Ethereum stays below bearish strain on the day by day chart, with merchants watching whether or not resistance breaks and momentum improves after current liquidations.

Ethereum ($ETH) is buying and selling at $1,967.04, down 1.6% over the past 24 hours, with value motion reflecting a uneven session that in the end tilted bearish. The 24-hour vary runs from a low of $1,927.71 to a excessive of $2,030.77, exhibiting a reasonably extensive intraday swing as $ETH briefly pushed above the $2K space earlier than sliding again towards the mid-range.

On the exercise aspect, $ETH reveals 24-hour buying and selling quantity at $22.48B, alongside a market cap of $237.34B. Efficiency tiles additionally point out $ETH is down 0.4% in 1 hour, up 0.1% over 7 days, down 6.7% over 14 days, and down 38.0% over 30 days. This efficiency leaves merchants cautious, with consideration shifting as to if $ETH can reclaim intraday resistance at $2,000.

Can Ethereum Take a look at $2,000 Once more?

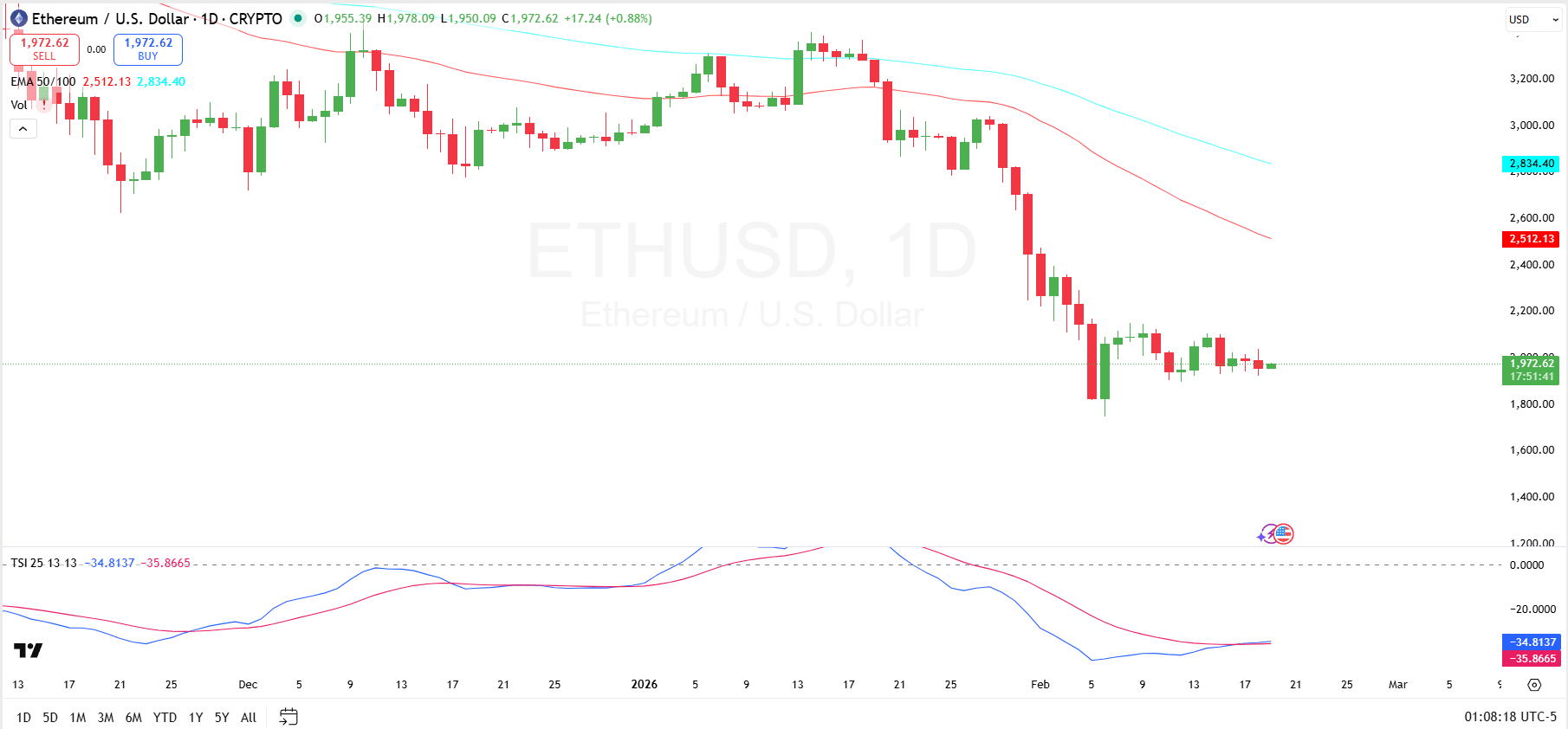

On a technical view, Ethereum stays below broader bearish strain on the day by day chart, with value buying and selling properly under each the 50-day EMA at $2,512 and the 100-day EMA at $2,834. These transferring averages are sloping downward, reinforcing the prevailing downtrend and performing as dynamic resistance zones on any restoration try.

Ethereum 1D Chart

Fast horizontal resistance now sits close to the $2,100–$2,200 area, whereas stronger overhead strain stays across the 50-day EMA. On the draw back, current value motion reveals help forming across the $1,825 space, with a deeper help zone close to $1,750, the place patrons beforehand stepped in aggressively.

The True Energy Index (TSI) at present prints round -34 for the principle line and -35 for the sign line, each positioned properly under the zero degree. This displays sustained bearish momentum, though the strains seem like flattening barely, suggesting that draw back momentum could also be stabilizing.

A bullish sign would require a crossover above the sign line and a transfer again towards the zero axis, whereas continued rejection under zero would affirm that sellers nonetheless management the pattern.

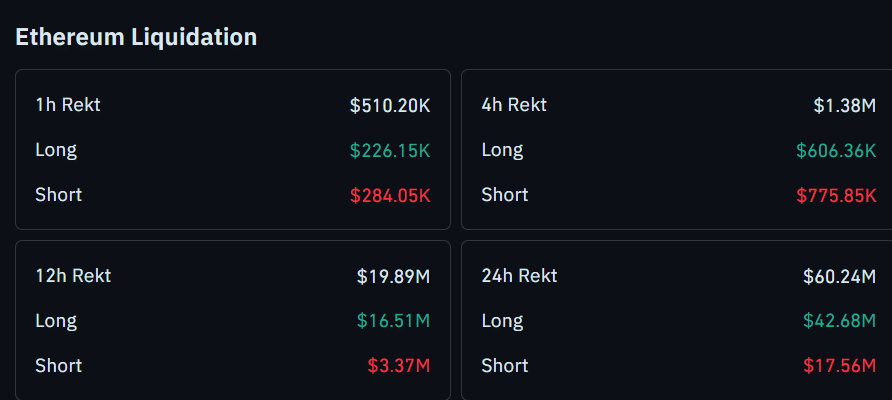

Ethereum Liquidation Information

Ethereum’s liquidation information reveals a pointy imbalance growing over the upper timeframes, with complete liquidations reaching $60.24 million up to now 24 hours. Of that quantity, lengthy positions account for $42.68 million, considerably outweighing the $17.56 million briefly liquidations.

$ETH Liquidation

Within the shorter timeframes, the 12-hour liquidations stand at $19.89 million, once more dominated by longs at $16.51 million in comparison with $3.37 million in shorts. Nonetheless, within the 1-hour and 4-hour home windows, liquidations seem extra balanced, with barely increased brief liquidations in each durations. The 4-hour information reveals $1.38 million complete liquidations, with $775.85K in shorts versus $606.36K in longs, indicating transient brief squeezes amid broader long-side strain.