Ethereum (ETH), the world’s second-largest cryptocurrency, is caught within the crossfire of a worldwide selloff triggered by tariff battle tensions. With President Trump’s aggressive tariff measures shaking up international markets, crypto is as soon as once more proving it is not resistant to macroeconomic chaos. As ETH plunges beneath essential ranges, merchants are scrambling to evaluate the injury and ask the all-important query: How low can Ethereum go this April?

An in depth evaluation of Ethereum’s each day and hourly charts provides perception into simply how susceptible the asset has turn out to be—and whether or not a reversal is even potential within the close to time period.

Ethereum Value Prediction: What Is the Each day Chart Signaling About Ethereum’s Development?

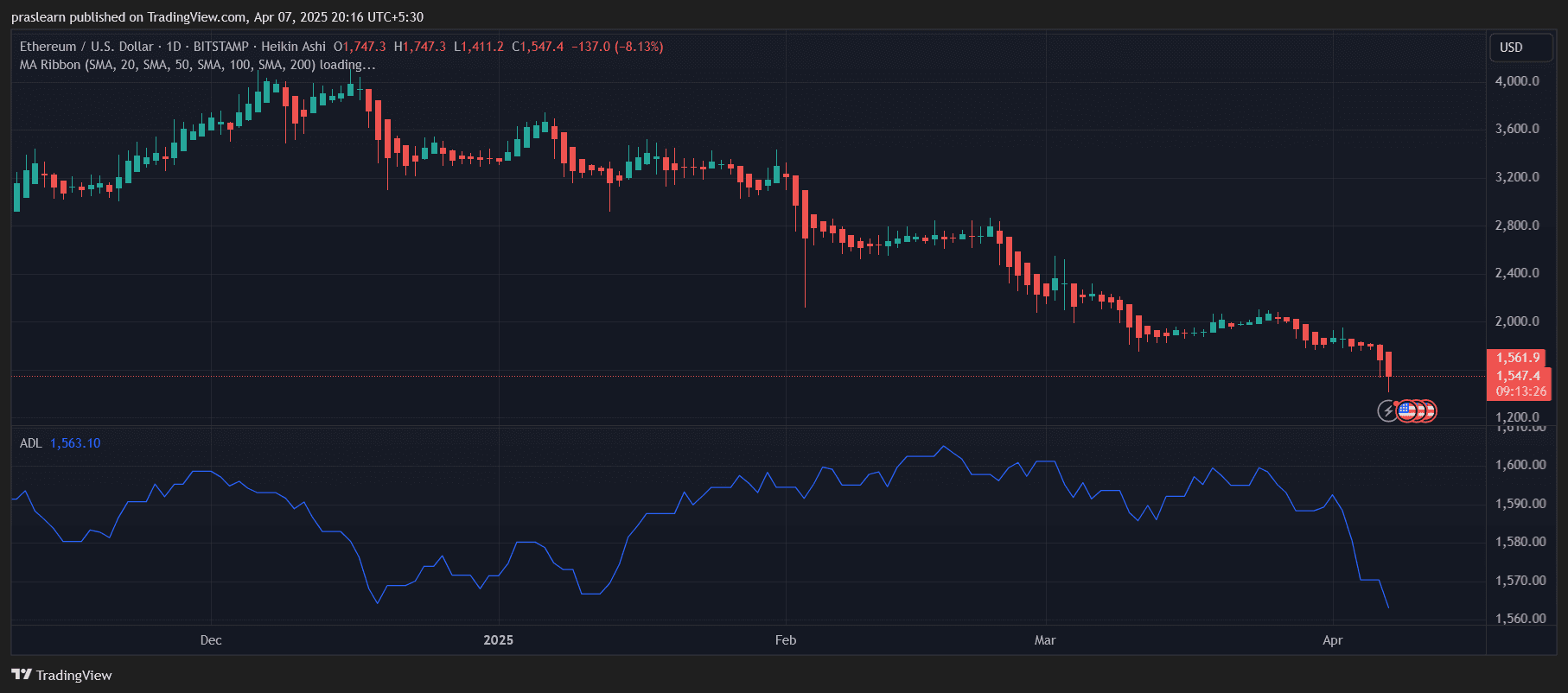

ETH/USD Each day Chart- TradingView

Ethereum’s each day chart reveals a steep downtrend that’s accelerating. The Heikin Ashi candles are printing long-bodied crimson bars, with little to no higher wicks—clear indicators of sturdy bearish momentum. ETH value closed the newest session at round $1,547, down 8.13% in a single day. That transfer adopted a number of consecutive shedding days, confirming not only a correction however a deeper breakdown.

The asset has fallen properly beneath all key transferring averages. Whereas the complete MA ribbon information didn’t load, it’s evident from construction and value motion that Ethereum is now buying and selling beneath the 200-day SMA, which generally serves as a essential assist stage for long-term traders. Breaking that line is traditionally a crimson flag for prolonged bearish intervals.

The Accumulation/Distribution Line (ADL) provides to the fear. It is in sharp decline, confirming that sensible cash isn’t stepping in to purchase this dip. With out accumulation, it’s unlikely Ethereum can stage a significant reversal within the coming days.

Can the Hourly Chart Give Bulls Any Hope?

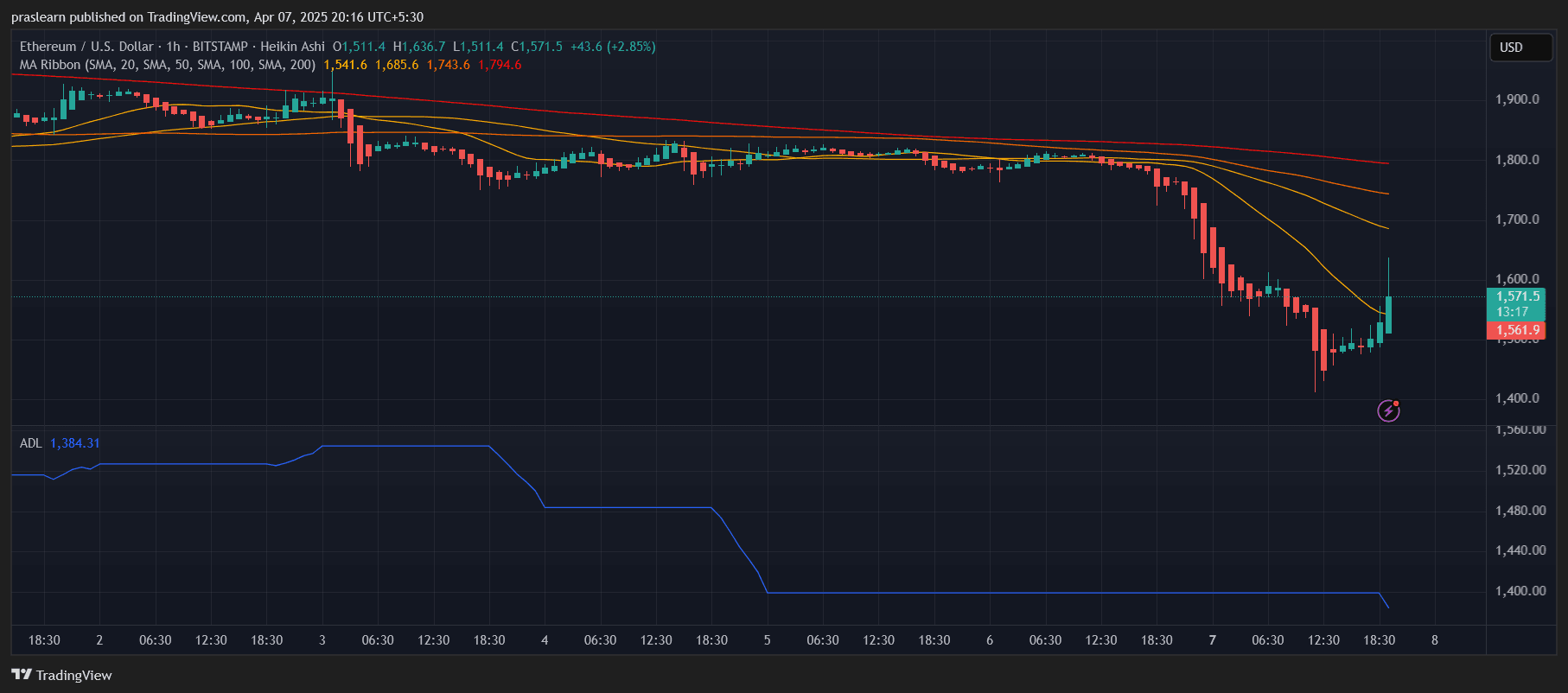

ETH/USD 1 Hr Chart- TradingView

On the hourly chart, Ethereum has proven a small bounce off the current low close to $1,411, rising again to $1,571 on the time of writing. Whereas this will appear to be a bullish response, the rebound got here after an prolonged downward cascade and remains to be underneath all main transferring averages—together with the 20, 50, 100, and 200 SMAs. The 200 SMA at $1,794 is especially distant, exhibiting how stretched the value is to the draw back.

Heikin Ashi candles on the hourly timeframe have turned inexperienced, however solely lately and with out sturdy upward momentum. The current candle spike suggests a brief squeeze or profit-taking somewhat than actual pattern reversal. The ADL right here stays flat to declining, indicating no actual accumulation even on quick timeframes.

Briefly, the hourly chart provides a short lived pause in promoting, not a dependable signal of bullish restoration.

The place Are the Key Help and Resistance Ranges for Ethereum?

Ethereum’s subsequent main assist stage is $1,400, which held up in the newest drop. If this stage breaks once more underneath stronger promoting strain, the subsequent targets lie close to $1,320 and $1,200, zones that beforehand acted as demand throughout the 2022–2023 bear market.

On the upside, Ethereum should reclaim $1,685 (the 50 SMA on the hourly chart) to neutralize the short-term pattern. However the actual shift in momentum would solely happen above $1,800, the place the 200 SMA and key resistance converge. With out these ranges being damaged, rallies stay suspect and susceptible to fast rejection.

What Are the Chart Indicators Telling Us?

Shifting Averages: ETH value is buying and selling beneath all main transferring averages throughout each timeframes, with the downward-sloping nature of the SMAs reinforcing the bearish momentum. This alignment often precedes additional draw back until invalidated by volume-backed breakouts.

Heikin Ashi Candles: Each day candles are extraordinarily bearish, and whereas hourly candles have proven a bounce, the dearth of consistency and quantity weakens any bullish interpretation. Bulls have to see smaller-bodied, greater low candles to substantiate reversal, which haven’t shaped but.

ADL (Accumulation/Distribution Line): The ADL on each charts is trending down, which is among the many most troubling indicators. A falling ADL throughout value dips means that whales and establishments are exiting, not accumulating—unhealthy information for bullish continuation.

Ethereum Value Prediction: How Low May It Go in April?

If bearish momentum persists and $1,400 breaks, Ethereum value may retrace to $1,200 and even $1,000 in April, notably if macro fears escalate and crypto sentiment weakens. This may mark a full capitulation transfer and doubtlessly type a long-term backside.

Nonetheless, if ETH stabilizes above $1,500 and begins to reclaim $1,685–$1,700, a short-term aid rally to $1,800–$1,850 could possibly be on the desk. However with out sturdy quantity and a rising ADL, even such a rally can be susceptible to rejection.

Is Ethereum Headed for a Deeper Collapse?

Ethereum is at a essential juncture. With its long-term pattern damaged, institutional promoting confirmed, and macro headwinds intensifying resulting from tariff wars, the draw back could be very actual. Whereas the short-term bounce might provide hope, the broader pattern stays clearly bearish until a reversal sample with quantity emerges.

So how low can Ethereum go in April? If the $1,400 stage doesn’t maintain, $1,200–$1,000 turns into an actual risk—and quick.