Excessive-risk crypto dealer James Wynn, who made headlines for his aggressive leveraged buying and selling methods and accompanying losses, has turned a revenue, incomes over half one million {dollars} at this time. This marked his largest revenue since Could 25.

This marks a dramatic turnaround for Wynn, whose luck had run dry after watching all his earlier good points worn out by extremely leveraged positions on Hyperliquid.

James Wynn’s Buying and selling Rollercoaster Ends in Inexperienced—for Now

In June, BeInCrypto reported on Wynn’s substantial $100 million loss on Hyperliquid. Regardless of the blow, he continued making high-stakes bets.

This month, the blockchain analytics platform Lookonchain highlighted that Wynn transferred 27,522 USDC to Hyperliquid and picked up a referral bonus of $3,960.84 on July 10. He then opened a high-risk 40x leveraged brief place on Bitcoin.

Nonetheless, as soon as once more, betting towards the market didn’t show favorable for Wynn. In lower than 12 hours, Wynn’s high-stakes brief was totally liquidated, leading to a contemporary lack of $27,921.63. At some point later, Wynn deactivated his X (previously Twitter) account.

“James Wynn has deactivated his X account! What occurred? Did he blow up utterly? All his wallets and Hyperliquid stability mixed are down to simply $10,176,” Lookonchain posted.

Nonetheless, the silence didn’t final lengthy. On July 15, Wynn reemerged, claiming a referral reward of 6,792.53 USDC. This time, he went lengthy on PEPE with 10x leverage.

Lookonchain then noticed that the dealer added round 468,000 USDC into Hyperliquid. He took one other daring step, opening a 40x leveraged lengthy place on Bitcoin. Regardless of dealing with partial liquidation, Wynn managed to revenue by shifting methods.

“He flipped from lengthy to brief on BTC and HYPE — pulling in $473.9K in earnings,” the agency added.

Hyperdash information additional revealed that he made $105,948 and $345,456, respectively, on July 18 and 19, from his brief Bitcoin positions. Moreover, yesterday, Wynn deposited a further 536,573 USDC into Hyperliquid. He then opened two new leveraged positions: a 25x lengthy on Ethereum and a 10x lengthy on PEPE.

As we speak, he closed each trades, incomes $33,386 from ETH and a staggering $521,313.86 from PEPE. The latter marks his most worthwhile single commerce since his $18 million win on Could 25.

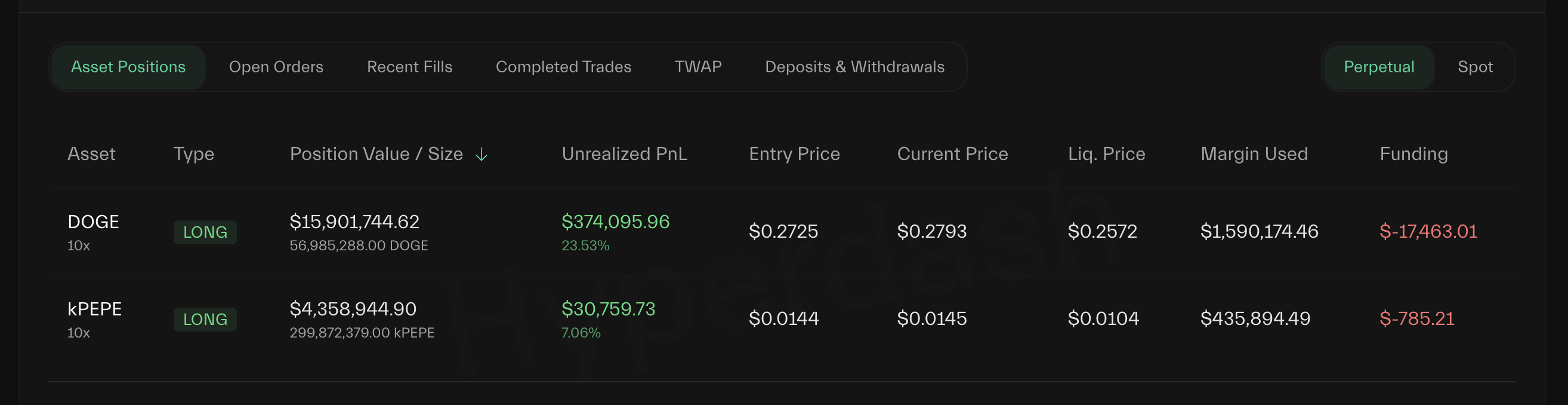

Wynn nonetheless has two open leveraged positions. This features a 10× lengthy on DOGE, which is sitting on an unrealized acquire of $374,095. One other 10× lengthy on PEPE at the moment reveals an unrealized acquire of $30,759.

James Wynn Hyperliquid Open Positions. Supply: Hyperdash

Since returning to the market on July 15, the dealer has had a combined efficiency, with seven worthwhile trades and eight internet losses recorded. On the time of writing, his win charge stood at 36.6%.

Whereas none of those good points are sufficient to reverse his losses, they nonetheless provide a glimmer of hope for the dealer.

In the meantime, Lookonchain additionally highlighted one other dealer, not for heavy losses, however for a collection of well-timed strategic bets that earned him almost $30 million in simply seven days.

“Meet ‘The White Whale,’ a prime dealer on Hyperliquid with almost $30 million revenue in only one week! Over the previous week alone, he used 4 wallets to lengthy ETH and SOL—locking in almost 30 million in good points and claiming the #1 spot on the leaderboard,” Lookonchain wrote.

Thus, the contrasting performances of James Wynn and the “White Whale” spotlight the high-risk, high-reward nature of leveraged buying and selling, the place fortunes could be made or misplaced in a matter of hours.