Ethereum’s worth is lastly displaying indicators of bullish continuation after reclaiming a key stage.

Nonetheless, there’s nonetheless work to do for the market to pave its method towards a brand new all-time excessive.

Technical Evaluation

By Edris Derakhshi (TradingRage)

The Each day Chart

On the every day chart, the value has rebounded from the $3,200 assist stage and broke $3,500 to the upside. If the asset is ready to maintain above this space, a rally towards the $4,000 stage may very well be anticipated within the brief time period.

With the RSI additionally displaying values above 50%, the momentum is bullish as soon as once more, which provides to the chance of this situation occurring.

The 4-Hour Chart

The 4-hour chart reveals a extra clear image of current worth motion. Nonetheless, it additionally demonstrates a probably worrying sign. Whereas the market has damaged by way of the $3,500 stage with power, the bearish divergence between the current worth highs and the RSI indicator is a sign that ought to be considered.

This bearish divergence might result in a minimum of a pullback and retest of the $3,500 stage earlier than any continuation increased within the coming days.

On-Chain Evaluation

By Edris Derakhshi (TradingRage)

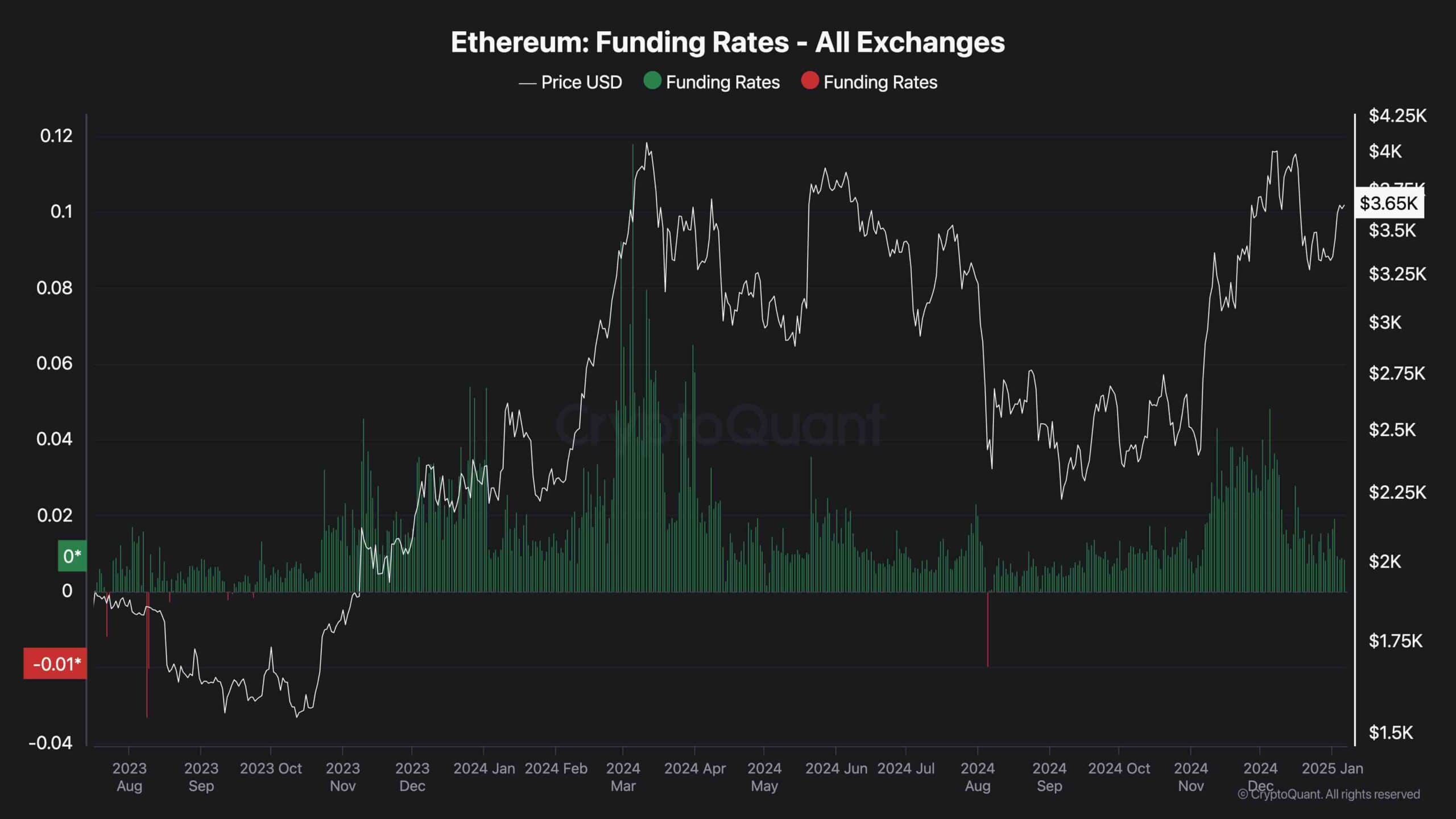

Ethereum Funding Charges

Whereas Ethereum’s worth has been holding above the $3,000 mark over the previous few months, many traders had been closely optimistic that the market will create a brand new all-time excessive quickly. Nonetheless, this important optimism has additionally led to a correction that halted the asset’s uptrend.

This chart presents the Ethereum funding charges metric, which measures whether or not the consumers or the sellers within the futures market are executing their orders extra aggressively. Because the chart presents, the funding charges confirmed extraordinarily excessive values when the value first approached the $4,000 stage. Nonetheless, the lengthy liquidation cascades occurring afterward have led to a correction and consolidation.

In the meantime, funding charges have decreased over the previous couple of weeks, indicating that the futures market sentiment has cooled considerably. This might end in a sustainable rally within the coming weeks if adequate demand is current within the spot market.