It is a section from the Provide Shock publication. To learn full editions, subscribe.

Greetings, and completely happy forty first birthday to Ross Ulbricht!

By now, rehashing the Silk Highway timeline — from a secret psychedelics lab in an off-the-grid Texas cabin to a world clandestine operation with half a dozen workers — doesn’t appear completely helpful.

Apart from, long-time Bitcoin Historical past readers have already walked by means of the occasions that led to Ulbricht’s dramatic 2013 arrest in a San Francisco public library.

Anybody who missed our electronic mail from final yr can discover it in our archives — it’s positively nonetheless well worth the learn!

Consider, although: That telling of the story misses its completely happy ending. It was written earlier than President Trump pardoned Ulbricht earlier this yr, releasing him from a double-life jail sentence after serving almost a decade.

To have fun Ulbricht’s first birthday since his launch, let’s as a substitute pay homage to the approach he built-in bitcoin funds into Silk Highway, for causes which were largely misplaced on modern-day crypto.

Onto this week’s Bitcoin Legend.

Silk Highway founder Ross Ulbricht | Freeross.org modified by Blockworks

No turning again

Bitcoin was the apparent match for Silk Highway. It uniquely separates international funds from each governmental and company management, imbuing the person with monetary self-sovereignty that goes past real-world money.

“Each single transaction that takes place exterior the nexus of state management is a victory for these people participating within the transaction,” Ulbricht wrote in 2012.

It was bitcoin’s uncontrollable nature that matched his imaginative and prescient: a worthy complement to Silk Highway’s hidden existence by means of Tor.

Ulbricht totally understood that bitcoin transfers are immutable. This property, mixed with its pseudonymity, types the idea for what makes bitcoin so attention-grabbing because the forex for underground exercise: autonomy.

Utilized in the proper approach — with stringent opsec in thoughts — bitcoin would allow true freedom of commerce on Silk Highway.

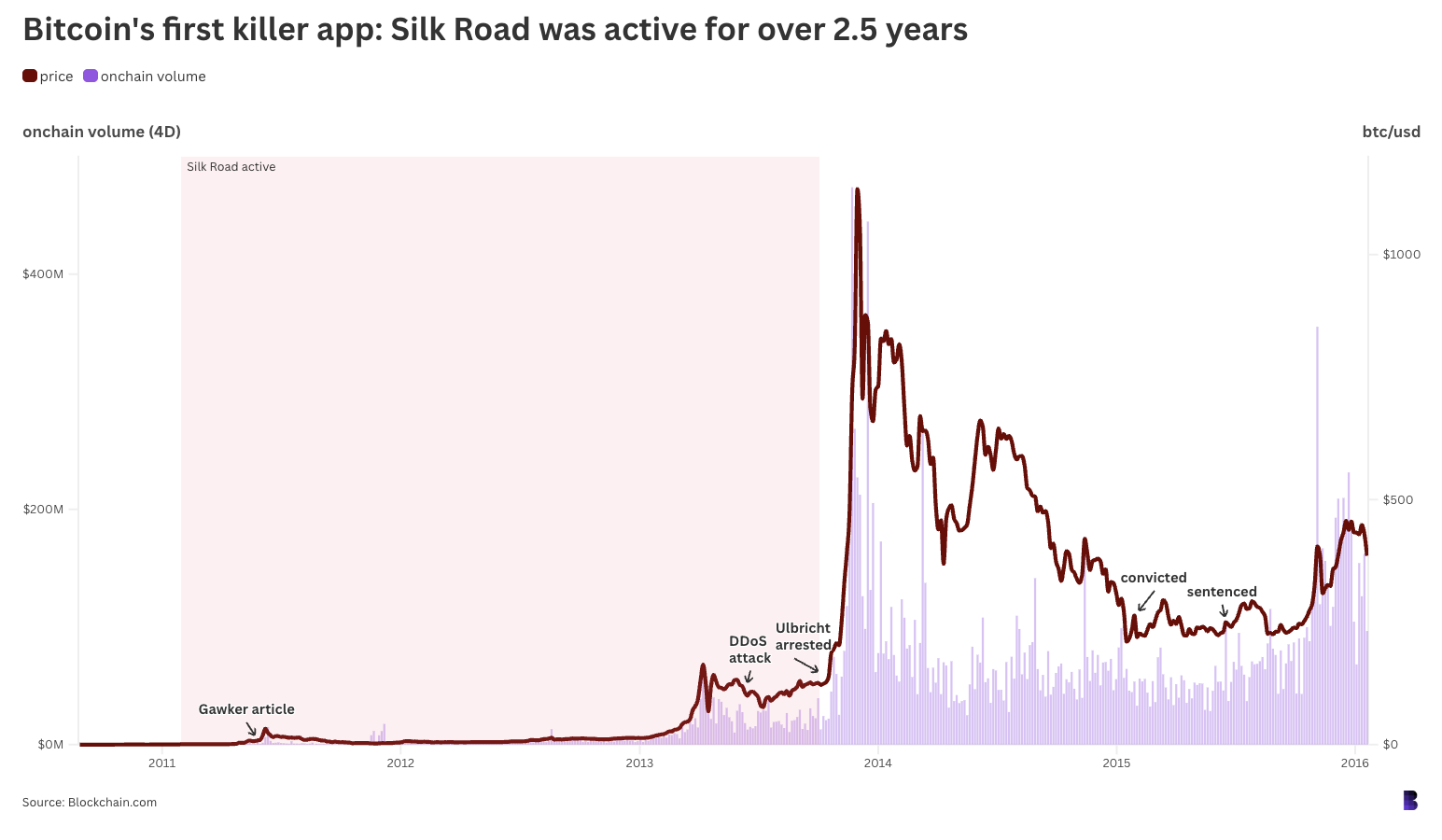

Silk Highway was energetic throughout considered one of bitcoin’s first nice bull runs, however was taken down simply earlier than it hit $1,000 for the primary time. (Onchain quantity = whole onchain quantity, not simply on Silk Highway.)

Ulbricht meant the platform “to be about giving individuals the liberty to make their very own decisions, to pursue their very own happiness, nevertheless they individually noticed match,” and never the “handy approach for individuals to fulfill their drug addictions” it had partly turn into, as he as soon as put it.

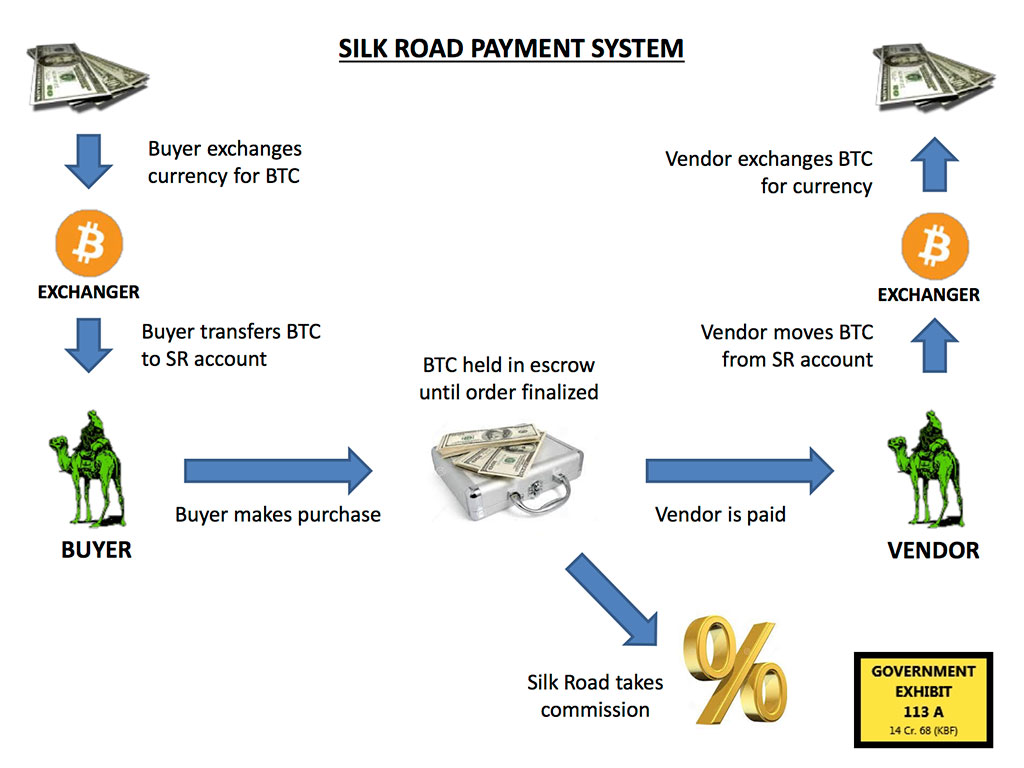

Silk Highway wanted guardrails if it was to solely settle for bitcoin for cost. High quality management was crowdsourced through a public overview system, and to guard customers from fraud, Ulbricht positioned Silk Highway as mediator for all transactions on the platform.

That meant escrow. In an automatic system, any time a purchase order was made, the client’s bitcoin cost was quickly held in a pockets managed by Silk Highway admins, together with Ulbricht.

Silk Highway then notified the vendor that cost was acquired, and the vendor may then proceed with cargo. As soon as the bundle arrived on the opposite facet, the client would lodge a affirmation on the Silk Highway website, after which the bitcoin was launched to the vendor, who may then withdraw the cash to their very own wallets.

Moderators manually dealt with disputes on a case-by-case foundation through a ticker system, just like how Amazon, eBay and Airbnb function immediately.

There’s no query that these processes have been riddled with belief assumptions. Each patrons and sellers have been required to belief that Silk Highway wouldn’t merely vanish with all their bitcoin, and that Silk Highway was nicely outfitted to safeguard person funds in any respect.

This Silk Highway cost flowchart was Exhibit 113 A throughout Ulbricht’s trial

Customers additionally needed to consider that moderators would handle disputes appropriately. At occasions, mods required customers to submit potentially-incriminating photographic proof, together with transport labels and monitoring data, which might additionally have to be protected towards leaks and theft.

Regardless, the system labored. By the point the Feds shuttered Silk Highway, it had processed 9.5 million BTC in gross sales — 80% of bitcoin’s circulating provide on the time — and earned 600,000 BTC in commissions, which in September 2013 was equal to $1.2 billion and $80 million, respectively.

Nonetheless, Silk Highway largely built-in bitcoin in all the proper methods. The platform routinely generated a brand new bitcoin handle for each transaction — making them tougher to hint. All transactions additionally occurred over Tor, which, when used accurately, can hold IP addresses hidden.

If Silk Highway had been constructed immediately, possibly it would’ve held escrowed cash in a multisig pockets. Not less than that may unfold a number of the belief round. Bitcoin multisigs wouldn’t be enabled till April 2012 — greater than a yr after Silk Highway first launched.

Match for goal

Setting apart these considerations, bitcoin and solely bitcoin may do what Ulbricht wanted.

That is very true, contemplating there have been solely a handful of other cryptocurrencies in Silk Highway’s heyday, together with Litecoin, Peercoin and Namecoin, all of which had a tiny fraction of bitcoin’s market cap and liquidity.

Let’s say Silk Highway was launched on Ethereum in 2025. Maybe for quicker funds, extra versatile escrow performance, or stablecoin assist (Silk Highway truly allowed customers to lock the greenback worth of their bitcoin at time of buy to reduce the impression of value volatility).

If that was the case, hypothetically, one OFAC sanction on Silk Highway’s contracts would instantly make it considerably tougher for its transactions to be processed — 31% of all Ethereum blocks proper now are configured to uphold OFAC directives by means of censorship. In November, that determine was over 70%.

To not point out, virtually all main stablecoins have in-built performance that enables their issuers to freeze and confiscate tokens at will, which they usually do upon request from legislation enforcement.

Such options clearly conflict with the notion of an unbiased, libertarian market, whatever the energy held by Ulbricht and the remainder of the Silk Highway workforce on the platform.

Silk Highway’s legacy is then this: For all of the philosophical distance separating “bitcoin” from “crypto” immediately, the idealistic platform that Ulbricht constructed was the divergence catalyst. It was a schism level that cracked open the large fault line now dividing the house.

By means of bitcoin, Silk Highway undermined the standard monetary system and, much more critically, all the social order. Ulbricht acted as a freedom maximalist constructing freedom tech, with not one of the cosplay.

It’s a purpose far faraway from the compliant commerce that stablecoins and their good contract platforms — which emerged within the wake of Silk Highway’s demise — aspire to serve.

These programs have grown to reinforce legacy finance fairly than free us from it within the methods Ulbricht had hoped.

Surprising outcomes

After all, even Bitcoin’s strong censorship resistance was not sufficient to guard Ulbricht from the US authorities. The identical goes for different Silk Highway operators and energy customers.

In whole, greater than 144,000 BTC ($26 million then, $12.6 billion immediately) was seized from wallets initially managed by Ulbricht, plus a further 120,000 BTC from two hackers who’d individually stolen bitcoin from Silk Highway whereas it was energetic.

It’s possible that tens of hundreds extra cash have been seized from Silk Highway customers in much less high-profile circumstances through the years.

Therein lies the rub. Bitcoin is clearly resistant in digital house, and Ulbricht was good sufficient to know that Silk Highway may very well be the very first killer crypto app. In some ways, there’s been no second-best to this present day.

The identical can’t be mentioned in our bodily meatspace. Ulbricht’s cash have been actually taken from him by pressure and bought for relative pennies on their present greenback worth.

In flip, the US authorities response to the Silk Highway case has shaped the playbook for what’s turn into the Feds’ strategic bitcoin reserve.

Seized cash might by no means be bought once more, and at this stage, the one approach the reserve can get any larger is for authorities to grab much more cash from much more sovereign people, little doubt touchdown some in jail for a sentence similar to the time Ulbricht served.

And people cash are solely useful, partially, because of the implicit promise that they will’t be tampered with underneath regular circumstances.

Nothing can sq. that irony in any approach that’s passable, and when bitcoin does certainly turn into a boon to the Treasury Division, then it is going to awkwardly have Ulbricht and Silk Highway to thank.

Fortunately for Ulbricht, he’s simply acquired a present far larger than any bitcoin stash — freedom — resulting in what I can solely think about is the happiest of forty first birthdays.

To Ross. Bitcoin may by no means be what it’s immediately with out him.

— David

Rizzo’s take, from the Bitcoin Historian

“What did you get achieved this week?”

Such was the topic line for Elon Musk’s now notorious emails to the US authorities, however as David factors out above, that very same electronic mail may very well be despatched to the crypto business immediately.

Or I’d think about that may be Ross Ulbricht’s response to his realization this week that eBay is gradual on verifying his id, a reality that’s momentarily holding him from auctioning his belongings.

Is it actual person friction? An elaborate troll? On immediately’s hyper commercialized web, the place Snoop Dogg may “surrender smoke” after which promote you a grill, maybe you possibly can forgive the incredulity. Ross, I might hope, has skipped the net’s descent right into a maze of ref-links.

Nonetheless, one can’t assist however assume that Ross may be questioning what bitcoin and crypto have completed in his absence, maybe now greater than ever. Because the eBay instance reveals, on-line commerce frictions stay substantial, regardless of bitcoin’s preliminary promise to quell them.