November marks two years because the FTX change went bankrupt. Since then, main crypto exchanges have seen their Bitcoin reserves develop.

FTX’s incapacity to take care of ample reserves to fulfill consumer requests uncovered extreme flaws in its controls. It additionally highlighted the necessity for better transparency and dependable reserve reporting amongst all crypto exchanges.

Observers have grown keenly conscious of the dangers that exchanges face once they lack ample reserves. If they can not meet withdrawal requests, it undermines consumer confidence and places them prone to dropping funds. Sustaining enough reserves is vital for liquidity and order execution, particularly throughout risky intervals.

In gentle of this development, CryptoQuant shared with crypto.information a research on the state of change proof-of-reserves (PoR).

Desk of Contents

How has crypto modified post-FTX?

FTX‘s collapse in November 2022 was probably the most important and dramatic occasions within the crypto trade’s historical past. This incident undermined investor confidence and precipitated profound adjustments within the crypto market’s construction and functioning.

On the time, the worth of Bitcoin (BTC) and different main cryptocurrencies fell, reflecting concern and mistrust of institutional gamers available in the market. Many traders started to doubt the protection and stability of crypto and, in consequence, determined to go away the market fully.

Consideration towards safety points grew to become much more pressing. Many crypto exchanges and tasks have begun implementing new measures to guard customers’ funds, together with two-factor authentication, monitoring methods, and analyzing transactions for suspicious exercise.

New safety requirements have emerged, in addition to options to stop the lack of funds in case of hacks or fraudulent actions. Amongst others, the PoR commonplace has emerged — a mechanism cryptocurrency exchanges use to publicly show that they’ve sufficient belongings in reserve to cowl all consumer balances.

“PoR fosters belief and transparency, because it permits customers to verify that an change has not over-leveraged or mismanaged their belongings, which has change into notably essential following high-profile change collapses within the trade.”

CryptoQuant

You may additionally like: SEC criticized for doubtful stablecoin stance in FTX chapter

Main exchanges report Bitcoin outflow

Among the many main exchanges with essentially the most distinguished Bitcoin reserves, solely Coinbase doesn’t publish PoR reviews. Specialists be aware that the opposite main exchanges periodically present such reviews with various levels of transparency.

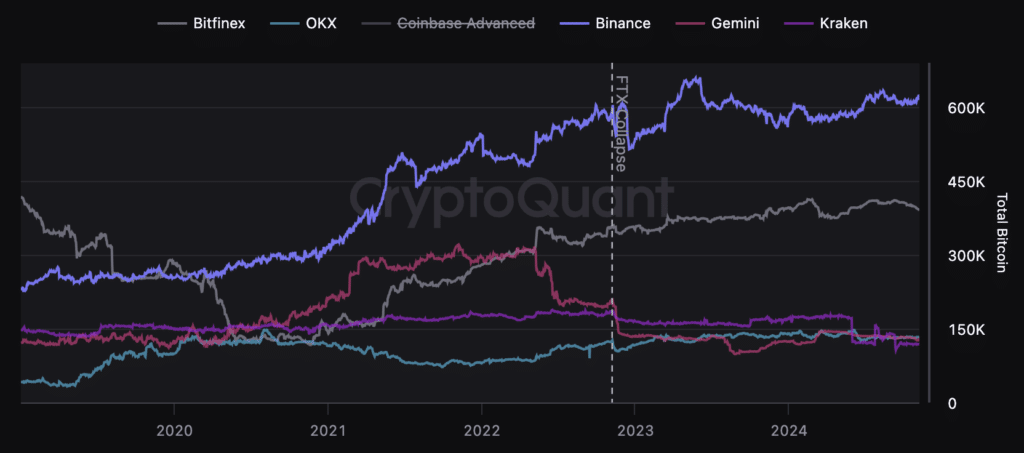

Binance’s reserve elevated by 28,000 BTC, or 5%, reaching 611,000, regardless of the strain from the U.S. authorities in 2023. Among the many main exchanges, Binance additionally reveals essentially the most minor reserve lower over your entire interval, not exceeding 16%.

Day by day change reserves. Supply: CryptoQuant

Three key exchanges maintain 75% of all Bitcoins held by exchanges. These are Coinbase Superior, with 830,000 BTC, Binance with 615,000, and Bitfinex, which has 395,000 Bitcoins.

Collectively, the reserves of those platforms attain 1.836 million BTC, which is 9.3% of the full quantity of Bitcoins in circulation. The remaining 17 exchanges maintain a complete of 684,000 BTC.

Reserves touchdown

At the moment, Binance, Bitfinex, and OKX present small decreases in reserves. On the similar time, Binance seems to be the one change that has not skilled important drawdowns in its historical past.

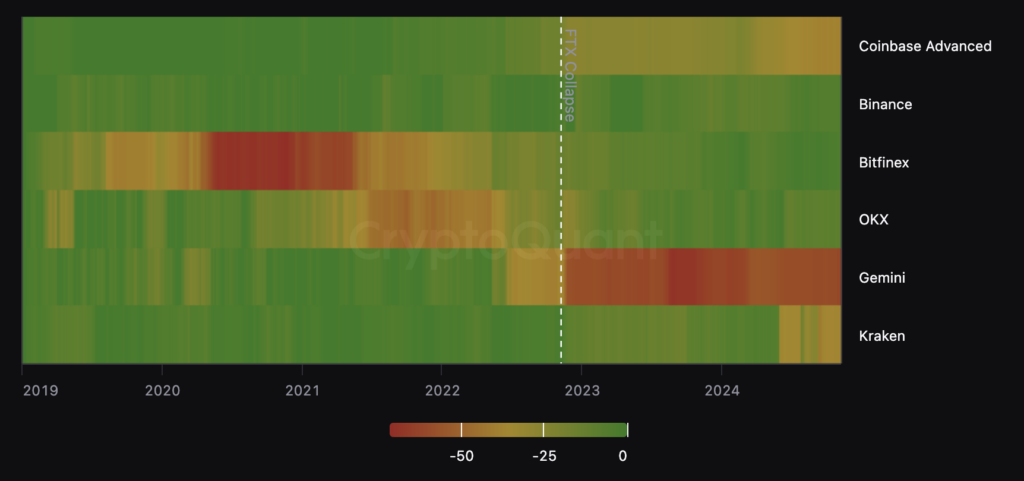

Analyzing change reserves based mostly on monitoring their adjustments permits us to evaluate their means to fulfill consumer calls for over time.

Vital declines could point out that customers are massively withdrawing their funds, indicating a lower in belief or monetary issues.

Essentially the most important decline in Binance’s reserves was 15%, which occurred in December 2022, shortly after the FTX crash. On the time, Binance confronted appreciable criticism and mistrust over its reserve report.

Nevertheless, Binance’s reserves have recovered and are presently down solely 7%. Different important exchanges have additionally seen slight declines, with Bitfinex down 5% and OKX down 11%.

Change reserves drawdown heatmap. Supply: CryptoQuant

Whereas trade leaders like Binance and Bitfinex have managed to shore up their reserves because the FTX crash, the state of affairs remains to be tense. The failure of some main gamers like Coinbase to publish PoR reviews means that the street to full transparency remains to be far off. However the present reserve dynamics point out a need to enhance and improve customers’ belief.

The knowledgeable, in a remark to crypto.information, emphasised that the chapter of FTX underscored the necessity for crypto exchanges to show that they’ve sufficient reserves.

“This occasion led to a shift the place customers want exchanges that present proof of their belongings on-chain. This pushed the trade to undertake PoR practices, serving to rebuild belief and guarantee exchanges can again up their customers’ funds.”

Nick Pitto, head of promoting at CryptoQuant

Learn extra: What awaits FTX after Sam Bankman-Fried’s 25-year sentence?