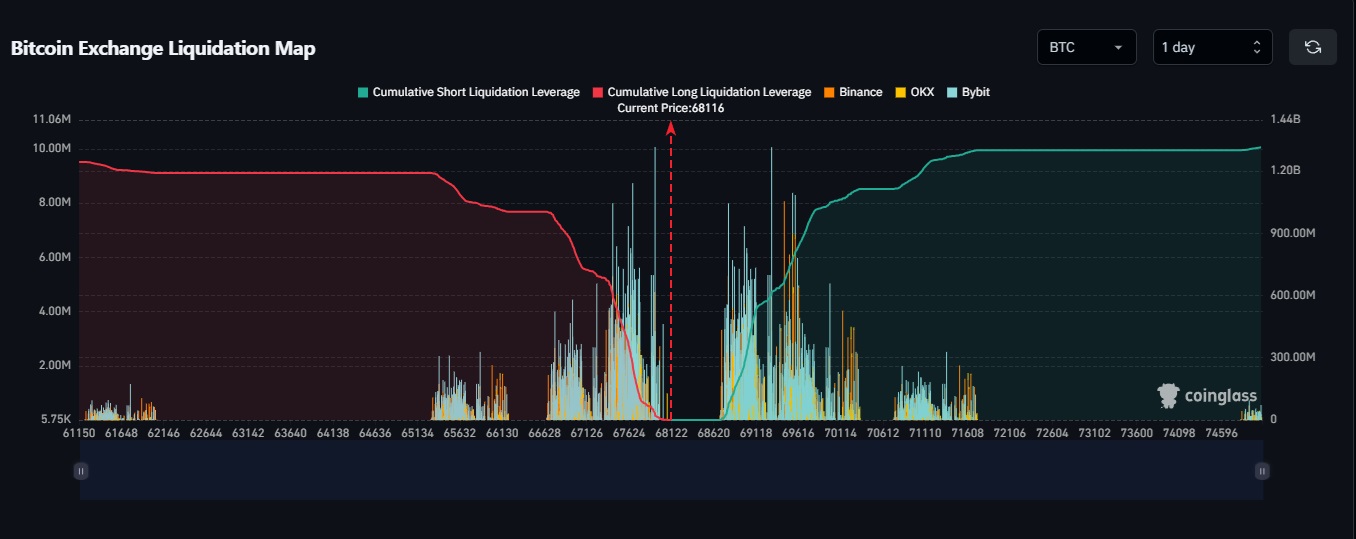

If Bitcoin surpasses $69,000, the cumulative brief order liquidation depth on mainstream centralized exchanges (CEX) may attain $101 million, in accordance with Coinglass knowledge.

Nonetheless, if Bitcoin falls beneath $68,000, the cumulative lengthy order liquidation density on these exchanges may rise to $293 million.

It is very important word that the liquidation desk doesn’t give the precise quantity or worth of contracts to be liquidated. As an alternative, it exhibits the relative significance of every liquidation cluster in comparison with neighboring clusters and highlights the depth of every potential value transfer. A better liquidation bar signifies that the market is prone to react extra strongly to a liquidation wave at that value degree.

Coinglass liquidation knowledge over the previous hours reveals the next for the complete cryptocurrency market:

- 1-Hour Information: $4.62 million was liquidated, together with $3.94 million price of lengthy orders and $680,000 price of brief orders.

- 4-Hour Information: $9.21 million was liquidated, together with $6.32 million price of lengthy orders and $2.89 million price of brief orders.

- 12-Hour Information: $26.29 million was liquidated, together with $18.62 million price of lengthy orders and $7.67 million price of brief orders.

- 24-Hour Information: $60.59 million was liquidated, together with $31.31 million lengthy and $29.28 million brief.

*This isn’t funding recommendation.