Bitcoin merchants are watching the Federal Reserve carefully at the moment following a sample of sturdy worth strikes after previous FOMC conferences.

Particularly, distinguished market analyst Merlijn The Dealer posted on X that “Bitcoin loves FOMC,” noting that 5 out of the final 7 conferences resulted in upside actions. Information from an accompanying chart confirms this disclosure, with Bitcoin rallying no less than 10% instantly after the previous three conferences.

For context, Bitcoin surged by as a lot as 40% following the November 2024 assembly after a 16% rally in October 2024. In the meantime, in 2025, previous FOMC conferences in April, June, and July had led to 18%, 10%, and 14% surge in Bitcoin, respectively.

Given this historic sample of predominantly optimistic worth motion, Merlijn anticipates the potential for an additional upward shift if related circumstances unfold. Notably, Bitcoin is buying and selling at $117,558, a 1.2% drop prior to now day, decreasing its month-to-month achieve to 9.2%.

No Fee Change Anticipated, Deal with Powell’s Feedback

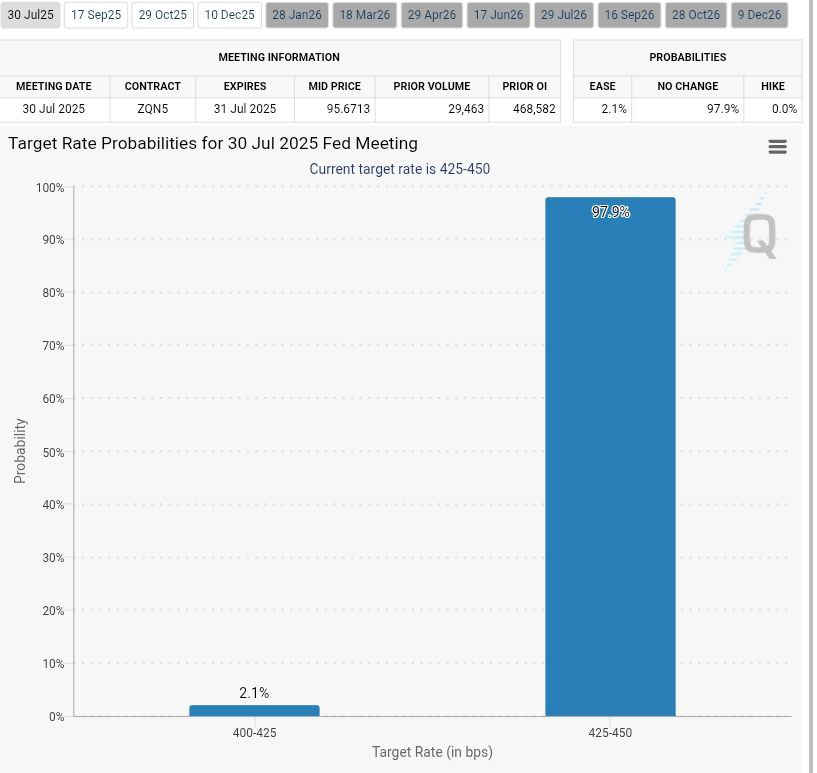

At the moment’s FOMC resolution is scheduled for two p.m. ET. In accordance with market information, there’s a 97.9% chance the Fed will maintain charges regular. This displays the present financial outlook and up to date inflation readings.

Nonetheless, the market doesn’t deal with the speed resolution as the primary occasion. As a substitute, merchants are centered on what Powell will say throughout the press convention following the announcement.

Monetary analyst Cas Abbé highlighted the potential for sharp market strikes surrounding at the moment’s occasions, pointing to the significance of Jerome Powell’s press convention as the important thing second that might drive volatility.

He famous that latest conferences between Powell and political leaders, together with Donald Trump, have raised hypothesis that Powell could strike a extra dovish tone.

Dovish Indicators May Set off a Rally

In financial coverage, a dovish stance signifies the potential for fee cuts or looser monetary circumstances. If Powell alerts such a shift, merchants consider it might improve threat property, particularly Bitcoin.

Bitcoin usually reacts strongly to Fed steerage, reflecting broader sentiment round liquidity and risk-taking. If Powell hints at easing within the months forward, merchants could take that as a inexperienced mild to rotate capital into crypto and tech-related property.

Notably, Merlijn additionally pointed to a powerful hyperlink between rising international liquidity and Bitcoin’s latest worth positive factors, highlighting that Bitcoin has carefully tracked will increase in World M2.

BITCOIN LIQUIDITY IS STACKING BOTH SIDES| ETH COILING| ALTCOINS BLEEDING – BUT THE FOMC IS THE HEAT!

Watch right here:👇https://t.co/65imkQetAN pic.twitter.com/tIH5PBWJBA

— Merlijn The Dealer (@MerlijnTrader) July 30, 2025

He emphasised that liquidity is constructing forward of at the moment’s FOMC assembly, positioning the occasion as a key catalyst. With Ethereum consolidating and altcoins weakening, he means that the result of the Fed’s resolution might drive the subsequent main transfer within the crypto market.

Bitcoin’s Worth Evaluation

In the meantime, Bitcoin is consolidating tightly inside a symmetrical triangle sample forward of at the moment’s FOMC assembly. Worth has been range-bound between $117,000 and $118,700 over the previous 72 hours, with volatility anticipated to extend because the sample approaches its apex.

Regardless of short-term weak spot indicated by technical alerts just like the Parabolic SAR and VWAP rejection close to $118,099, Bitcoin defends its ascending trendline.