Nigeria just lately confronted one of the extreme financial crises. Inflation surged to document highs in the direction of the tip of 2024. Regardless of some degree of easing, residents nonetheless endure inflationary pressures.

In the meantime, the Nigerian authorities is accelerating efforts to manage cryptocurrency transactions. Prospects are that interventions might increase income for the nation.

Nigeria Faces Inflationary Pressures

Nigeria, Africa’s most populous nation and largest economic system, has lengthy struggled with financial instability. Sources point out its annual inflation charge soared to 24.48% in January 2025 earlier than dropping to 23.18% in February.

The 1.3% decline suggests the federal government’s financial tightening measures could also be beginning to take impact. Nevertheless, the nation’s naira foreign money has devalued considerably. It misplaced 230% of its worth in opposition to the US greenback over the previous yr.

“The drop within the inflation charge is principally as a result of rebase of the Shopper Worth Index (CPI), not an precise discount in worth ranges or inflationary stress,” highlighted one citizen.

It comes because the nation’s import-dependent economic system is extremely weak to exterior shocks. Towards this backdrop, President Bola Tinubu’s administration applied daring financial reforms to stabilize the economic system.

Amongst them are the elimination of decade-long gasoline subsidies and the unification of the nation’s a number of trade charges. Nevertheless, these measures triggered unintended penalties, reminiscent of skyrocketing gasoline costs and a extreme cost-of-living disaster.

The results of inflation are notably devastating in conflict-ridden areas the place communities depend on subsistence farming for meals.

Crypto as a Hedge With New Laws on the Horizon

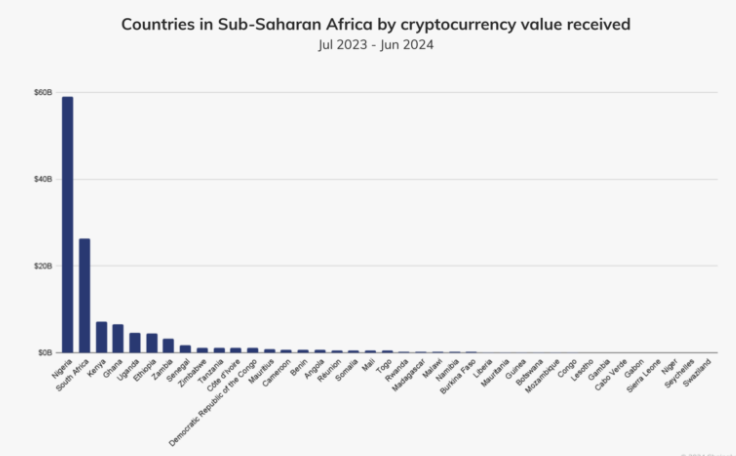

Amid the financial uncertainty, many Nigerians have turned to crypto as a hedge in opposition to inflation and foreign money depreciation. Blockchain analytics agency Chainalysis revealed that between July 2023 and June 2024, Nigerians traded roughly $59 billion in crypto property.

Nigeria Tops Crypto Transactions in Sub-Saharan Africa. Supply: Chainalysis report

This surge in crypto adoption displays a rising mistrust within the conventional monetary system. It additionally suggests a need for extra secure and accessible monetary alternate options.

Nigerian authorities are finalizing new laws in response to the rise in crypto adoption. They need to combine digital asset transactions into the formal economic system.

The Nigerian SEC (Securities and Trade Fee) is drafting insurance policies to make sure all eligible transactions on regulated exchanges are integrated into the nation’s tax community.

A proposed invoice outlining taxation insurance policies for crypto transactions and different digital property is below legislative assessment. The overall sentiment is that it’s going to move inside the first quarter (Q1) of 2025.

In the meantime, the Central Financial institution of Nigeria (CBN) is stabilizing the foreign money and restoring investor confidence. Governor Olayemi Cardoso introduced that the financial institution had cleared $2.5 billion of the overseas trade backlog, with one other $2.2 billion anticipated to be resolved quickly.

Nigeria’s President Tinubu has additionally ordered the discharge of meals reserves and establishing a commodity board to curb hoarding and stabilize costs.

Whereas Nigeria’s financial disaster leaves hundreds of thousands struggling, the federal government’s intervention efforts involving crypto taxes and indicators of easing inflation counsel a possible turnaround. Nevertheless, a lot depends upon how successfully authorities implement their insurance policies and whether or not world financial situations stay favorable.

On the identical time, the nation’s cryptocurrency adoption presents each alternatives and challenges. If regulated correctly, digital property might present Nigerians with monetary alternate options that assist them navigate financial instability.

However, putting a stability between innovation and regulation will be certain that crypto stays a viable resolution quite than a supply of latest monetary dangers.

“At present, Nigeria wants large funding in each formal {and professional} schooling; that is important to extend our expert labor pressure and be competent in at present’s world digital economic system.Particular consideration ought to be paid to areas in Blockchain, Digital Belongings, Web3,” one person shared on X.