Stablecoin firms working in Hong Kong posted double-digit losses on Friday amid native regulatory shifts and a broader market correction.

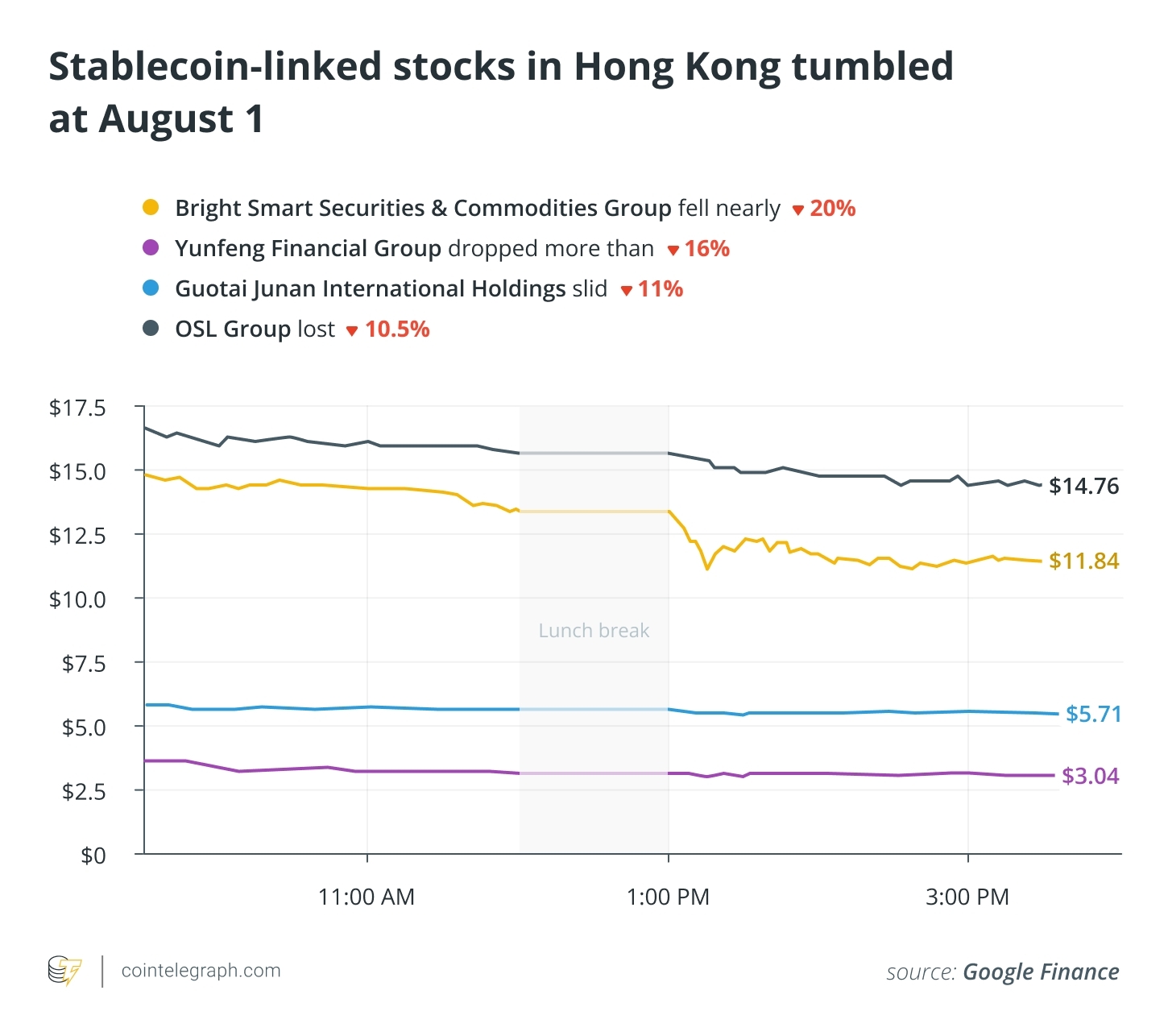

Vivid Sensible Securities & Commodities Group fell practically 20% on Friday, in line with Google Finance information. Yunfeng Monetary Group dropped greater than 16% through the buying and selling session, whereas Guotai Junan Worldwide Holdings slid 11% and OSL Group declined 10.5%.

These firms are known as “Hong Kong stablecoin-concept firms,” with share costs pushed by publicity to stablecoin issuance, custody, buying and selling, or associated infrastructure. Nonetheless, some native specialists view the correction as a constructive market adjustment.

It’s “a wholesome correction,” stated Allen Huang, a senior stablecoin coverage researcher on the Hong Kong College of Science and Know-how. “There are indicators that the stablecoin frenzy has spilled over to different monetary markets together with the fairness market,” Huang instructed Cointelegraph.

The correction comes amid a broader downturn in Hong Kong’s monetary markets. The Hold Seng Index closed down greater than 1% on Friday, whereas the Hold Seng SmallCap Index fell 1.54% through the session. The Hold Seng Tech Index misplaced 1.02%.

Associated: Pyth Community brings Hong Kong inventory costs onchain for world entry

A wholesome market correction

The autumn in shares follows Hong Kong’s entry right into a six-month transition interval with particular guidelines because it transitions to its new stablecoin framework. The brand new rules additionally come amid plans to criminalize unlicensed stablecoin promotion within the area.

Huang is much from the one knowledgeable who believes that this sell-off was only a sane market dynamic.

“The sell-off in ‘stablecoin idea’ shares is a rational market correction following months of speculative over-enthusiasm,” stated Xu Han, director of Liquid Fund at Hong Kong-licensed trade HashKey Group.

He defined that regulatory rigor, together with requiring a one-to-one full reserve, one-day redemptions and a minimal capital of 25 million Hong Kong {dollars} ($3.18 million), “is a deliberate technique to prioritize systemic stability and credibility.” He concluded:

“The correction filters out short-term hypothesis, permitting essentially robust gamers to anchor Hong Kong’s status as a globally trusted digital asset hub.“

“At this time’s sell-off in ‘stablecoin idea’ shares is probably going a wholesome correction after speculative positive factors,” stated Niko Demchuk, head of compliance at crypto forensics agency with Hong Kong operations, AMLBot. In response to Demchuk, excessive licensing necessities and challenges confronted by smaller corporations additionally weighed on a “market recalibration.”

Shukyee Ma, Hong Kong-based chief technique officer at real-world asset tokenization firm Plume, seemingly agreed with the opposite specialists. He concluded that “this drop represents a wholesome market correction pushed by revenue taking and regulatory readability.”

Associated: China’s JD.com registers ‘Jcoin’ forward of Hong Kong stablecoin regime

Many anticipated to go away the race

Huang stated that, with the brand new guidelines in place, “some establishments contemplating giving stablecoin a attempt could resolve to not proceed with the method.” He stated the early batch of license holders will profit from first-mover benefits, citing community results and economies of scale. He added:

“For those not anticipated to be included within the first batch, they’ll face an uphill battle, altering their cost-benefit evaluation. Additionally it is a approach to enhance the probability that the license holders can have business success.”

Ma stated that the regulatory transition interval will see smaller firms or these wanting into stablecoins for hypothesis pause their efforts or swap jurisdictions. Nonetheless, he expects well-funded gamers to observe the rules and bear the compliance prices.

Demchuk equally expects the six-month regulatory transition interval to “drive capital consolidation amongst would-be stablecoin issuers,” resulting in only some licenses being issued. He additionally expects banks, appearing as custodians, to prioritize partnerships with the license frontrunners, additional reshaping the market in the direction of bigger issuers.

Hong Kong and US stablecoin competitors

Huang stated that “within the brief run, it’s unlikely that the amount of Hong Kong dollar-backed stablecoins might be comparable with dollar-backed stablecoins.” Nonetheless, Ma factors out that China has the second largest market share when it comes to exports, including:

“The strict guidelines do profit HKD-stablecoin issuers because it units them up as the primary suppliers of a viable settlement stablecoin for worldwide buying and selling.“

Demchuk added that Hong Kong stablecoins “could achieve a strategic edge in cross-border funds and DeFi by leveraging” its monetary hub standing and strict regulation. Nonetheless, he stated that “vital quantity development in DeFi or funds is unlikely earlier than 2027, as market adoption and infrastructure develop.”

Journal: Hong Kong hoses down stablecoin frenzy, Pokémon on Solana: Asia Categorical