Hayden Davis, the infamous meme token shiller behind LIBRA and MELANIA, is energetic on the meme token market once more. The Kelsier Ventures wallets funded a brand new deal with that began swapping new memes and interacting with Kamino Lend.

Hayden Davis, the promoter of LIBRA, the ill-fated Argentinian meme token, is again with new trades. Kelsier Ventures, the fund managed by Davis, funded a brand new deal with on Solana, which engaged with Kamino Lend and varied tokens.

The wallets linked to Kelsier Ventures nonetheless managed to ship out USDC, regardless of an earlier freeze of over $57M in stablecoins. The preliminary switch was comparatively small, transferring simply $14.77K USDC to start out meme buying and selling.

One extra deal with despatched funds to Kamino Lend, depositing 199.60K USDC. The lending pockets has been in use for months, however was energetic for the primary time since June. Apparently, Kelsier Ventures just isn’t blocked from on-chain Solana exercise, although most of its transfers are comparatively small-scale in comparison with earlier token actions.

Along with the occasional buying and selling exercise, Davis can also be preventing to dismiss the category motion lawsuit from merchants harm by the crash of the LIBRA token.

Hayden Davis takes up BRYAN token

Hayden Davis is returning with small-scale buying and selling for a token, simply beginning out. BRYAN is a particularly illiquid token, nonetheless constructing its liquidity towards SOL.

The wallets linked to Kelsier Ventures carried out a number of small-scale purchases of BRYAN.

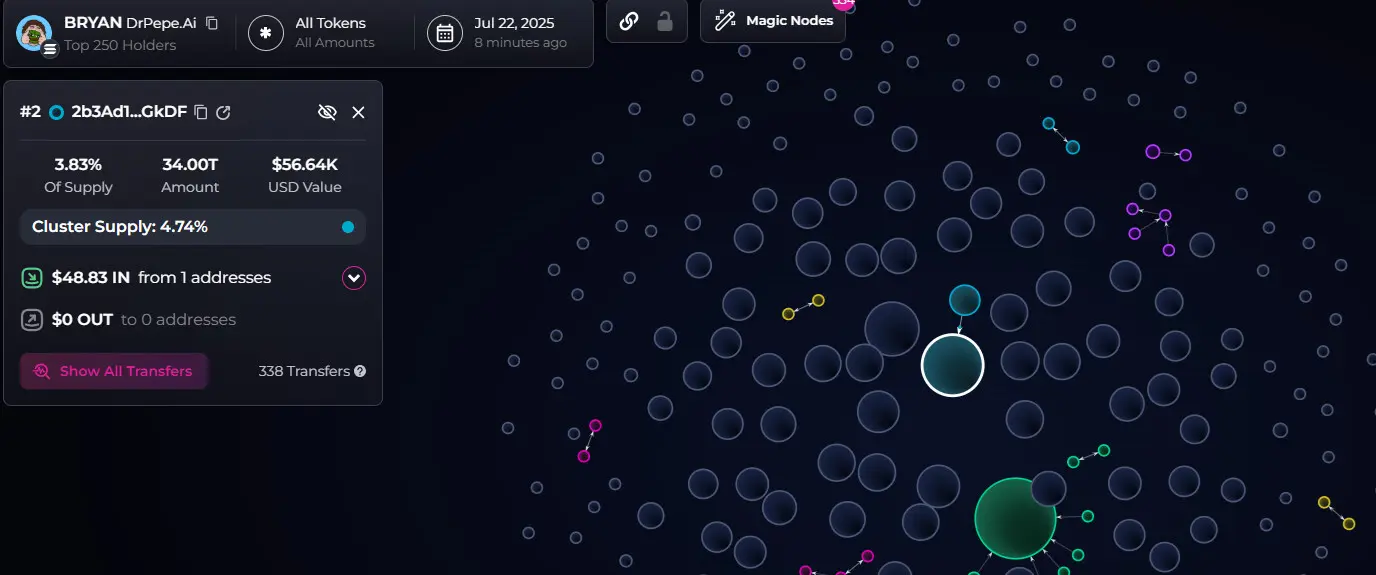

Because of this, the pockets now holds 3.83% of the BRYAN provide.

One of many buying and selling wallets funded by Hayden Davis holds 3.83% of the BRYAN provide. | Supply: Bubblemaps

The token has not produced returns, and continues to be carrying solely round $100K in its liquidity pair. The engagement from Kelsier Ventures positions the fund as an early purchaser, as BRYAN is a comparatively latest launch.

Beforehand, Kelsier Ventures wallets interacted with BRYAN on a number of events. At present, the Kelsier Ventures fund nonetheless holds $943.77K of BRYAN, after beforehand promoting a few of its holdings.

At this level, Kelsier Ventures’ aim with regards to BRYAN is unsure. The token is down 99% from its January peak, and is buying and selling on extraordinarily low volumes. Thus far, Kelsier Ventures has made restricted makes an attempt to pump the token.

Kelsier Ventures makes use of Kamino Lend for passive revenue, factors

Even in the course of the peak of the LIBRA scandal, Kelsier Ventures by no means totally deserted the Solana economic system.

The remaining belongings in Kelsier Ventures wallets had been put to work on Kamino Lend, the rising Solana protocol. Beforehand, the fund deposited as a lot as $2.4M, reaching common passive revenue from Kamino’s yield.

A few of the funds used on Kamino Lend got here from proceeds of buying and selling LIBRA and MELANIA. Regardless of the continued lawsuits, Kelsier Ventures has not been blocked from utilizing its belongings for short-term trades.

Moreover, the fund is mining Kamino factors, and will profit from an eventual airdrop from the platform.

Kelsier Ventures retains $5.87M in its recognized addresses, down from round $10M at the start of the 12 months. Whereas not buying and selling aggressively, the fund nonetheless tries to make use of a few of its remaining stablecoins.