive sellers. Nevertheless, the sharp rejection that adopted signaled exhaustion at these highs, trapping late patrons within the course of.

At current, the heatmap reveals two essential liquidity zones:

- Upside: Above $4.9K, the place untested quick liquidations stay stacked, offering a magnet if bullish momentum regains energy.

- Draw back: Under $4K, the place dense clusters of lengthy liquidations may appeal to worth motion if the $4.2K help fails to carry.

Presently, ETH is consolidating inside a liquidity-driven vary between $4.2K and $4.9K. With important liquidity swimming pools positioned on each side, the market stays extremely weak to sharp, leverage-fueled strikes, as liquidity hunts proceed to dominate short-term dynamics.