Ondo Finance urged the US Securities and Alternate Fee (SEC) to delay or reject Nasdaq’s proposal to commerce tokenized securities, saying it lacks transparency and will give established market gamers an unfair edge.

In a Wednesday letter to the regulator, Ondo — a blockchain firm that points tokenized variations of conventional property — mentioned regulators and traders can’t pretty consider Nasdaq’s proposal with out public particulars on how the Depository Belief Firm (DTC) will deal with blockchain settlements. DTC serves as the principle depository for US securities and facilitates their post-trade settlement.

Whereas acknowledging help of Nasdaq’s transfer towards tokenization, Ondo warned that “Nasdaq’s reference to private info implies differential entry that deprives different companies of a good alternative to remark.”

The corporate additionally famous that Nasdaq’s rule can’t take impact till DTC finalizes its system, saying there’s no hurt in delaying approval till extra options are launched. It known as on the SEC to prioritize “open collaboration and clear requirements” earlier than making a last resolution.

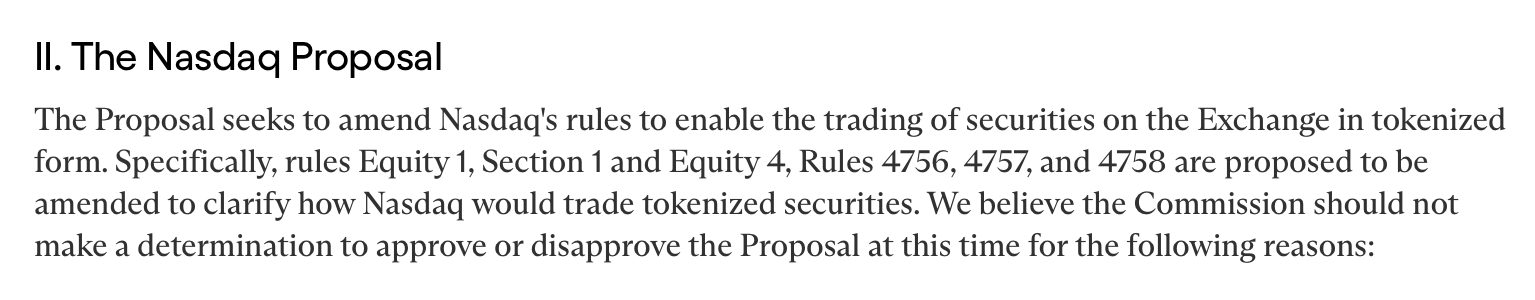

Excerpt of Ondo’s letter to the SEC. Supply: Ondo Finance

Ondo’s letter responds to Nasdaq’s Sept. 8 submitting with the SEC, by which the world’s second-largest inventory alternate sought to amend its guidelines to permit buying and selling in tokenized securities.

Tokenized shares are digital variations of conventional shares recorded on a blockchain.

If authorised, the proposal would let tokenized shares commerce alongside conventional ones, with settlements processed by the DTC’s forthcoming system for tokenized securities.

Nasdaq’s proposal was printed within the Federal Register on Sept. 22, beginning the SEC’s 45-day evaluation interval, which runs till early November or late December if prolonged.

Associated: $250M Ondo Catalyst fund alerts ‘arms race’ for RWA tokenization

The push for tokenized shares

The continuing debate concerning the tokenization of Nasdaq shares is going on whereas a number of platforms have already listed or are planning to checklist tokenized variations of US equities.

On June 30, Robinhood launched a layer-2 blockchain to help buying and selling tokenized US shares and ETFs for European customers. The platform mentioned it will checklist over 200 US equities and funds as onchain tokens.

Buying and selling platform eToro additionally introduced plans to launch tokenized shares as ERC-20 tokens on Ethereum. The corporate mentioned the rollout will embody 100 fashionable US-listed shares and ETFs, out there to commerce 24/5.

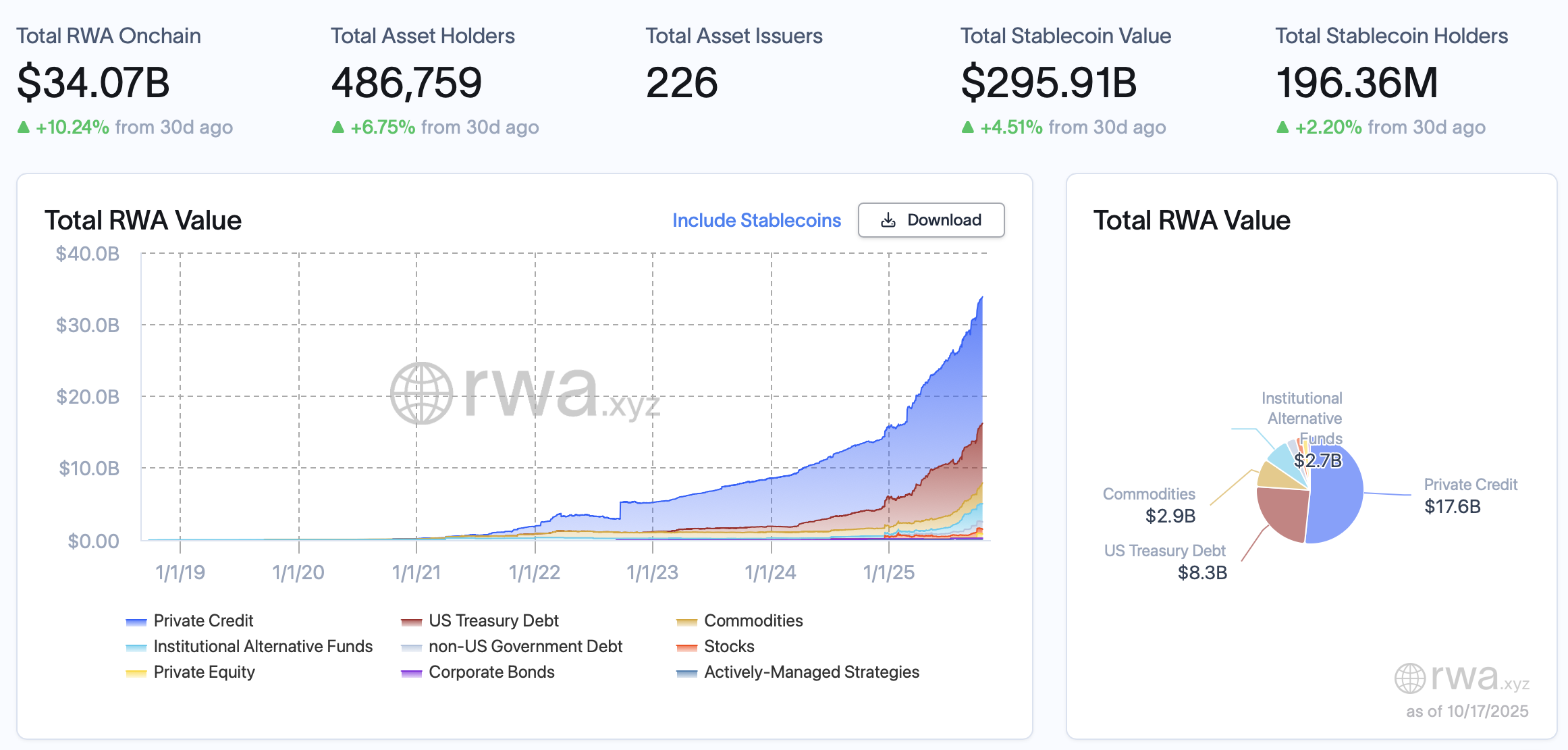

Whole onchain RWA worth. Supply: RWA.xyz

Kraken can also be following the development. The crypto alternate launched a tokenized securities platform in September, making tokenized shares out there to eligible clients in Europe.

Galaxy Digital warned that the continuing tokenization push may threaten the New York Inventory Alternate’s dominance, saying in July that it challenges the liquidity of conventional markets.

Journal: Robinhood’s tokenized shares have stirred up a authorized hornet’s nest