An analyst who nailed Bitcoin’s pre-halving correction final yr is updating his outlook for when BTC could peak within the present cycle.

The analyst pseudonymously often called Rekt Capital tells his 105,000 YouTube subscribers that based mostly on historic priority, Bitcoin could peak within the second half of 2025.

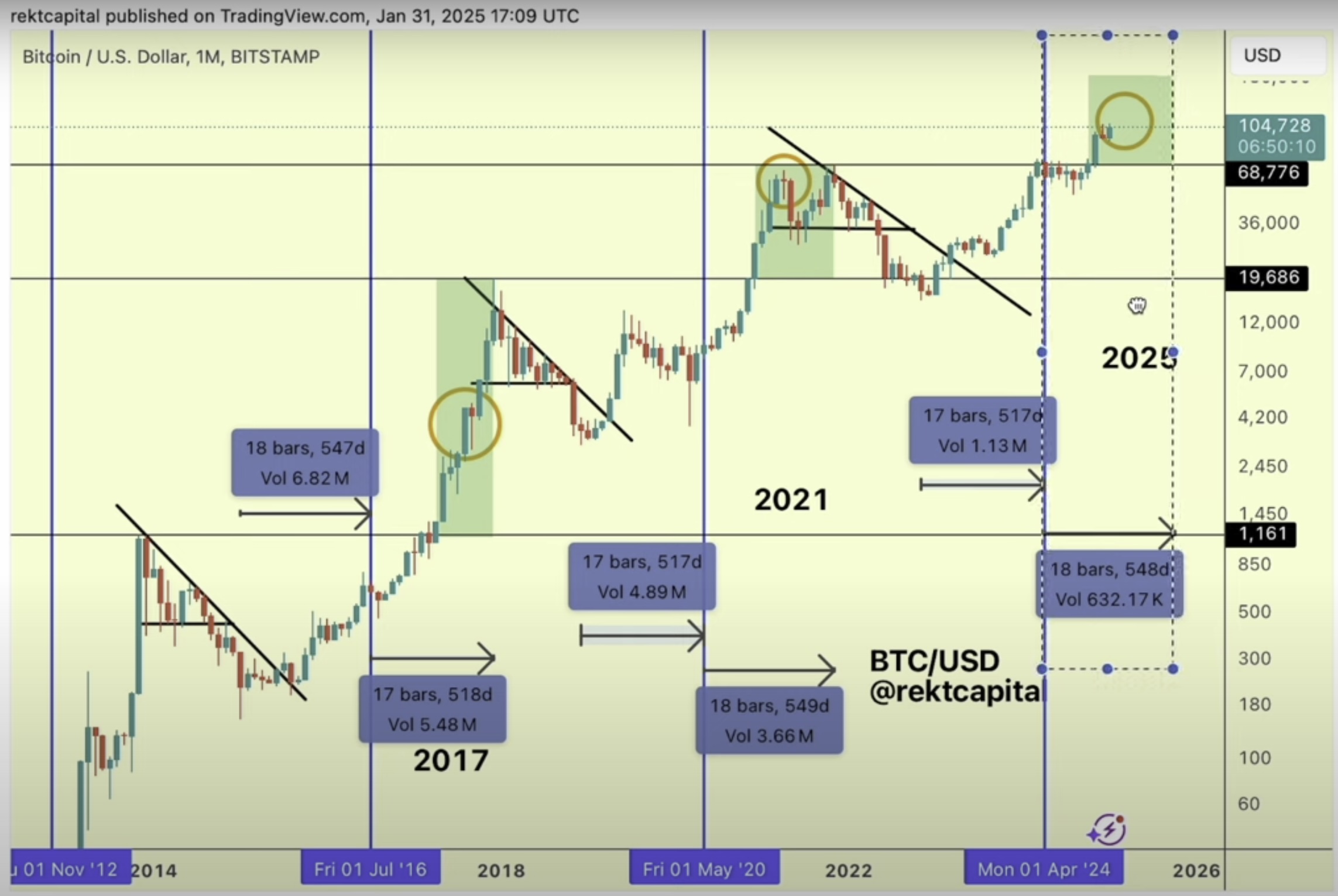

The analyst appears to be like at how lengthy it took Bitcoin to hit its peak in earlier cycles, from the time BTC broke out of prior all-time highs to the second it printed new market cycle highs. He says the vary varies from as little as 250 days to as excessive as 329 days.

“If historical past repeats, and we see a 250-day interval from breaking previous all-time highs to rallying to new all-time highs, that may imply that we may get a mid-July 2025 bull market peak.

Nevertheless, if we see issues go the opposite approach, and we see an prolonged interval – similar to in 2021 the place we had been rallying for 329 days past previous all-time highs earlier than we lastly peaked within the bull market high – then 329 days would get us to late September 2025.”

The analyst notes {that a} late September Bitcoin peak can be about 550 days from its April 2024 halving, when miners’ rewards are minimize in half. Based on Rekt Capital, a September bull market crescendo is according to earlier cycles.

“A 550-day bull market high after the halving, that may get us into September or October 2025, so that is very a lot in alignment, whereas nonetheless appreciating and acknowledging the truth that we see various levels of acceleration past breaking into worth discovery. We see these variations throughout cycles, and so they give us this vary. And what’s fascinating is that the accelerated cycle thesis means mid-July, and the extended-cycle thesis, so to talk, nonetheless leaves us with a standard halving cycle peaking in late September or October 2025.”

Supply: Rekt Capital/YouTube

Bitcoin is buying and selling for $102,439 at time of writing, down 2.7% within the final 24 hours.

?

Generated Picture: Midjourney