The FED, which began the rate of interest discount cycle with a 50 foundation level minimize in September, minimize charges by 25 foundation factors in November.

Because the FED prepares to announce its last rate of interest determination for 2024 in December, expectations for a price minimize have diminished. In a press release yesterday, FED Chairman Jerome Powell mentioned that there ought to be no rush to decrease rates of interest.

Following Powell, Boston FED President Susan Collins additionally made heat statements.

Talking to the Wall Avenue Journal, Collins mentioned one other price minimize was on the desk in December, however that the choice to chop charges was not last.

Collins mentioned the Fed might finally have to decelerate the tempo of rate of interest cuts and that it was too early to say whether or not that will occur in December, including that they wished to see extra information earlier than making their December determination.

“A price minimize in December is unquestionably on the desk, however it isn’t a definitive determination.

We are going to see extra information by December and proceed to weigh what is smart.

“I see no purpose to take care of restrictive coverage within the absence of proof of latest value pressures.”

“We are going to get to a spot the place it is going to be acceptable to proceed extra slowly and extra cautiously,” mentioned Collins, who will sit down on the Federal Reserve’s FOMC as a voting member subsequent 12 months.

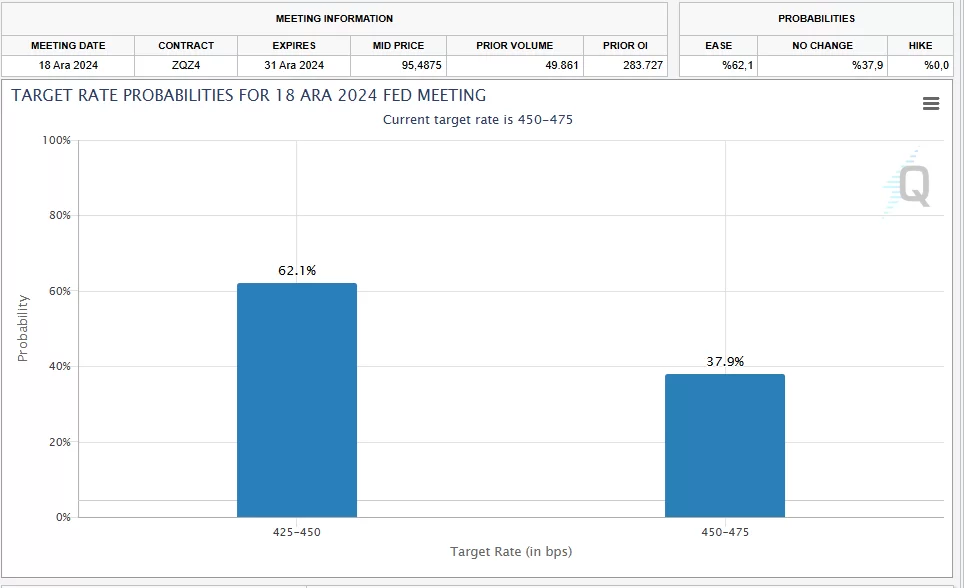

The FED’s subsequent assembly will likely be held on December 17-18. Following Powell’s statements, rate of interest minimize expectations have dropped and a 25 foundation level price minimize is priced in at 62.1% on the CME FedWatchTool.

*This isn’t funding recommendation.