Ethereum, the main altcoin, has been displaying constructive indicators over the past week after months of bearish consolidations.

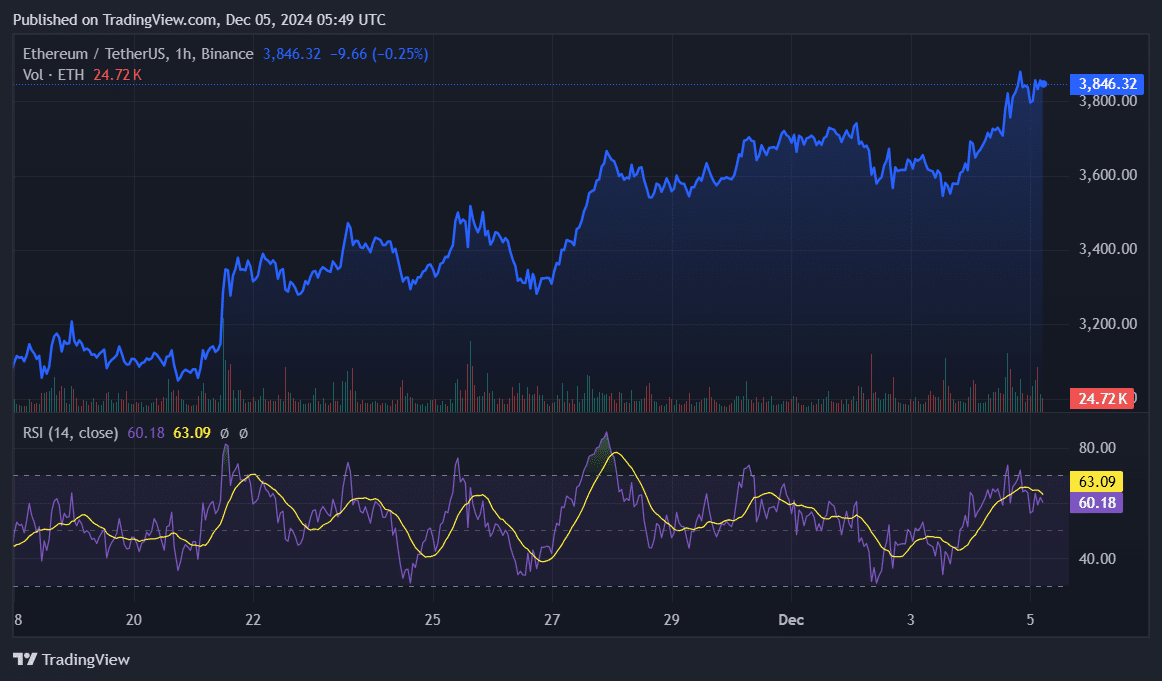

Ethereum (ETH) is up 4% prior to now 24 hours and is buying and selling round $3,840 on the time of writing. The king altcoin hit a six-month excessive of $3,900 on the again of Bitcoin’s (BTC) rally above the $100,000 threshold early Thursday.

Supply: crypto.information

At this level, Ethereum is 21% away from its all-time excessive of $4,891 in November 2021.

The second-largest cryptocurrency reached a market cap of $463 billion as its each day buying and selling quantity elevated by 46% to $63 billion.

What’s driving the ETH rally?

There are a lot of components driving Ethereum upwards, creating sturdy shopping for strain.

Most notably, the U.S.-based spot ETH exchange-traded funds recorded eight days of constant inflows. In accordance with information supplied by Farside Buyers, spot Ethereum ETFs noticed a internet influx of $882.3 million since Nov. 22, principally coming from BlackRock’s ETHA fund.

This introduced the whole inflows into these funding merchandise to $901.3 million regardless of a $3.4 billion outflow from Grayscale’s ETHE fund.

You may additionally like: Newly launched memecoin HAWK crashes from practically $500M to $60M market cap in 20 minutes

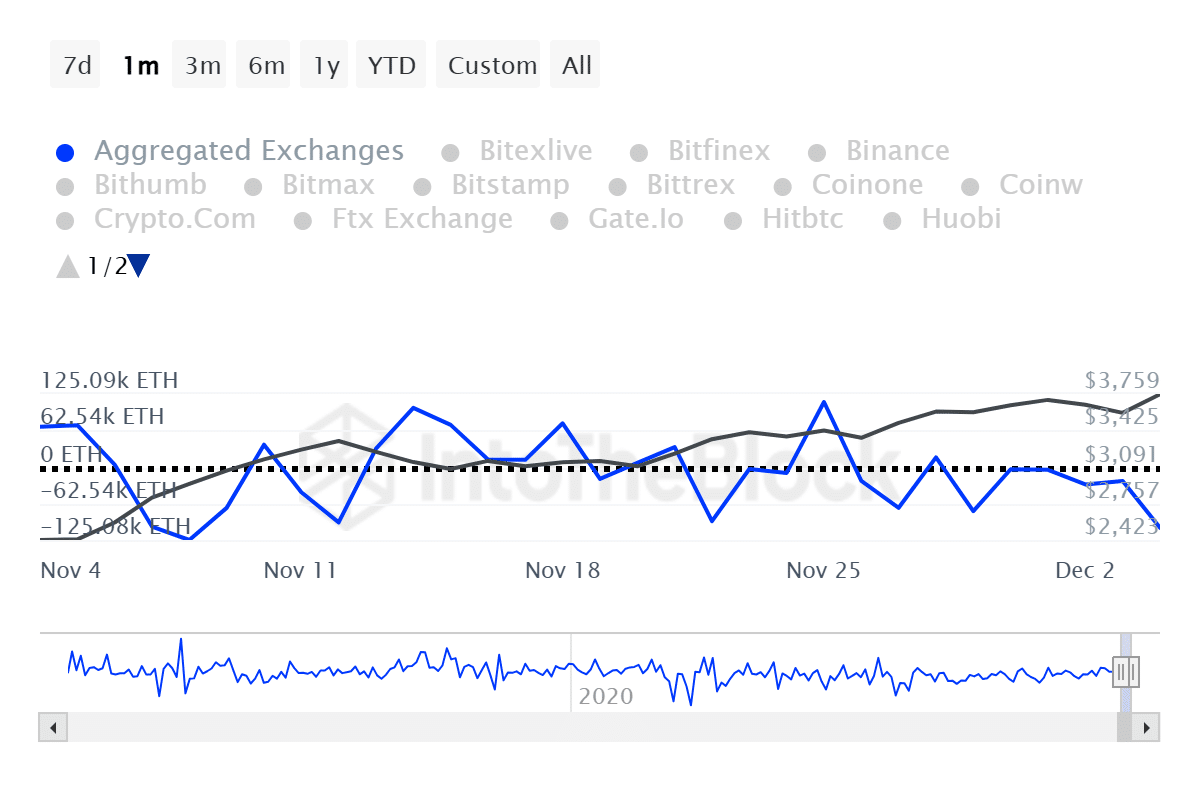

Furthermore, Ethereum registered an alternate internet outflow of $820 million within the final seven days — recording a one-month excessive outflow of $385 million on Dec. 4 alone — in keeping with information from the analytics platform IntoTheBlock.

ETH alternate internet stream | Supply: IntoTheBlock

The on-chain motion means that traders have been accumulating the asset. Contemplating that 74% of Ethereum holders have held onto their property for over a yr, per ITB information, the main altcoin might doubtlessly see declining promoting strain.

Knowledge from ITB reveals that whale transactions consisting of no less than $100,000 price of ETH reached $73 billion over the past week.

Rising whale exercise often triggers indicators of FOMO (worry of lacking out) amongst retail traders, consequently growing shopping for strain as a consequence of grasping market situations.

Moreover, Ethereum’s decentralized finance sector has additionally been rising at a powerful tempo. Per a crypto.information report Wednesday, Ethereum’s DeFi whole worth locked reached $72.9 billion as the whole TVL touched a 31-month excessive of $134.7 billion.

Regardless of the worth hike to June highs, Ethereum’s Relative Power Index continues to be hovering throughout the impartial zone, at present sitting at 63. This means a maturing accumulation part for the main altcoin, following the trail of the digital gold.

Disclosure: This text doesn’t signify funding recommendation. The content material and supplies featured on this web page are for academic functions solely.

Learn extra: Vladimir Putin: Bitcoin can’t be stopped