4 years in the past, because the world grappled with the financial fallout from the COVID-19 pandemic, the U.S. authorities issued $1,200 stimulus checks to eligible People underneath the CARES Act.

Whereas many recipients used these funds to cowl instant wants, others noticed a possibility for long-term funding—notably in Bitcoin (BTC), which was buying and selling at a fraction of its present worth.

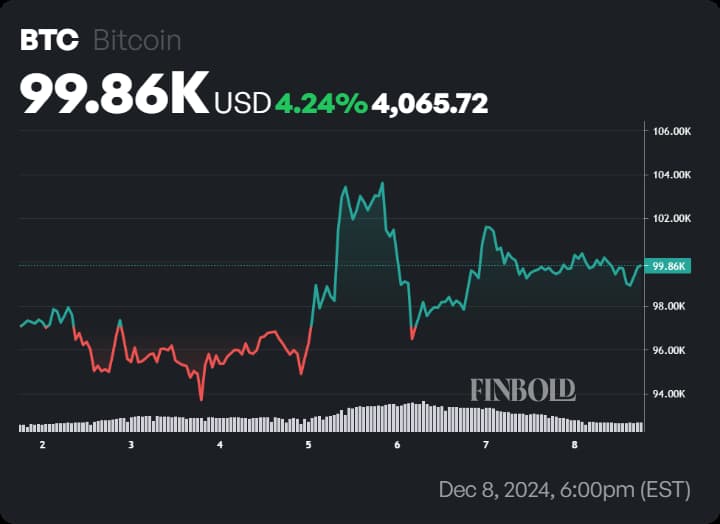

Quick ahead to 2024, Bitcoin has achieved a historic milestone, crossing the $100,000 mark amid strong curiosity from each institutional and retail traders.

At press time, Bitcoin is buying and selling at $99,866, reflecting a 7% weekly achieve. On the month-to-month chart, the cryptocurrency has surged 31%.

From reduction to returns: How a lot would $1,200 invested in BTC be price now?

If you happen to had invested everything of your $1,200 stimulus test in Bitcoin on April 15, 2020, when BTC was priced round $6,966, you’ll have acquired roughly 0.1723 BTC.

Quick ahead to at this time, with Bitcoin hovering close to $99,773, that preliminary funding would now be price a staggering $17,187—a return of practically 1,387%.

The primary stimulus checks have been a part of a sequence of Financial Impression Funds geared toward assuaging monetary stress in the course of the pandemic. Subsequent rounds, such because the $600 test in December 2020, offered related alternatives.

Investing this second spherical in Bitcoin, when the cryptocurrency was buying and selling at roughly $33,098, would have resulted in a portfolio price $2,144 at this time—a powerful 257% improve.

In the meantime, American households are grappling with record-high debt, which surged to $17.9 trillion in Q3 2024, pushed by mounting pupil loans, bank card balances, and auto loans, as reported by Finbold.

Though revenue progress has barely outpaced debt accumulation—lowering the debt-to-income ratio from 86% in 2019 to 82% in 2024—monetary stress stays a big concern for a lot of households.

The narrative, nevertheless, may need performed out in a different way if most residents had poured their stimulus funds into Bitcoin in the course of the pandemic.

The main cryptocurrency’s exponential progress might have supplied households with a considerable monetary cushion. These returns spotlight the asset’s potential to function a hedge in opposition to inflation and financial uncertainty.

Bitcoin’s market evolution

Bitcoin’s meteoric rise over the previous 4 years has been fueled by rising adoption, institutional curiosity, and market developments such because the approval of spot exchange-traded funds (ETFs) in the US.

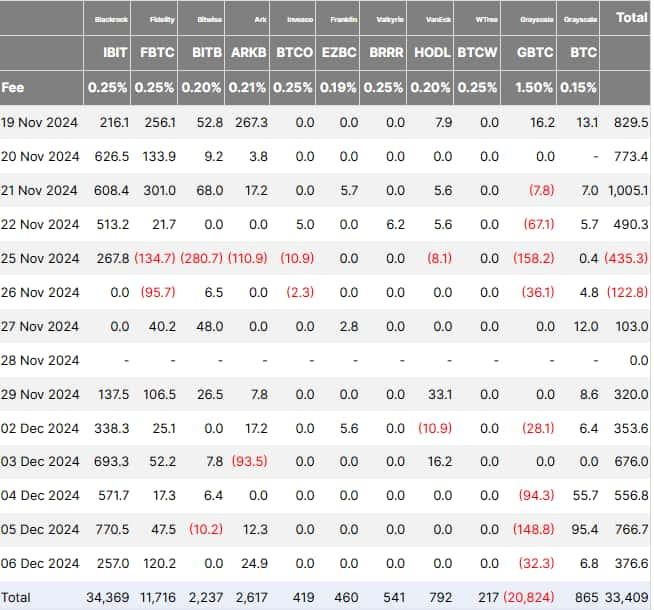

Latest information highlights this momentum, with ETF inflows surpassing $2.7 billion in a single week, pushing Bitcoin costs to an all-time excessive of $103,630.

Main gamers like BlackRock (NYSE: BLK) and Constancy have contributed to this surge, with BlackRock’s iShares Bitcoin Belief (IBIT) registering cumulative inflows of $34.4 billion since its January 2024 launch.

This inflow of institutional capital has elevated U.S. BTC-spot ETFs to the place of the most important Bitcoin holders, surpassing even Satoshi Nakamoto’s estimated stash.

Regulatory winds and the highway forward

Political developments additionally favor Bitcoin’s trajectory. President-elect Donald Trump’s appointment of Paul Atkins, a pro-crypto advocate, as SEC Chair has additional bolstered market optimism.

The U.S. authorities’s shifting stance on Bitcoin, together with plans to designate it as a strategic reserve asset underneath President-elect Donald Trump, provides one other layer of intrigue. Such strikes, coupled with bullish ETF inflows, might drive Bitcoin costs towards $120,000.

Nevertheless, market dangers stay, with potential oversupply considerations stemming from U.S. authorities transfers and Mt. Gox’s creditor reimbursements.

For individuals who selected to take a position their stimulus checks in Bitcoin, the returns have been extraordinary, far outpacing conventional asset courses.

As Bitcoin continues to achieve institutional traction and regulatory readability, its position as a transformative monetary asset seems more and more solidified.

Whether or not Bitcoin’s journey will lead it to $120,000—or face downward stress from market oversupply—stays a key query for traders navigating this evolving panorama.

Featured picture by way of Shutterstock