TL;DR

- ETH’s current consolidation could be adopted by a significant worth swing in both route.

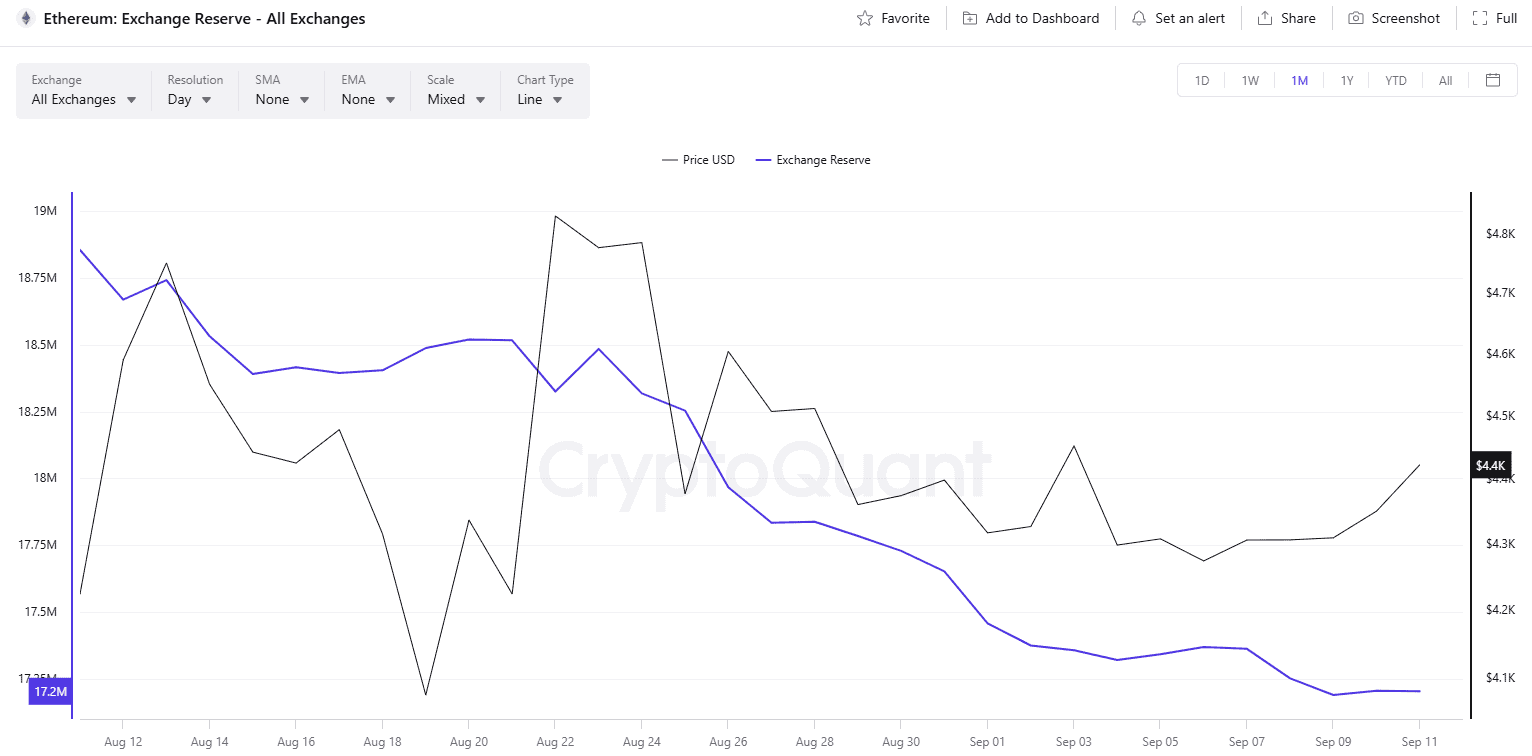

- Some X analysts evaluate ETH’s cycle to BTC’s 2020–2021 rally, projecting targets between $8,000 and $10,000 within the coming months. In the meantime, trade reserves hit a nine-year low of roughly 17.1 million tokens, signaling lowered promote strain.

The Calm Earlier than the Storm?

Whereas Ethereum (ETH) has been buying and selling in a good vary between $4,300 and $4,500 prior to now week, the technical evaluation instrument Bollinger Bands suggests {that a} main worth transfer may very well be simply across the nook.

The metric, developed by John Bollinger within the Eighties, helps merchants spot oversold or overbought situations. When the bands squeeze, it often signifies a interval of low volatility, which may very well be a precursor of a major resurgence or a substantial correction.

Earlier this week, the favored X consumer Ali Martinez revealed that the bands have tightened, warning the crypto group to “anticipate an enormous transfer.”

Count on an enormous transfer for Ethereum $ETH quickly because the Bollinger Bands squeeze! pic.twitter.com/5KgYzuF3Vb

— Ali (@ali_charts) September 10, 2025

The vast majority of customers commenting on the publish predicted that the potential swing might be to the upside. Nonetheless, a handful stay bearish, alerting of a potential drop to $3,500.

Current Worth Predictions

In response to X consumer Ted, ETH is “precisely mirroring” the bull cycle of BTC in 2020-2021. That stated, he expects the value of the second-largest cryptocurrency to blow up to $8,000-$10,000 within the subsequent three to 4 months. Nevertheless, he sees potential for a short-term correction that can “liquidate high-leveraged longs earlier than reversal and a brand new ATH.”

Crypto Basic and Max Crypto outlined related forecasts. The previous believes ETH may attain $8,000 earlier than the top of 2025.

“I’m all in on this commerce. Thousands and thousands (of) earnings or homeless,” they added.

The lowering quantity of ETH saved on crypto exchanges helps the bullish thesis. CryptoQuant’s knowledge exhibits that not too long ago the determine dropped to a recent nine-year low of round 17.1 million tokens. This means buyers proceed to maneuver holdings from centralized platforms towards self-custody strategies, thus decreasing the instant promoting strain.