Ethereum’s worth isn’t nearly blockchain upgrades or on-chain exercise. It’s additionally tethered to the identical macroeconomic winds that sway equities and bonds. With the U.S. authorities shutdown now delaying vital financial information, the Federal Reserve faces a blind spot forward of its October coverage assembly. That uncertainty feeds straight into how threat belongings, together with ETH, are priced. The chart exhibits Ethereum worth in restoration mode, however the shutdown throws in a brand new layer of volatility.

Why the Shutdown Issues for ETH Value?

The shutdown halts the Bureau of Labor Statistics, which means no official jobs report or inflation information. For the Fed, that is like steering with out devices. Usually, such information drives rate of interest selections, and charges in flip form liquidity throughout markets. If the Fed hesitates to chop with out dependable numbers, threat belongings like ETH worth may lose momentum. On the flip aspect, if non-public information (like ADP payrolls) seems weak, the Fed might lean towards extra cuts, boosting liquidity and not directly supporting crypto.

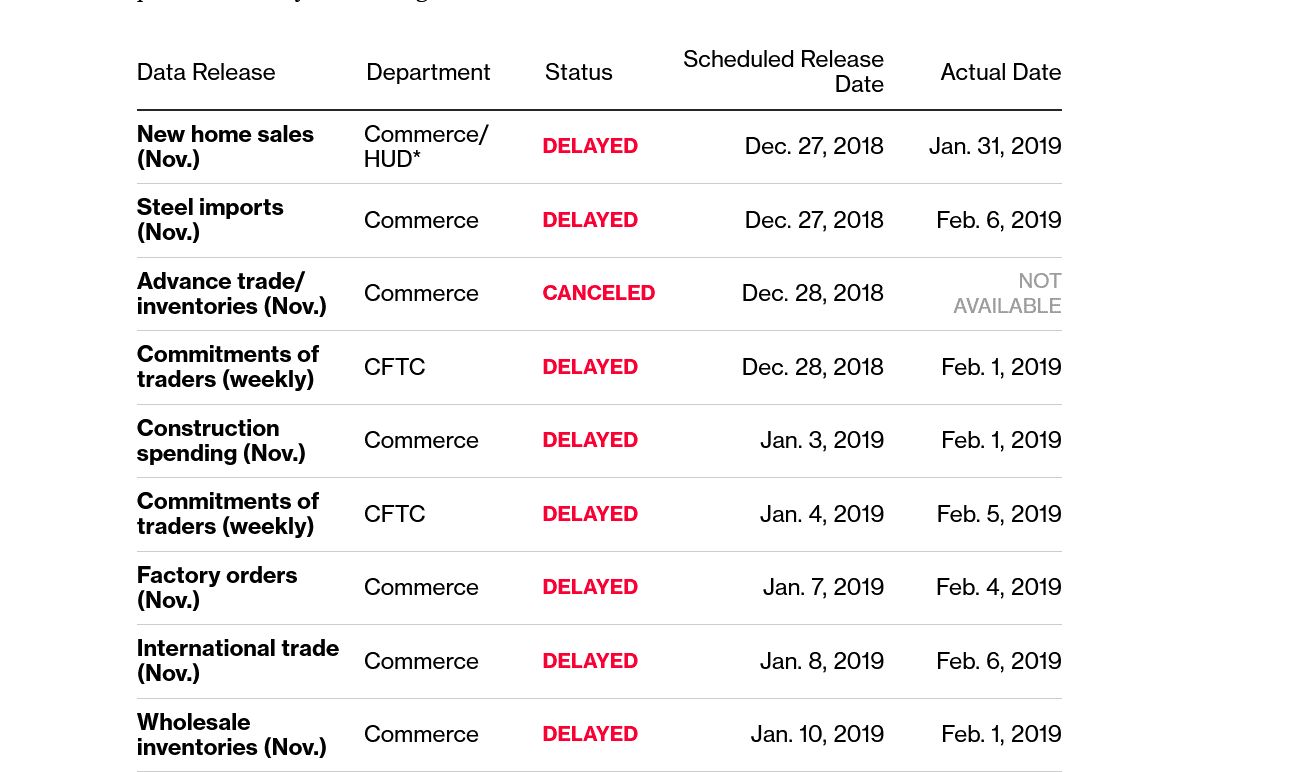

Picture Supply: Bloomberg

This isn’t simply principle. Through the 2018–2019 shutdown, delayed studies prompted the Fed to pause its charge hikes, underscoring how coverage may be swayed by lacking information. If the present shutdown drags, ETH worth may swing on shifting expectations of Fed coverage fairly than its personal fundamentals. Within the 17-day shutdown of October 2013, when the BLS final shut down, each the September and October studies have been pushed again.

Ethereum Value Prediction: Studying the ETH Day by day Chart

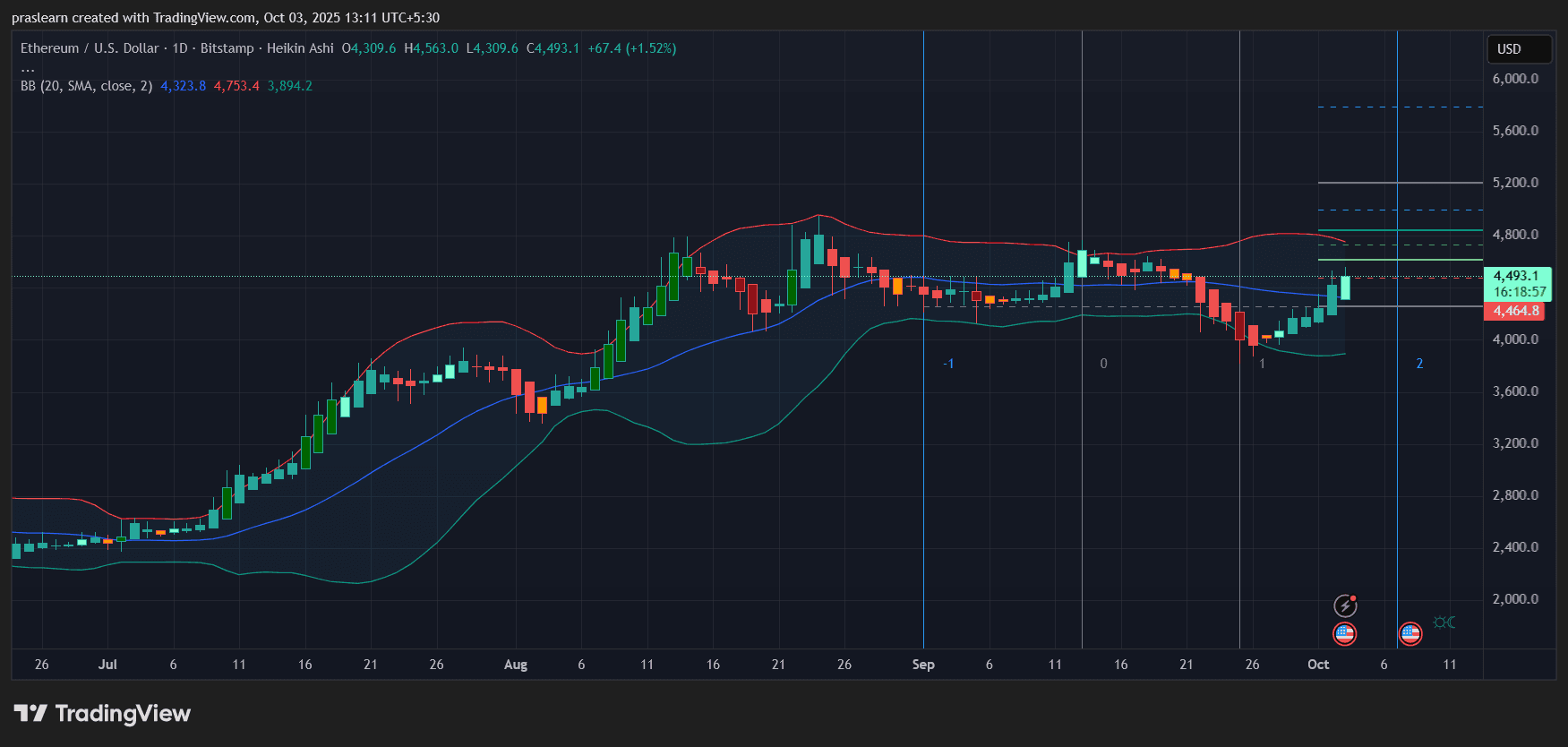

ETH/USD Day by day Chart- TradingView

The chart exhibits Ethereum worth bouncing strongly from the $4,300 zone, now buying and selling round $4,493. Key technical alerts:

- The decrease Bollinger Band close to $3,900 acted as help, with patrons stepping in aggressively.

- Value has reclaimed the center band and is pushing towards the higher band close to $4,750, which is the speedy resistance.

- A break above $4,750 may open the door to $5,200, with $5,600 in sight if momentum accelerates.

On the draw back, if U.S. authorities shutdown-driven uncertainty pressures markets, ETH worth may revisit $4,300 after which $3,900. The Heikin Ashi candles additionally present bullish reversal power, however quantity affirmation can be wanted for a sustained breakout.

Shutdown Influence Eventualities for Ethereum Value Prediction

-

Brief Shutdown, Weak Personal Information

If ADP and different non-public indicators present job weak spot and the Fed feels compelled to chop charges, ETH may break via resistance, benefiting from elevated threat urge for food. -

Extended Shutdown, Fed Stalls

With no dependable authorities information, the Fed may delay cuts, leaving markets in limbo. That indecision may cap ETH’s rally and hold it caught in consolidation under $4,750. -

Market Overreaction to Uncertainty

If equities tumble on information blackouts and coverage confusion, ETH could possibly be pulled decrease with broader threat belongings, testing $4,300 help once more.

Investor Psychology and Macro Correlation

Crypto merchants usually declare Ethereum worth is decoupling from conventional markets, however historical past exhibits ETH worth nonetheless reacts to macro catalysts. Price cuts gasoline liquidity, risk-on habits, and stablecoin inflows into DeFi. Conversely, uncertainty starves ETH of speculative demand. Proper now, the shutdown acts as a psychological overhang. Even when Ethereum’s fundamentals stay sturdy, the shortage of readability from Washington may amplify volatility within the coming weeks.

Conclusion

$Ethereum is at a crossroads. The each day chart factors to bullish restoration, however the shutdown clouds the Fed’s decision-making course of, which is essential for ETH’s subsequent leg. If the shutdown is resolved shortly or non-public information pushes the Fed towards easing, $ETH may climb towards $5,200 and past. But when political gridlock drags and the Fed stalls, Ethereum dangers one other dip towards $4,300. For now, merchants ought to anticipate heightened volatility and watch each Bollinger Band ranges and Fed alerts intently.