A crypto analyst recognized for precisely calling Bitcoin’s pre-halving correction final 12 months believes that BTC must reclaim a key technical indicator as assist to regain bullish momentum.

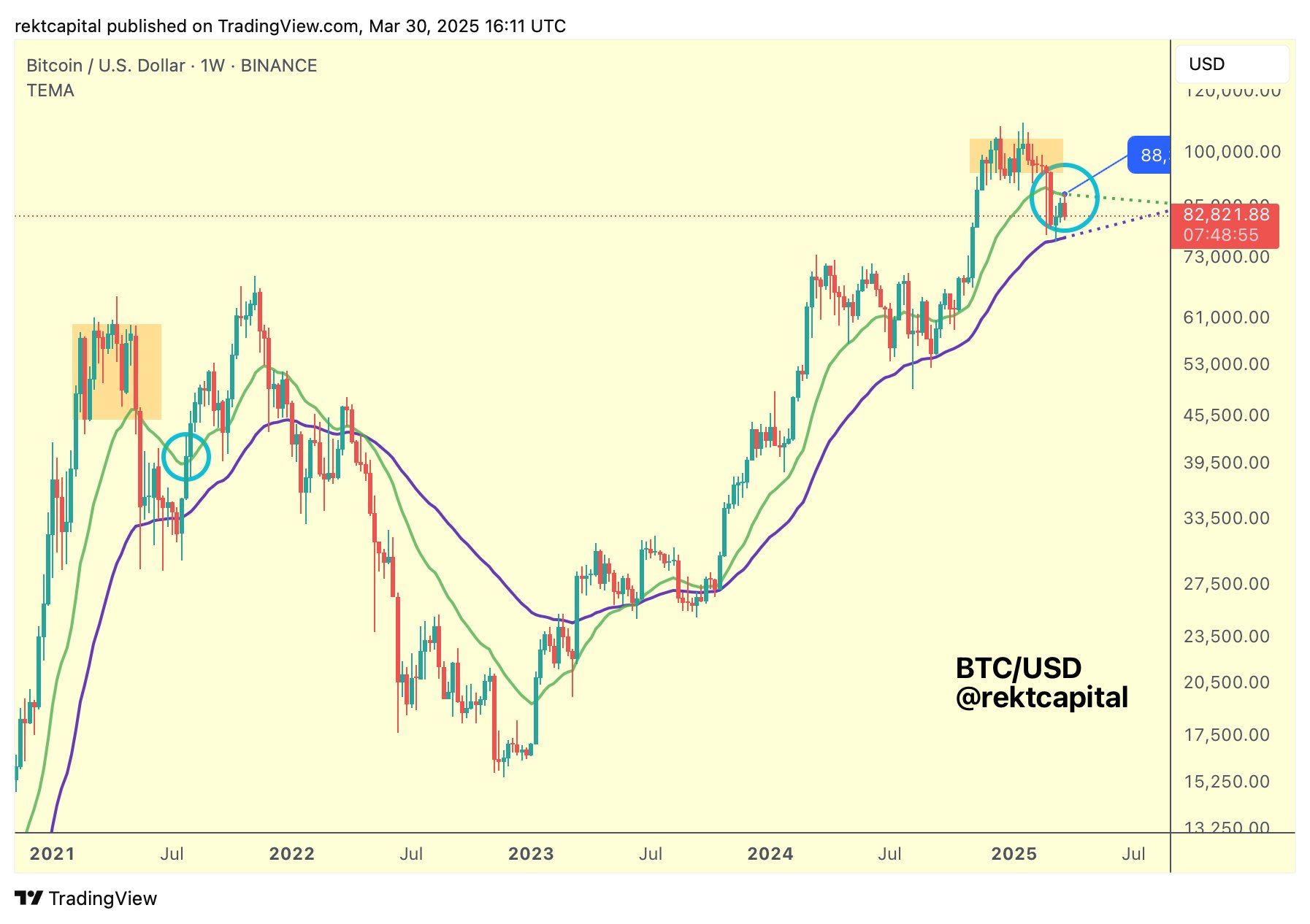

Pseudonymous crypto strategist Rekt Capital tells his 542,600 followers on the social media platform X that BTC seems to be mirroring its value motion in 2021 when Bitcoin consolidated between two key exponential transferring averages (EMAs) on the weekly chart.

In line with Rekt, Bitcoin should convert the 21-week EMA into assist to set off the resumption of bullish value motion.

“Earlier this week, Bitcoin rejected from the 21-week EMA resistance (inexperienced).

Consequently, Bitcoin continues to consolidate between these two Bull Market EMAs, very similar to it did in mid-2021.

Nonetheless, for the longer term, the important thing affirmation sign for a breakout shall be a weekly shut above the inexperienced EMA adopted by a post-breakout retest of it into new assist (gentle blue circle).”

Supply: Rekt Capital/X

At time of writing, Bitcoin is buying and selling for $82,536.

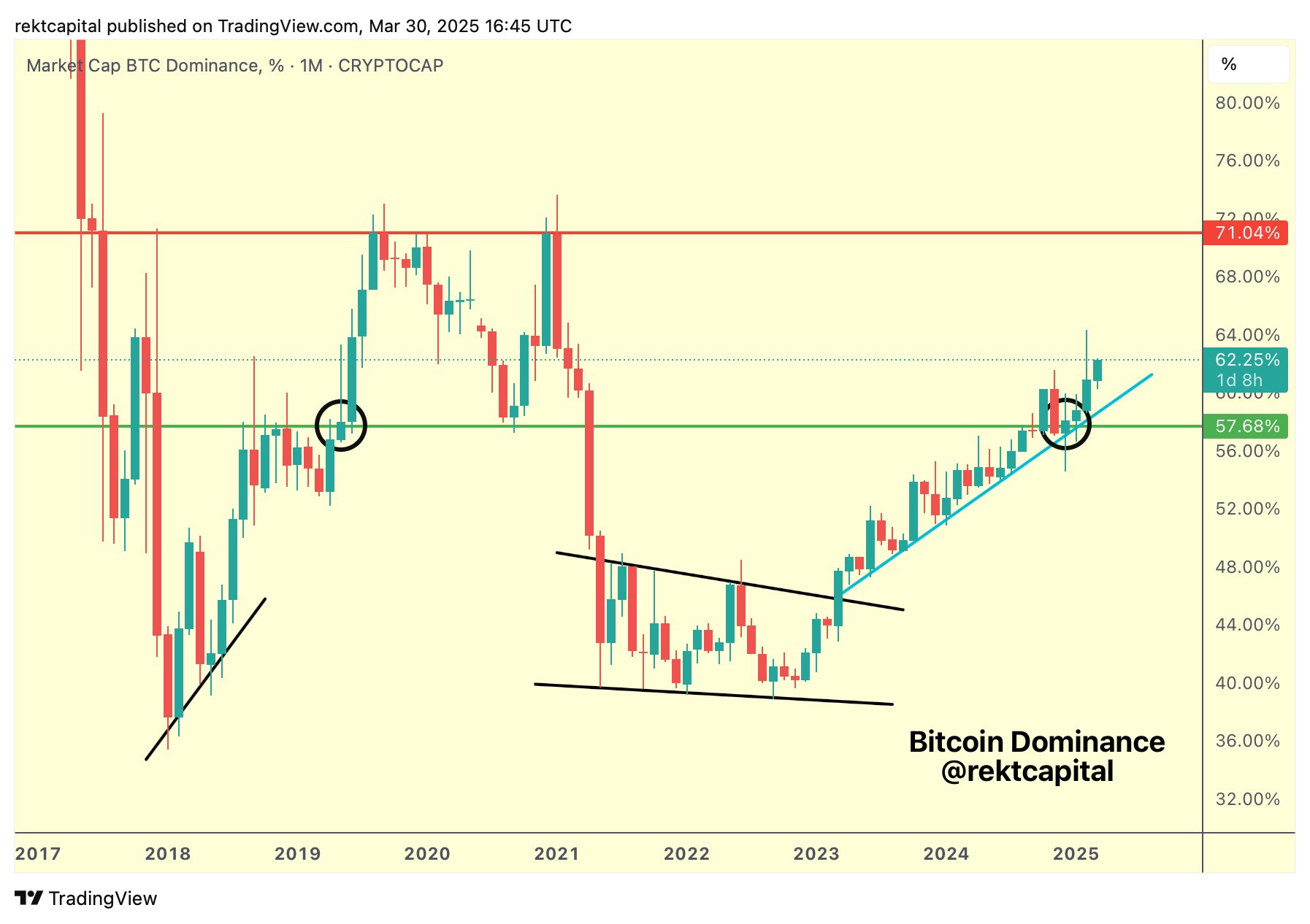

Wanting on the altcoin market, the dealer says he expects alts to proceed underperforming Bitcoin primarily based on the BTC dominance (BTC.D) chart, which tracks how a lot of the whole crypto market cap belongs to the flagship digital asset.

In line with Rekt, BTC.D may hit a vital resistance stage that has remained intact since 2017 earlier than dropping steam. As soon as that occurs, Rekt predicts that an actual altcoin season will come to fruition.

“BTC Dominance.

If historical past repeats, the actual Altseason everyone is ready for would start as soon as Bitcoin Dominance rejects from 71% (purple).”

Supply: Rekt Capital/X

A bearish BTC.D chart means that altcoins are rising in worth sooner than Bitcoin. At time of writing, BTC.D is hovering at 62.26%.

Generated Picture: Midjourney